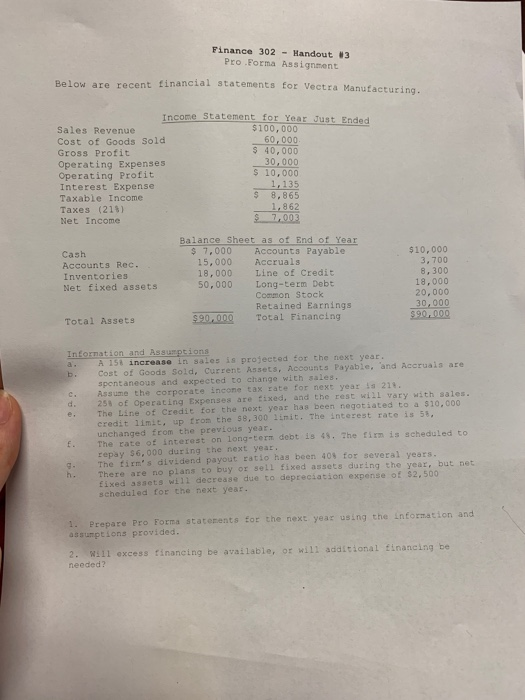

Question: Finance 302 Handout #3 Pro .Forma Assignment Below are recent financial statements for Vectra Manufacturing.. Income Statement for Year Just Ended $100,000 60,000 40,000 30,000

Finance 302 Handout #3 Pro .Forma Assignment Below are recent financial statements for Vectra Manufacturing.. Income Statement for Year Just Ended $100,000 60,000 40,000 30,000 S 10,000 1,135 8,865 1,862 S 7,003 Sales Revenue Cost of Goods Sold Gross Profit Operating Expenses Operating Profit Interest Expense Taxable Income Taxes (218) Net Income S Balance Sheet as of End of Year 7,000 15,000 18,000 50,000 Accounts Payable $10,000 3,700 Cash Accruals Accounts Rec. Inventories Net fixed assets Line of Credit Long-term Debt Common $tock Retained Earnings Total Financing 8,300 18,000 20,000 30,000 $90,000 $90,000 Total Assets Infornation and Assumptions A 158 increase in sales is projected for the next year. Cost of Goods Sold, Current Assets, Accounts Payable, and Accruais are spentaneous and expected to change with sales. Assume the corporate incone tax rate for next year is 218. 25 of Operating Expenses are ixed, and the rest wi11 vary with sales. The Line of Credit for the next year has been negotiated to a $10.c00 credit limit, up from the S8, 300 limit. The interest rate is 58, unchanged from the previous year. The rate of interest on long-term debt is 48. The firm is scheduled to repay $6,000 during the next year. The firm's dividend payout ratio has been 40% for several years. There are no plans to buy or sell fixed assets during the year, but net fixed assets will decrease due to depreciation expernse of $2,500 scheduled for the next year a. b. C. d. e. h. Prepare Pro Forma statenents for the next year using the information and assumptions provided. 1. 2. Will excess financing be available, or will additional financing be needed

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts