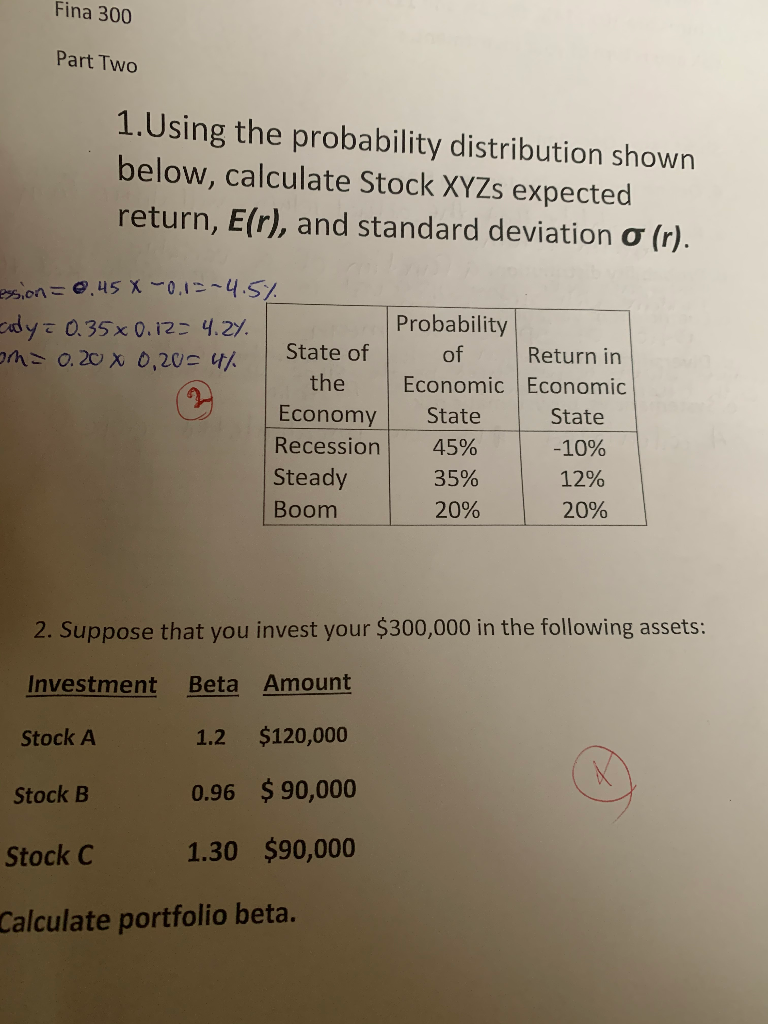

Question: Fina 300 Part Two 1.Using the probability distribution shown below, calculate Stock XYZs expected return, Elr), and standard deviation o (r). ession=0.45 X 012-4.5% ady

Fina 300 Part Two 1.Using the probability distribution shown below, calculate Stock XYZs expected return, Elr), and standard deviation o (r). ession=0.45 X 012-4.5% ady = 0.35*0.12=4.27. on = 0.20 0,20= 4/ State of the Economy Recession Steady Boom Probability of Return in Economic Economic State State 45% -10% 35% 12% 20% 20% 2. Suppose that you invest your $300,000 in the following assets: Investment Beta Amount Stock A 1.2 $120,000 Stock B 0.96 $ 90,000 Stock C 1.30 $90,000 Calculate portfolio beta

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts