Question: FIN4504: Explain how to construct the table to find answers including break-even point, the most Ken can lose, the most Ken can gain? What is

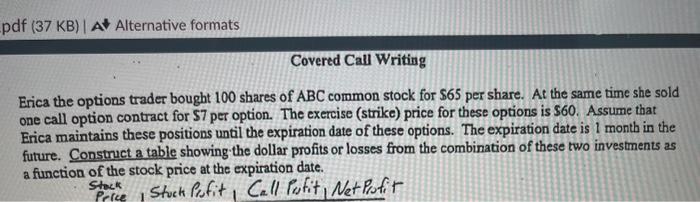

Erica the options trader bought 100 shares of ABC common stock for $65 per share. At the same time she sold one call option contract for $7 per option. The exercise (strike) price for these options is $60. Assume that Erica maintains these positions until the expiration date of these options. The expiration date is l month in the future. Construct a table showing the dollar profits or losses from the combination of these two investments as a function of the stock price at the expiration date. Stock , Stuck Profit, Call Pufit, Net Profit Price I Erica the options trader bought 100 shares of ABC common stock for $65 per share. At the same time she sold one call option contract for $7 per option. The exercise (strike) price for these options is $60. Assume that Erica maintains these positions until the expiration date of these options. The expiration date is l month in the future. Construct a table showing the dollar profits or losses from the combination of these two investments as a function of the stock price at the expiration date. Stock , Stuck Profit, Call Pufit, Net Profit Price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts