Question: FIN4802_2020: ASSIGNMENT 2 Assignment Due Date: 27 August 2020 Unique number: 731364 QUESTION 1 25 marks a) A U.S. multinational firm. CD Corporation, is considering

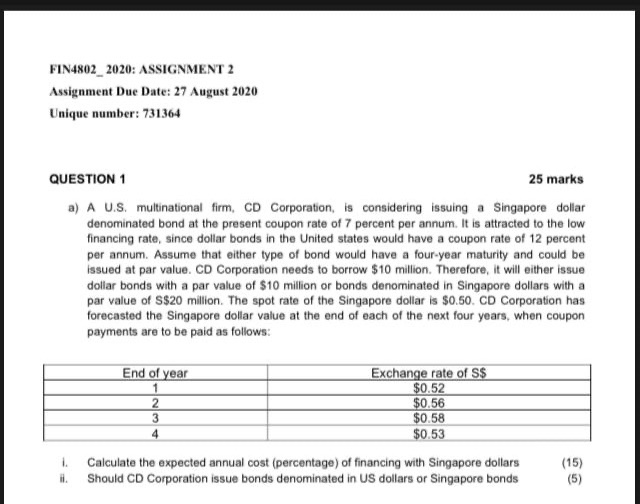

FIN4802_2020: ASSIGNMENT 2 Assignment Due Date: 27 August 2020 Unique number: 731364 QUESTION 1 25 marks a) A U.S. multinational firm. CD Corporation, is considering issuing a Singapore dollar denominated bond at the present coupon rate of 7 percent per annum. It is attracted to the low financing rate, since dollar bonds in the United states would have a coupon rate of 12 percent per annum. Assume that either type of bond would have a four-year maturity and could be issued at par value. CD Corporation needs to borrow $10 million. Therefore, it will either issue dollar bonds with a par value of $10 million or bonds denominated in Singapore dollars with a par value of S$20 million. The spot rate of the Singapore dollar is $0.50. CD Corporation has forecasted the Singapore dollar value at the end of each of the next four years, when coupon payments are to be paid as follows: End of year 1 2 3 4 Exchange rate of S$ $0.52 $0.56 $0.58 $0.53 Calculate the expected annual cost (percentage) of financing with Singapore dollars Should CD Corporation issue bonds denominated in US dollars or Singapore bonds (15)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts