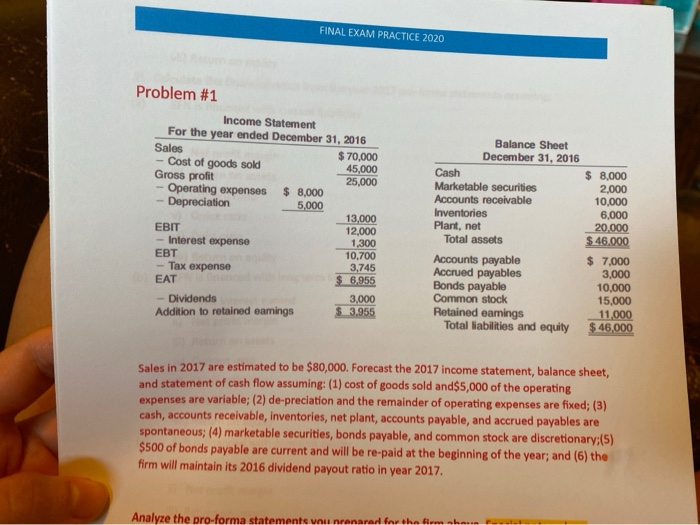

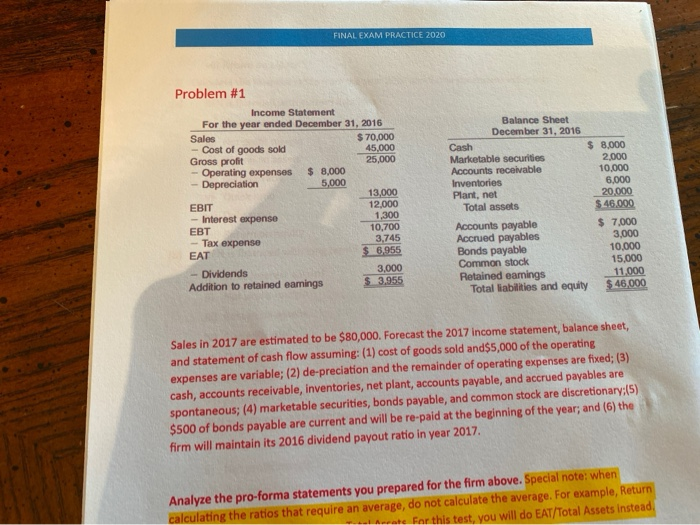

Question: FINAL EXAM PRACTICE 2020 Problem #1 Income Statement For the year ended December 31, 2016 Sales $ 70,000 Cost of goods sold 45,000 Gross profit

FINAL EXAM PRACTICE 2020 Problem #1 Income Statement For the year ended December 31, 2016 Sales $ 70,000 Cost of goods sold 45,000 Gross profit 25,000 - Operating expenses $ 8,000 - Depreciation 5,000 13,000 EBIT 12,000 - Interest expense 1,300 EBT 10,700 - Tax expense 3,745 EAT $ 6,955 - Dividends 3,000 Addition to retained eamings $ 3.955 Balance Sheet December 31, 2016 Cash Marketable securities Accounts receivable Inventories Plant, net Total assets Accounts payable Accrued payables Bonds payable Common stock Retained earnings Total liabilities and equity $ 8,000 2,000 10.000 6,000 20.000 $ 46.000 $ 7,000 3,000 10.000 15,000 11,000 $ 46,000 Sales in 2017 are estimated to be $80,000. Forecast the 2017 income statement, balance sheet, and statement of cash flow assuming: (1) cost of goods sold and$5,000 of the operating expenses are variable; (2) de-preciation and the remainder of operating expenses are fixed; (3) cash, accounts receivable, inventories, net plant, accounts payable, and accrued payables are spontaneous; (4) marketable securities, bonds payable, and common stock are discretionary:(5) $500 of bonds payable are current and will be re-paid at the beginning of the year; and (6) the firm will maintain its 2016 dividend payout ratio in year 2017. Analyze the pro-forma statements voll nranared for the FINAL EXAM PRACTICE 2020 Problem #1 Income Statement For the year ended December 31, 2016 Sales $70,000 - Cost of goods sold 45,000 Gross profit 25,000 - Operating expenses $ 8.000 - Depreciation 5,000 13,000 EBIT 12.000 - Interest expense 1,300 EBT 10,700 - Tax expense 3,745 EAT $6.955 - Dividends 3,000 Addition to retained oamings $ 3.955 Balance Sheet December 31, 2016 Cash Marketable securities Accounts receivable Inventories Plant, not Total assets Accounts payable Accrued payables Bonds payable Common stock Retained earings Total liabilities and equity $ 8,000 2.000 10.000 6.000 20.000 $ 46.000 $ 7.000 3.000 10.000 15,000 11.000 $ 46,000 Sales in 2017 are estimated to be $80,000. Forecast the 2017 Income statement, balance sheet, and statement of cash flow assuming: (1) cost of goods sold and$5,000 of the operating expenses are variable; (2) de-preciation and the remainder of operating expenses are fixed; (3) cash, accounts receivable, inventories, net plant, accounts payable, and accrued payables are spontaneous; (4) marketable securities, bonds payable, and common stock are discretionary:(5) $500 of bonds payable are current and will be re-paid at the beginning of the year; and (6) the firm will maintain its 2016 dividend payout ratio in year 2017, Analyze the pro-forma statements you prepared for the firm above. Special note when calculating the ratios that require an average, do not calculate the average. For example, Return cate for this test you will do FAT Total Assets instead FINAL EXAM PRACTICE 2020 Problem #1 Income Statement For the year ended December 31, 2016 Sales $ 70,000 Cost of goods sold 45,000 Gross profit 25,000 - Operating expenses $ 8,000 - Depreciation 5,000 13,000 EBIT 12,000 - Interest expense 1,300 EBT 10,700 - Tax expense 3,745 EAT $ 6,955 - Dividends 3,000 Addition to retained eamings $ 3.955 Balance Sheet December 31, 2016 Cash Marketable securities Accounts receivable Inventories Plant, net Total assets Accounts payable Accrued payables Bonds payable Common stock Retained earnings Total liabilities and equity $ 8,000 2,000 10.000 6,000 20.000 $ 46.000 $ 7,000 3,000 10.000 15,000 11,000 $ 46,000 Sales in 2017 are estimated to be $80,000. Forecast the 2017 income statement, balance sheet, and statement of cash flow assuming: (1) cost of goods sold and$5,000 of the operating expenses are variable; (2) de-preciation and the remainder of operating expenses are fixed; (3) cash, accounts receivable, inventories, net plant, accounts payable, and accrued payables are spontaneous; (4) marketable securities, bonds payable, and common stock are discretionary:(5) $500 of bonds payable are current and will be re-paid at the beginning of the year; and (6) the firm will maintain its 2016 dividend payout ratio in year 2017. Analyze the pro-forma statements voll nranared for the FINAL EXAM PRACTICE 2020 Problem #1 Income Statement For the year ended December 31, 2016 Sales $70,000 - Cost of goods sold 45,000 Gross profit 25,000 - Operating expenses $ 8.000 - Depreciation 5,000 13,000 EBIT 12.000 - Interest expense 1,300 EBT 10,700 - Tax expense 3,745 EAT $6.955 - Dividends 3,000 Addition to retained oamings $ 3.955 Balance Sheet December 31, 2016 Cash Marketable securities Accounts receivable Inventories Plant, not Total assets Accounts payable Accrued payables Bonds payable Common stock Retained earings Total liabilities and equity $ 8,000 2.000 10.000 6.000 20.000 $ 46.000 $ 7.000 3.000 10.000 15,000 11.000 $ 46,000 Sales in 2017 are estimated to be $80,000. Forecast the 2017 Income statement, balance sheet, and statement of cash flow assuming: (1) cost of goods sold and$5,000 of the operating expenses are variable; (2) de-preciation and the remainder of operating expenses are fixed; (3) cash, accounts receivable, inventories, net plant, accounts payable, and accrued payables are spontaneous; (4) marketable securities, bonds payable, and common stock are discretionary:(5) $500 of bonds payable are current and will be re-paid at the beginning of the year; and (6) the firm will maintain its 2016 dividend payout ratio in year 2017, Analyze the pro-forma statements you prepared for the firm above. Special note when calculating the ratios that require an average, do not calculate the average. For example, Return cate for this test you will do FAT Total Assets instead

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts