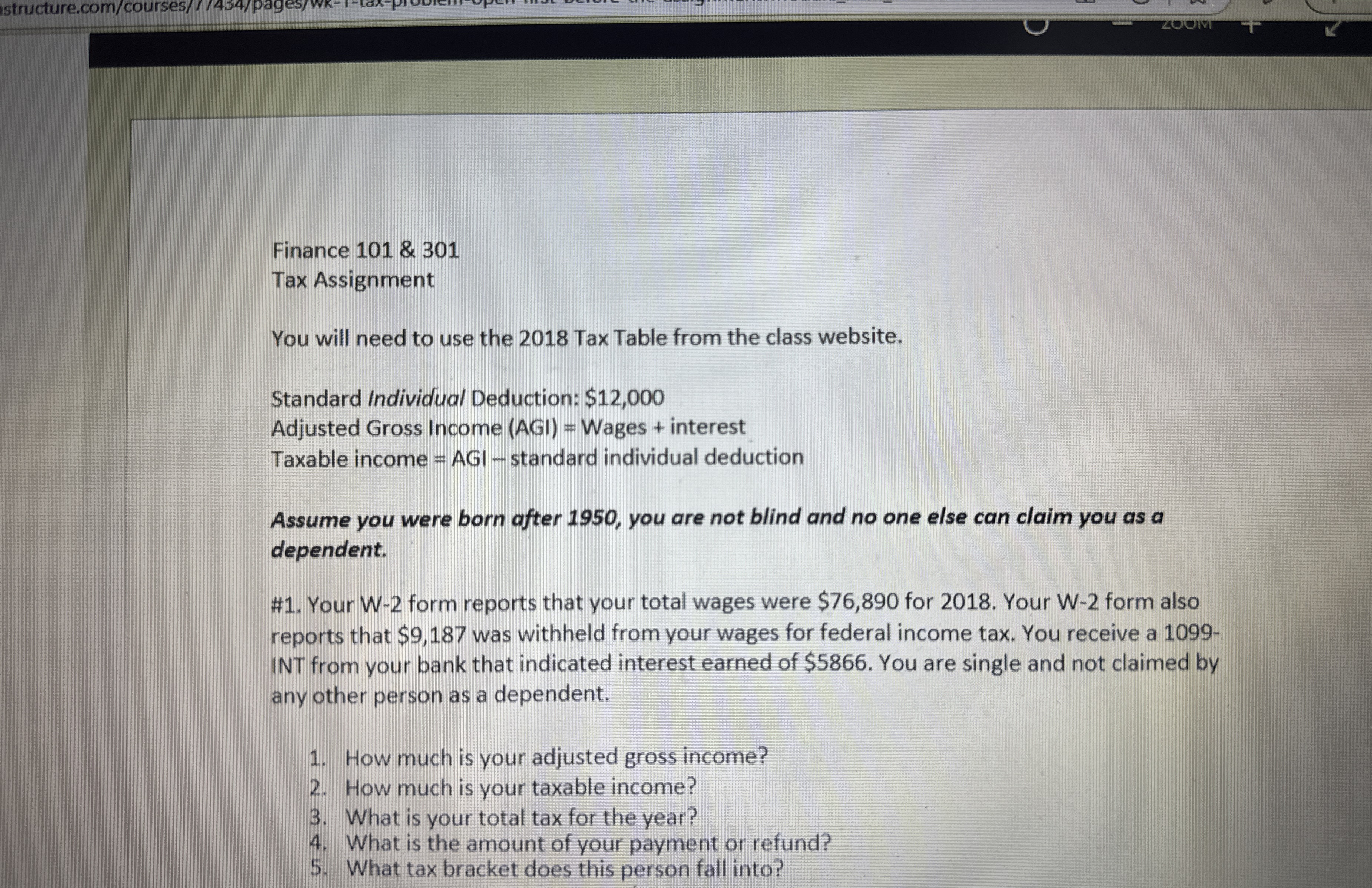

Question: Finance 1 0 1 & 3 0 1 Tax Assignment You will need to use the 2 0 1 8 Tax Table from the class

Finance &

Tax Assignment

You will need to use the Tax Table from the class website.

Standard Individual Deduction: $

Adjusted Gross Income AGI Wages interest

Taxable income AGI standard individual deduction

Assume you were born after you are not blind and no one else can claim you as a dependent.

# Your W form reports that your total wages were $ for Your W form also reports that $ was withheld from your wages for federal income tax. You receive a INT from your bank that indicated interest earned of $ You are single and not claimed by any other person as a dependent.

How much is your adjusted gross income?

How much is your taxable income?

What is your total tax for the year?

What is the amount of your payment or refund?

What tax bracket does this person fall into?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock