Question: Final Finishing is considering three mutually exclusive alternatives for a new polisher. Each alternative has an expected life of 10 years and no salvage value.

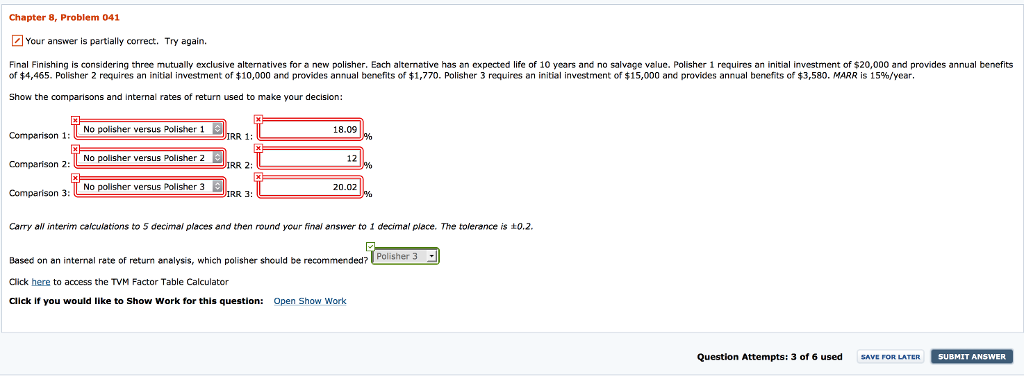

Final Finishing is considering three mutually exclusive alternatives for a new polisher. Each alternative has an expected life of 10 years and no salvage value. Polisher 1 requires an initial investment of $20,000 and provides annual benefits of $4,465. Polisher 2 requires an initial investment of $10,000 and provides annual benefits of $1,770. Polisher 3 requires an initial investment of $15,000 and provides annual benefits of $3,580. MARR is 15%/year. Show the comparisons and internal rates of return used to make your decision:

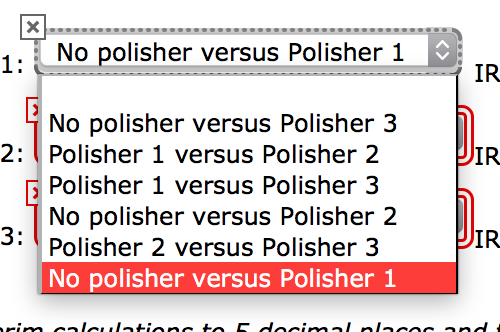

Comparison Possibilities: No poliser versus polisher 3, Polisher 1 vs Polisher 2, Polisher 1 vs Polisher 3, No poliser versus polisher 2, Polisher 2 vs Polisher 3, No poliser versus polisher 1

Comparison 1: ,IRR 1:

Comparison 2: , IRR 2:

Comparison 3: , IRR 3:

Comparison 3: , IRR 3:

Chapter 8, Problem 041 aYour answer is partially correct. Try agai Final Finishing is considering three mutually exclusive alternatives for a new polisher. Each alternative has an expected life of 10 years and no salvage value. Polisher 1 requires an initial investment of $20,000 and provides annual benefits of $4,465. Polisher 2 requires an initial investment of $10,000 and provides annual benefits of $1 Polisher 3 requires an initial investment of $15,000 and provides annual benefits of $3,580. MARR is 15%/year, Show the comparisons and internal rates of return used to make your decision 18.09 No polisher versus Polisher 1 Comparison 1 RR 1 No polisher versus Comparison 2 Polisher 2 12 RR 2 No polisher versus Polisher 3 Comparison 3 20.02 RR 3 Carry all interim calculations to 5 decima places and then round your final answer to 1 decimal place. The tolerance is to, 2. Pol her 3 Based on an internal rate of return analysis, which polisher should be recommended? Click here to access the TVM Factor Table Calculator Click if you would like to show work for this question Open Show Work Question Attempts: 3 of 6 used SAVE OR LATER SUBMIT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts