Question: FINAL PROJECT HELP NEEDED! Directions Using the Chart of Accounts and Unadjusted Trial Balance below, prepare the following using the MS Excel files provided to

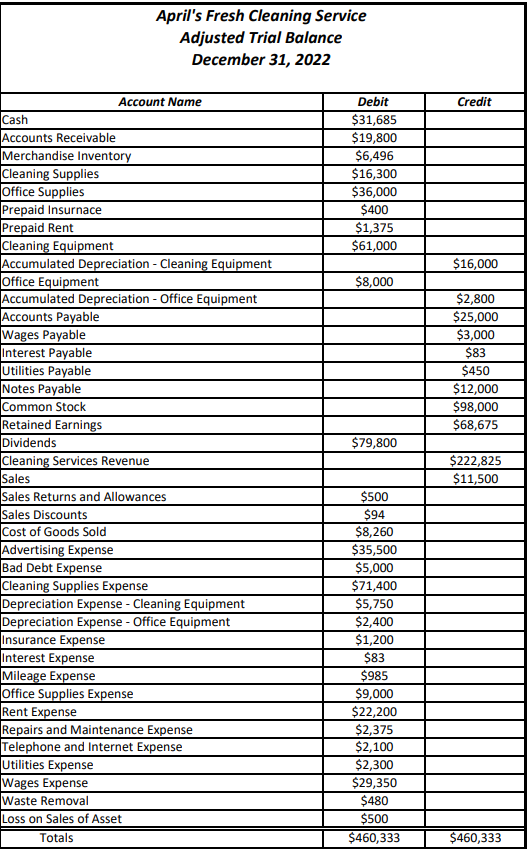

FINAL PROJECT HELP NEEDED! Directions Using the Chart of Accounts and Unadjusted Trial Balance below, prepare the following using the MS Excel files provided to you in the folder for Part 2 of the Comprehensive Project. a) Perform the end of year adjusting entries. Use letters in place of the date b) Complete the end of year worksheet c) Prepare and Adjusted Trial Balance as of December 31, 2022 the Accounts Receivable and Accounts Payable Accounts must be shown in consolidated format on the Unadjusted Trial Balance and Adjusted Trial Balance.

