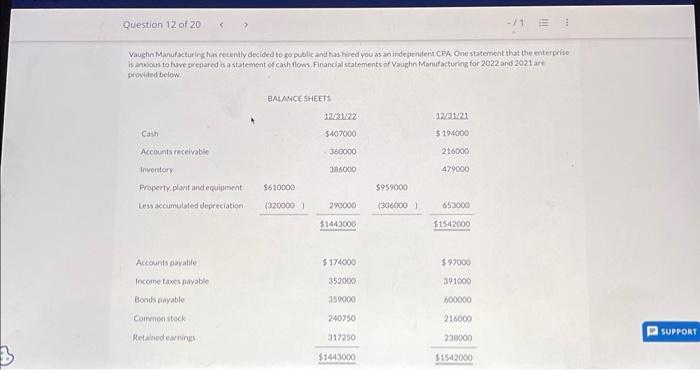

Question: Final. please help me. Vaughe Manufscturing has recenly decided to go public and hashired you as an independent CPA One statement that the enterprise provided

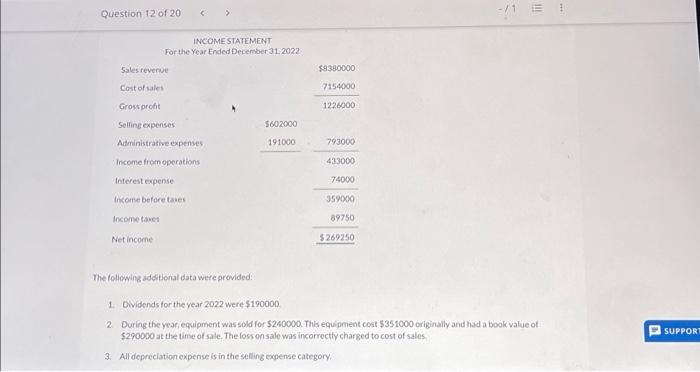

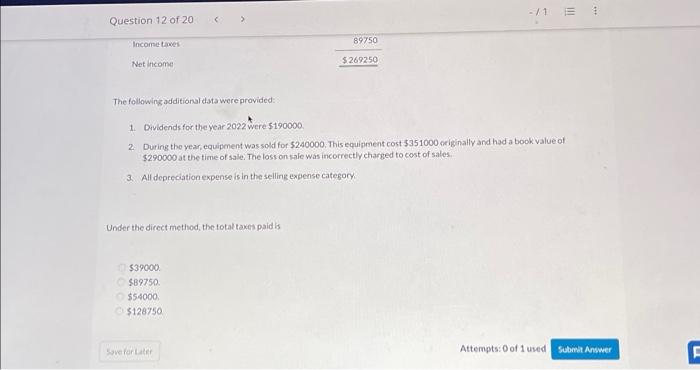

Vaughe Manufscturing has recenly decided to go public and hashired you as an independent CPA One statement that the enterprise provided below: INCOMESTATEMENT For the Year Ended December 312022 The following additional data were provided: 1. Owidends for the year 2022 were $190000 2 Durling the vear, equipment was sold for $240000. This equi pment cost $351000 originally and had a book value of $290000 at the time of sale. The foss onsale was incorrectly charged to cost of sales. 3. All depreciation expense is in the selling expense category. The following additionaldata were provided: 1. Dividends for the year 2022 were $190000 2. During the vear, equipment was sold for $240000. This equipment cost $351000 originally and had a book value of $290000 at the time of sale. The loss on rale was incorrectlycharged to cost of sales. 3. All depreciation expense is in the selling expense category. Under the direct method, the fotal taxes paid is $39000$89750$4000$128750

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts