Question: Finanace question please help me Question Completion Status: Moving to another question will save this response. Question 2 of 4 >> Question 2 10 points

Finanace question please help me

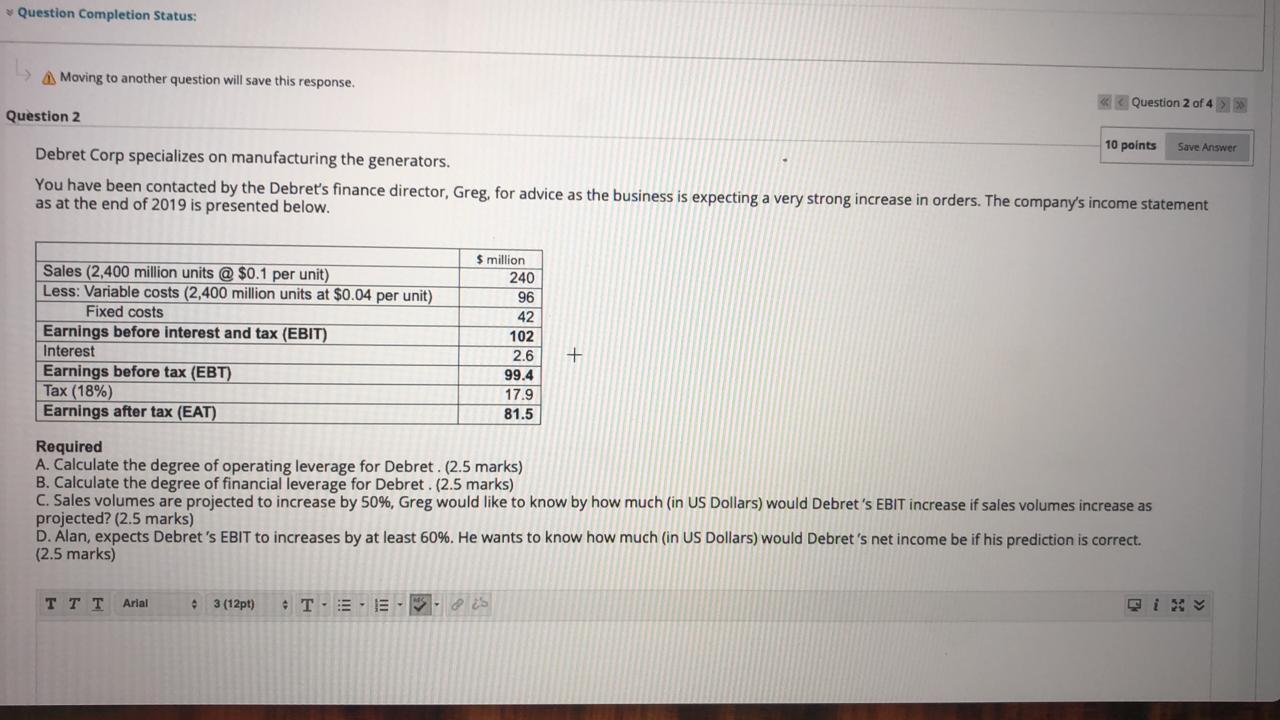

Question Completion Status: Moving to another question will save this response. Question 2 of 4 >> Question 2 10 points Save Answer Debret Corp specializes on manufacturing the generators. You have been contacted by the Debret's finance director, Greg, for advice as the business is expecting a very strong increase in orders. The company's income statement as at the end of 2019 is presented below. Sales (2,400 million units @ $0.1 per unit) Less: Variable costs (2,400 million units at $0.04 per unit) Fixed costs Earnings before interest and tax (EBIT) Interest Earnings before tax (EBT) Tax (18%) Earnings after tax (EAT) $ million 240 96 42 102 2.6 99.4 17.9 81.5 + Required A. Calculate the degree of operating leverage for Debret . (2.5 marks) B. Calculate the degree of financial leverage for Debret. (2.5 marks) C. Sales volumes are projected to increase by 50%, Greg would like to know by how much (in US Dollars) would Debret's EBIT increase if sales volumes increase as projected? (2.5 marks) D. Alan, expects Debret's EBIT to increases by at least 60%. He wants to know how much (in US Dollars) would Debret's net income be if his prediction is correct. (2.5 marks) Arial . 3 (12pt) TE-ES-25

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts