Question: Assignment 3 CLO 4 Pee Company acquired 80% in See Company for $800,000 on Jan 1, 2019, when See had $700,000 capital stock and

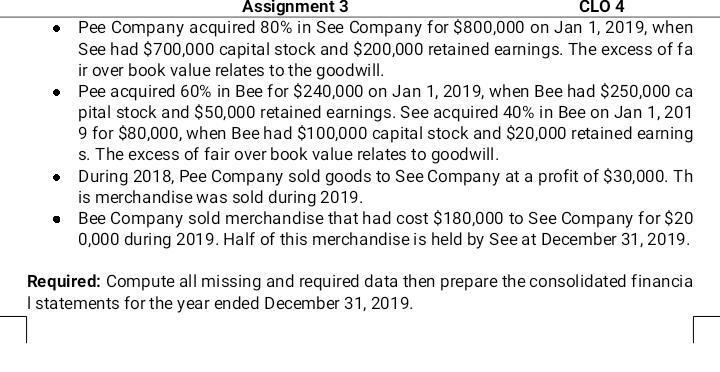

Assignment 3 CLO 4 Pee Company acquired 80% in See Company for $800,000 on Jan 1, 2019, when See had $700,000 capital stock and $200,000 retained earnings. The excess of fa ir over book value relates to the goodwill. Pee acquired 60% in Bee for $240,000 on Jan 1, 2019, when Bee had $250,000 ca pital stock and $50,000 retained earnings. See acquired 40% in Bee on Jan 1, 201 9 for $80,000, when Bee had $100,000 capital stock and $20,000 retained earning s. The excess of fair over book value relates to goodwill. . During 2018, Pee Company sold goods to See Company at a profit of $30,000. Th is merchandise was sold during 2019. Bee Company sold merchandise that had cost $180,000 to See Company for $20 0,000 during 2019. Half of this merchandise is held by See at December 31, 2019. Required: Compute all missing and required data then prepare the consolidated financia I statements for the year ended December 31, 2019.

Step by Step Solution

3.55 Rating (165 Votes )

There are 3 Steps involved in it

To prepare the consolidated financial statements for the year ended December 31 2019 we need to gather all the necessary information and perform the c... View full answer

Get step-by-step solutions from verified subject matter experts