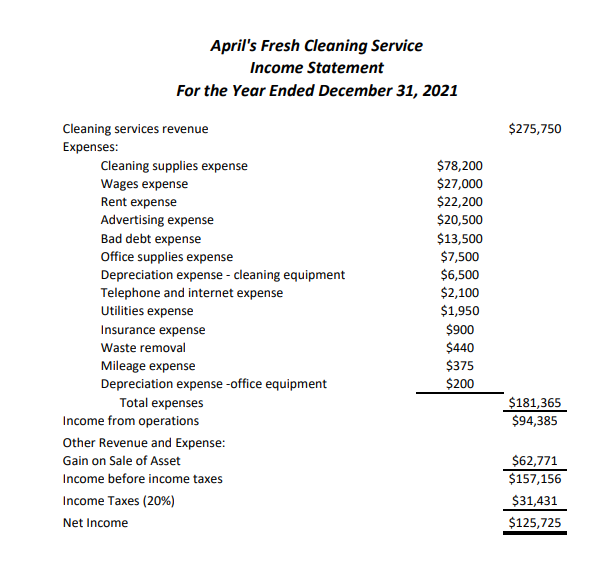

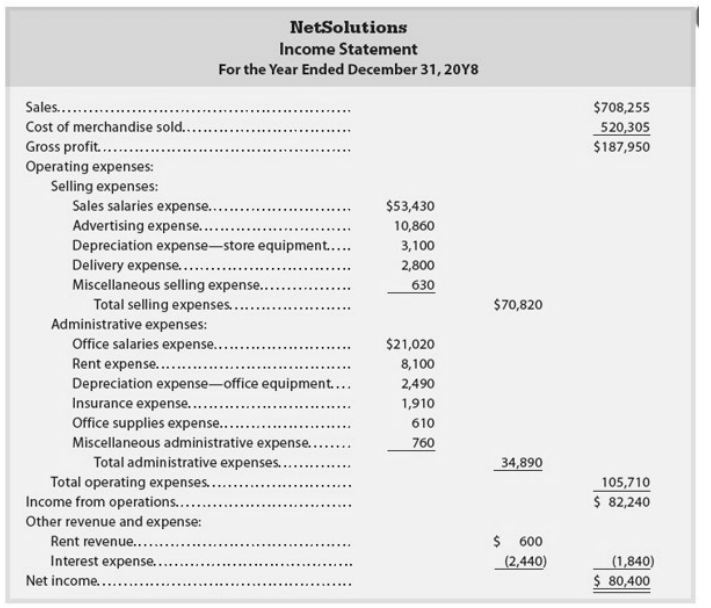

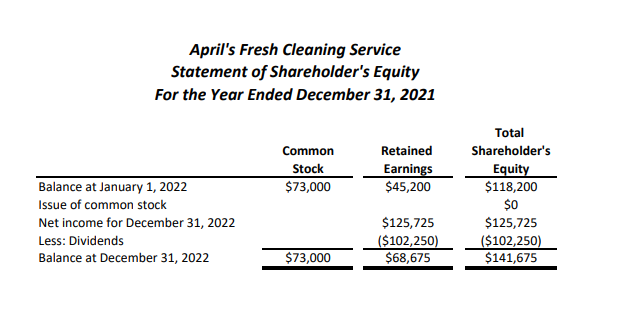

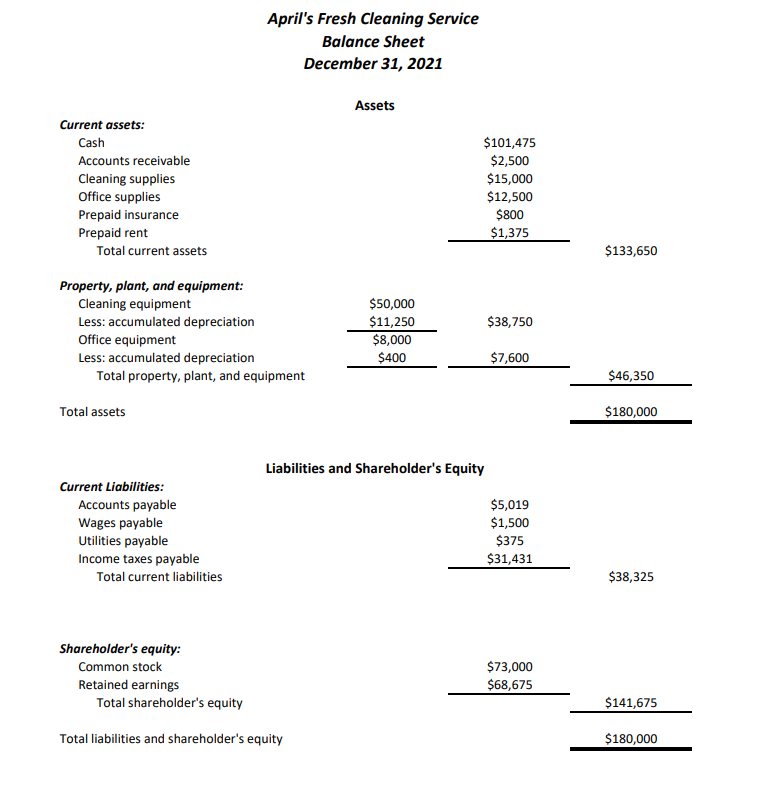

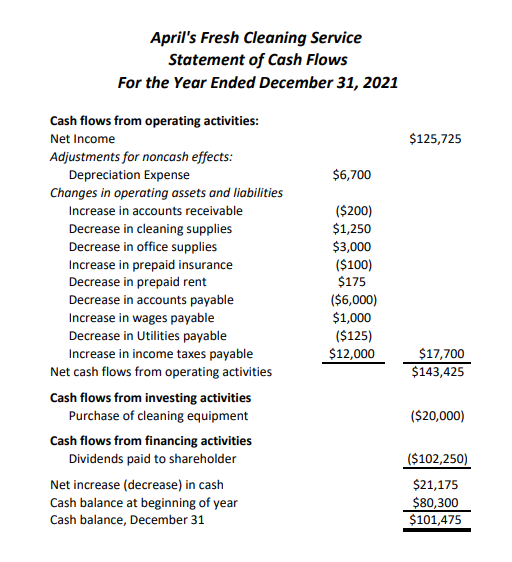

April's Fresh Cleaning Service Income Statement For the Year Ended December 31, 2021 Cleaning services revenue $275,750 Expenses: Other Revenue and Expense: Gain on Sale of Asset Income before income taxes Income Taxes (20\%) Net Income \begin{tabular}{l} $157,156$62,771 \\ $31,431 \\ $125,725 \\ \hline \end{tabular} NetSolutions Income Statement For the Year Ended December 31, 20Y8 Sales. Cost of merchandise sold. Gross profit. $708,255520,305$187,950 Operating expenses: Selling expenses: Sales salaries expense. Advertising expense.. \begin{tabular}{lr} Depreciation expense-store equipment..... & 10,860 \\ \hline \end{tabular} \begin{tabular}{lr} Delivery expense.......................... & 2,800 \\ Miscellaneous selling expense.............. & 630 \\ \hline \end{tabular} Miscellaneous selling expe Total selling expenses. Administrative expenses: Office salaries expense. Rent expense. Depreciation expense-office equipment.... 2,490 Insurance expense........................... 1,910 Office supplies expense......................... 610 Miscellaneous administrative expense....... 760 Total administrative expenses. 34,890 Total operating expenses. Income from operations. $82,240105,710 Other revenue and expense: Rent revenue. $600 Interest expense. Net income. Netincome. $80,400(1,840)(2,440) April's Fresh Cleaning Service Statement of Shareholder's Equity For the Year Ended December 31, 2021 April's Fresh Cleaning Service Balance Sheet December 31, 2021 Assets Current assets: \begin{tabular}{lc} Cash & $101,475 \\ Accounts receivable & $2,500 \\ Cleaning supplies & $15,000 \\ Office supplies & $12,500 \\ Prepaid insurance & $800 \\ Prepaid rent & $1,375 \\ \cline { 2 - 2 } Total current assets & \end{tabular} Property, plant, and equipment: Cleaning equipment Less: accumulated depreciation Office equipment Less: accumulated depreciation Total property, plant, and equipment Total assets Liabilities and Shareholder's Equity Current Liabilities: Shareholder's equity: Common stock Retained earnings Total shareholder's equity \begin{tabular}{l} $73,000 \\ $68,675 \\ \hline \end{tabular} April's Fresh Cleaning Service Statement of Cash Flows For the Year Ended December 31, 2021 April's Fresh Cleaning Service Income Statement For the Year Ended December 31, 2021 Cleaning services revenue $275,750 Expenses: Other Revenue and Expense: Gain on Sale of Asset Income before income taxes Income Taxes (20\%) Net Income \begin{tabular}{l} $157,156$62,771 \\ $31,431 \\ $125,725 \\ \hline \end{tabular} NetSolutions Income Statement For the Year Ended December 31, 20Y8 Sales. Cost of merchandise sold. Gross profit. $708,255520,305$187,950 Operating expenses: Selling expenses: Sales salaries expense. Advertising expense.. \begin{tabular}{lr} Depreciation expense-store equipment..... & 10,860 \\ \hline \end{tabular} \begin{tabular}{lr} Delivery expense.......................... & 2,800 \\ Miscellaneous selling expense.............. & 630 \\ \hline \end{tabular} Miscellaneous selling expe Total selling expenses. Administrative expenses: Office salaries expense. Rent expense. Depreciation expense-office equipment.... 2,490 Insurance expense........................... 1,910 Office supplies expense......................... 610 Miscellaneous administrative expense....... 760 Total administrative expenses. 34,890 Total operating expenses. Income from operations. $82,240105,710 Other revenue and expense: Rent revenue. $600 Interest expense. Net income. Netincome. $80,400(1,840)(2,440) April's Fresh Cleaning Service Statement of Shareholder's Equity For the Year Ended December 31, 2021 April's Fresh Cleaning Service Balance Sheet December 31, 2021 Assets Current assets: \begin{tabular}{lc} Cash & $101,475 \\ Accounts receivable & $2,500 \\ Cleaning supplies & $15,000 \\ Office supplies & $12,500 \\ Prepaid insurance & $800 \\ Prepaid rent & $1,375 \\ \cline { 2 - 2 } Total current assets & \end{tabular} Property, plant, and equipment: Cleaning equipment Less: accumulated depreciation Office equipment Less: accumulated depreciation Total property, plant, and equipment Total assets Liabilities and Shareholder's Equity Current Liabilities: Shareholder's equity: Common stock Retained earnings Total shareholder's equity \begin{tabular}{l} $73,000 \\ $68,675 \\ \hline \end{tabular} April's Fresh Cleaning Service Statement of Cash Flows For the Year Ended December 31, 2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts