Question: final answer for question (5): 27201.28 where n=12 question (6): 791.84 (balloon payment=4405.26) I just need the explanation 5. 5. Using an annual effective rate

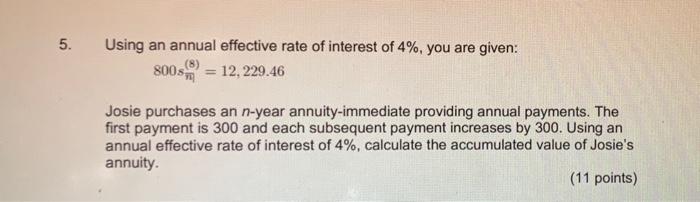

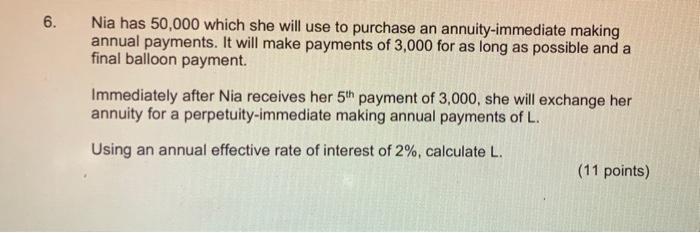

5. 5. Using an annual effective rate of interest of 4%, you are given: 80058 = 12, 229.46 Josie purchases an n-year annuity-immediate providing annual payments. The first payment is 300 and each subsequent payment increases by 300. Using an annual effective rate of interest of 4%, calculate the accumulated value of Josie's annuity. (11 points) 6. Nia has 50,000 which she will use to purchase an annuity-immediate making annual payments. It will make payments of 3,000 for as long as possible and a final balloon payment Immediately after Nia receives her 5th payment of 3,000, she will exchange her annuity for a perpetuity-immediate making annual payments of L. Using an annual effective rate of interest of 2%, calculate L. (11 points) 5. 5. Using an annual effective rate of interest of 4%, you are given: 80058 = 12, 229.46 Josie purchases an n-year annuity-immediate providing annual payments. The first payment is 300 and each subsequent payment increases by 300. Using an annual effective rate of interest of 4%, calculate the accumulated value of Josie's annuity. (11 points) 6. Nia has 50,000 which she will use to purchase an annuity-immediate making annual payments. It will make payments of 3,000 for as long as possible and a final balloon payment Immediately after Nia receives her 5th payment of 3,000, she will exchange her annuity for a perpetuity-immediate making annual payments of L. Using an annual effective rate of interest of 2%, calculate L. (11 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts