Question: Finance 3 2 2 0 0 0 2 / 0 0 3 Spring 2 0 2 4 Final Exam - Real Exam 0 5 1

Finance Spring Final Exam Real Exam

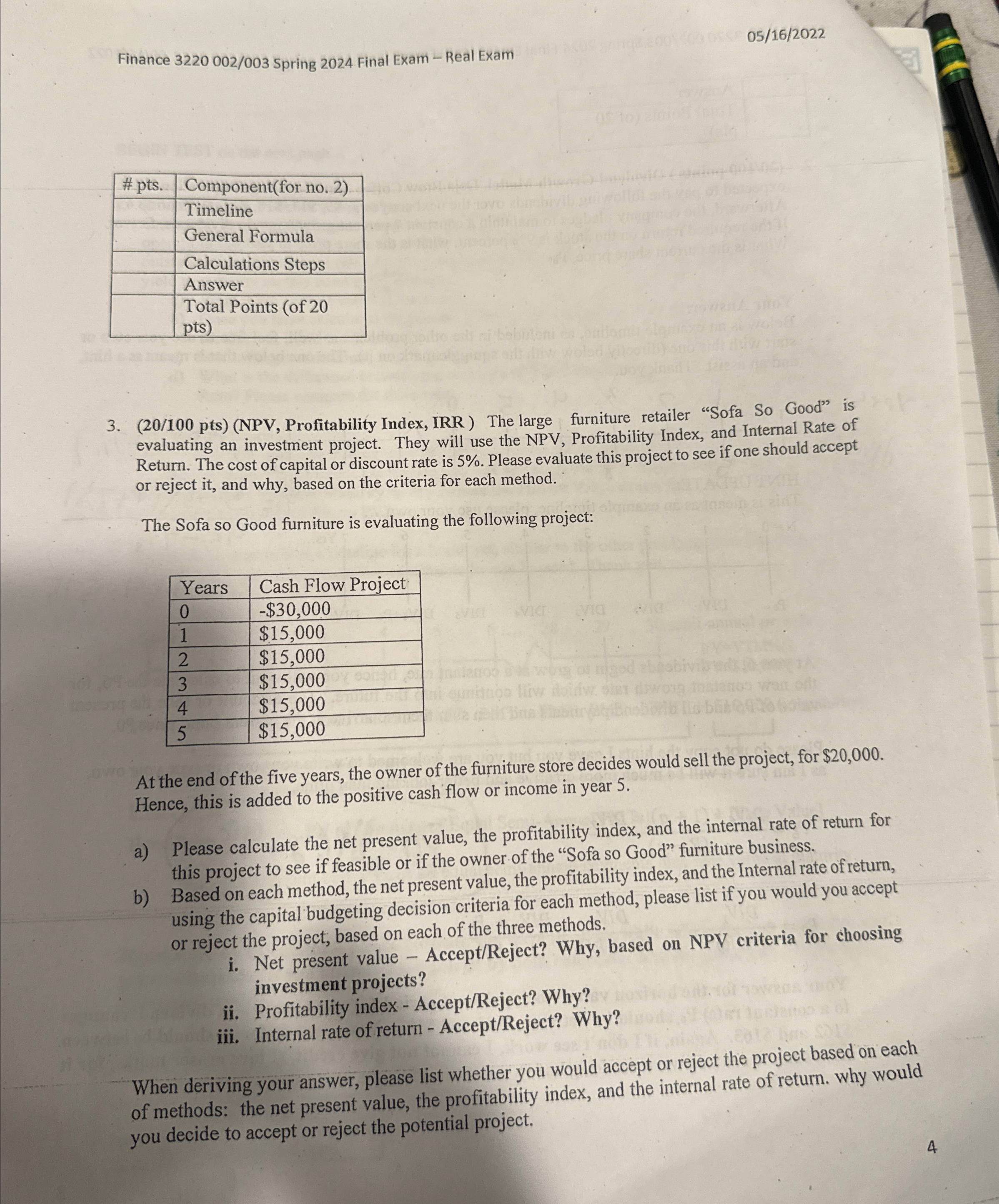

table# ptsComponentfor noTimelineGeneral FormulaCalculations StepsAnswertableTotal Points of pts

NPV Profitability Index, IRR The large furniture retailer "Sofa So Good" is evaluating an investment project. They will use the NPV Profitability Index, and Internal Rate of Return. The cost of capital or discount rate is Please evaluate this project to see if one should accept or reject it and why, based on the criteria for each method.

The Sofa so Good furniture is evaluating the following project:

tableYearsCash Flow Project$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock