Question: Final answer please 14 What is the implied probability of default if the 1-year T-bill rate is 8%, and the rate on 1-year zero-coupon corporate

Final answer please

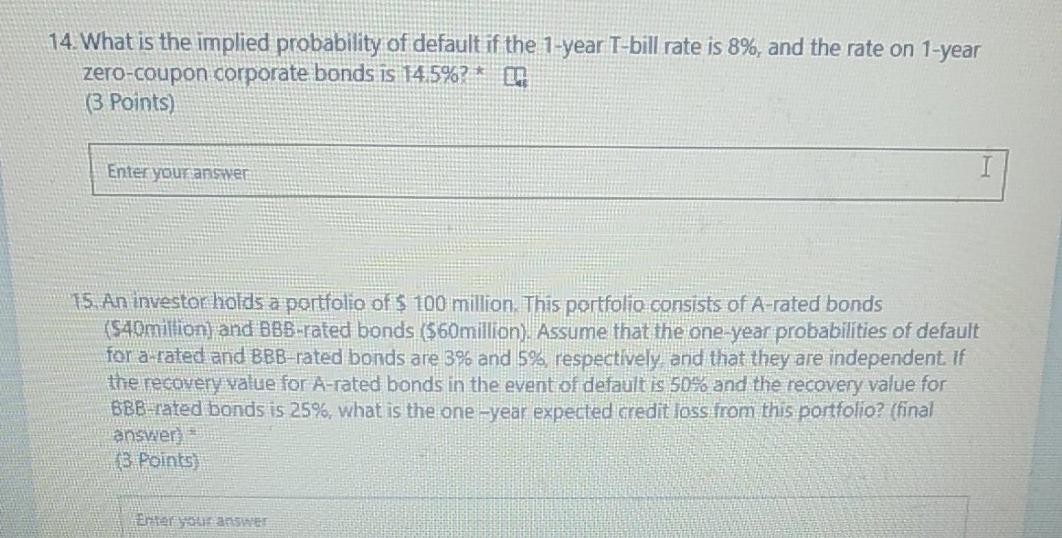

14 What is the implied probability of default if the 1-year T-bill rate is 8%, and the rate on 1-year zero-coupon corporate bonds is 14.5%?* ( (3 Points) Enter your answer 15. An investor holds a portfolio of $ 100 million. This portfolio consists of A-rated bonds ($40million and BBB-rated bonds ($60million). Assume that the one-year probabilities of default for a rated and BBB-rated bonds are 3% and 5%, respectively and that they are independent If the recovery value for A-rated bonds in the event of default is 50% and the recovery value for BBB-rated bonds is 25%, what is the one-year expected credit loss from this portfolio? (final answer B Points Ferranse

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts