Question: FINA 469 Homework 3 NAME: Instructions: You may work with other students on the homework, but you MUST turn in your own assignment. There is

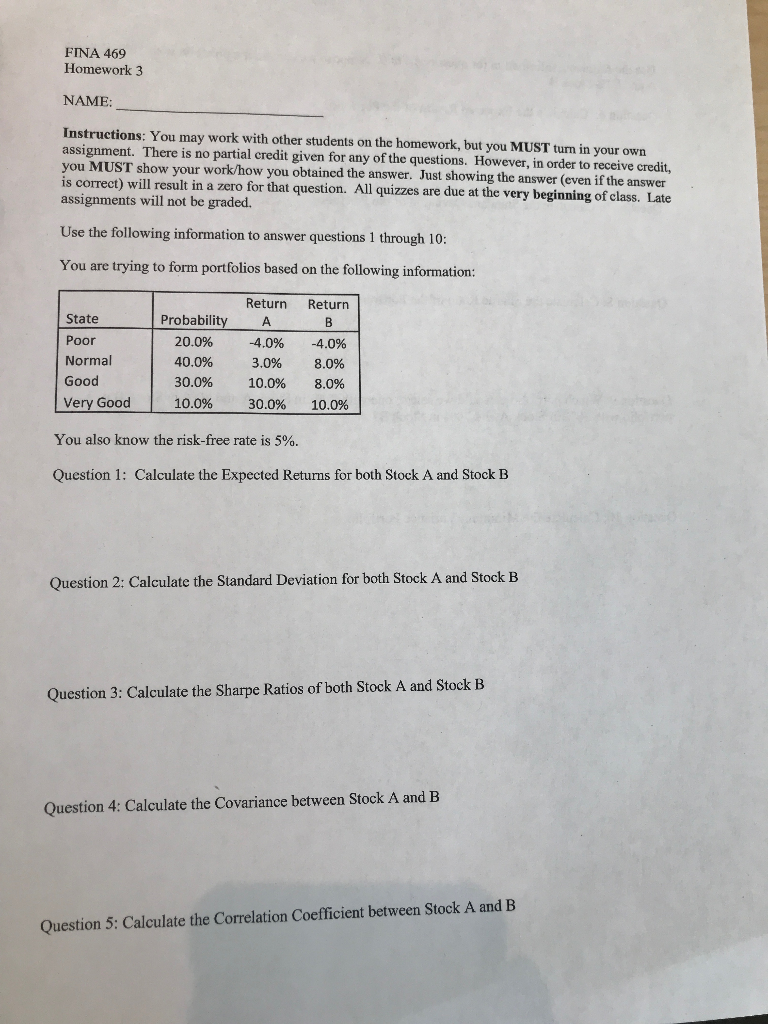

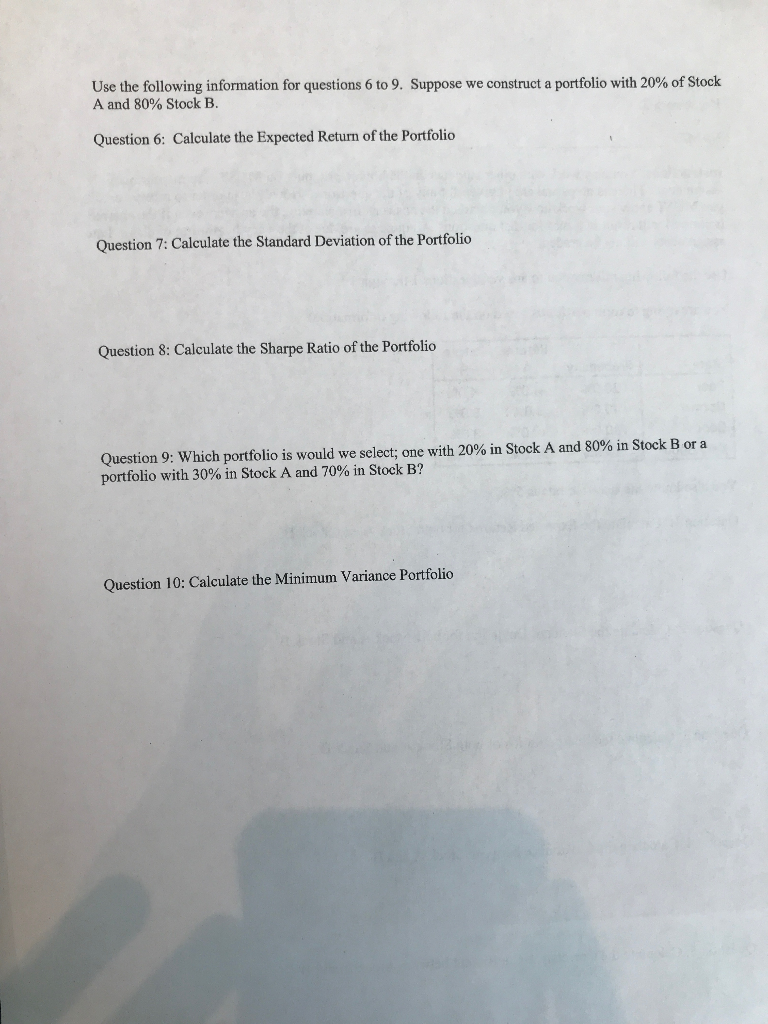

FINA 469 Homework 3 NAME: Instructions: You may work with other students on the homework, but you MUST turn in your own assignment. There is no partial credit given for any of the questions. However, in order to receive credit, you MUST show your work/how you obtained the answer. Just showing the answer (even if the answer is correct) will result in a zero for that question. All quizzes are due at the very beginning of class. Late assignments will not be graded. Use the following information to answer questions 1 through 10: You are trying to form portfolios based on the following information: State Poor Normal Good Very Good Return Probability A 20.0% -4.0% 40.0% 3.0% 30.0% 10.0% 10.0% 30.0% Return B -4.0% 8.0% 8.0% 10.0% You also know the risk-free rate is 5%. Question 1: Calculate the Expected Returns for both Stock A and Stock B Question 2: Calculate the Standard Deviation for both Stock A and Stock B Question 3: Calculate the Sharpe Ratios of both Stock A and Stock B Question 4: Calculate the Covariance between Stock A and B Question 5: Calculate the Correlation Coefficient between Stock A and B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts