Question: final answer required only thanks Question 21 1 pts Mr. Lee is considering a capacity expansion for his supermarket. The current capacity is equivalent to

final answer required only thanks

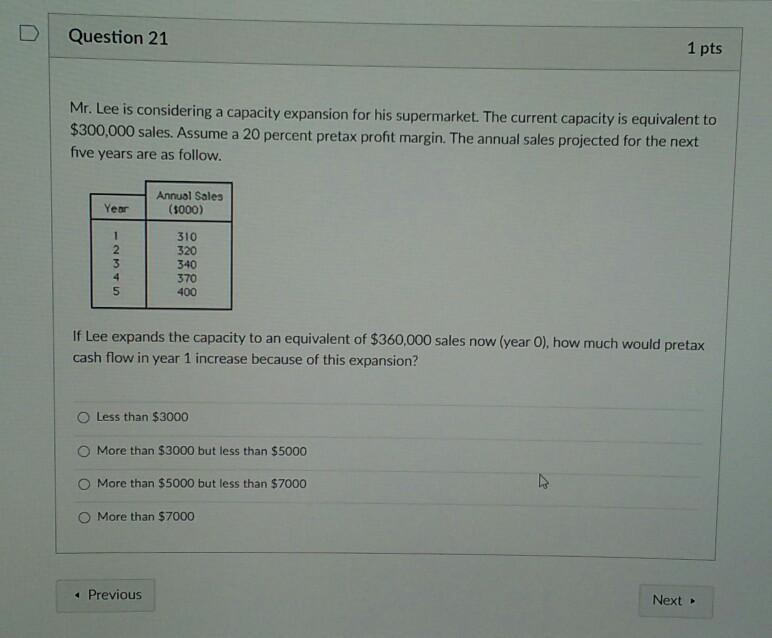

Question 21 1 pts Mr. Lee is considering a capacity expansion for his supermarket. The current capacity is equivalent to $300,000 sales. Assume a 20 percent pretax profit margin. The annual sales projected for the next five years are as follow. Year Annual Sales (5000) 1 3 310 320 340 370 400 5 If Lee expands the capacity to an equivalent of $360,000 sales now (year O), how much would pretax cash flow in year 1 increase because of this expansion? Less than $3000 More than $3000 but less than $5000 More than $5000 but less than $7000 More than $7000 Previous NextStep by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock