Question: Finance 3200 Quiz Circle the correct answer. (Q's I-20-1 point each 20 points total) 1. Given the component costs, the Optimal Capital Structure is the

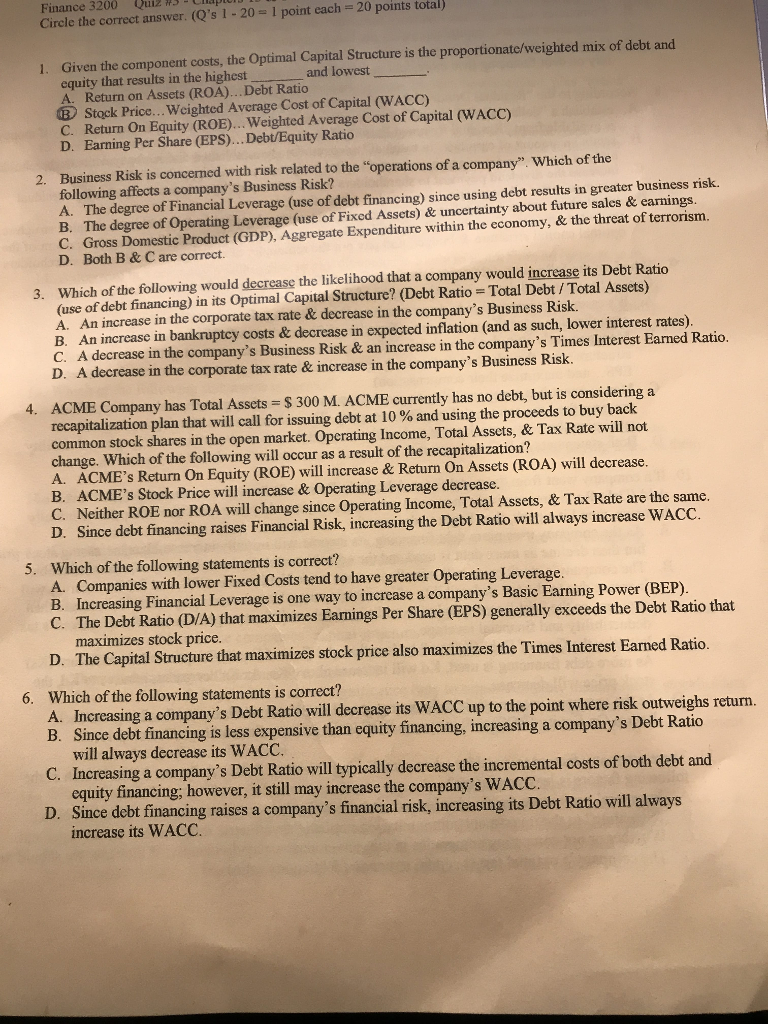

Finance 3200 Quiz Circle the correct answer. (Q's I-20-1 point each 20 points total) 1. Given the component costs, the Optimal Capital Structure is the proportionate/weighted mix of debt and equity that results in the highest and lowest A. Return on Assets (ROA) Debt Ratio B Stock Price... Weighted Average Cost of Capital (WACC) C. Return On Equity (ROE)...Weighted Average Cost of Capital (WACC) D. Earning Per Share (EPS)... Debt/Equity Ratio 2. Business Risk is concerned with risk related to the "operations of a company" Which of the following affects a company's Business Risk? A. The degree of Financial Leverage (use of debt financing) since using debt results in greater business risk. B. The degree of Operating Leverage (use of Fixed Assets) & uncertainty about future sales & earnings C. Gross Domestic Product (GDP), Aggregate Expenditure within the economy, & the threat of terrorism. D. Both B & C are correct. 3. Which of the following would decrease the likelihood that a company would increase its Debt Ratio (use ofdebt financing) in its Optimal Capital Structure? (Debt Ratio = Total Debt/ Total Assets) A. An increase in the corporate tax rate & decrease in the company's Business Risk. B. An increase in bankruptcy costs & decrease in expected inflation (and as such, lower interest rates) decrease in the company's Business Risk & an increase in the company's Times Interest Earned Ratio. D. A decrease in the corporate tax rate & increase in the company's Business Risk. ACME Company has Total Assets = $ 300 M. ACME currently has no debt, but is considering a recapitalization plan that will call for issuing debt at 10 % and using the proceeds to buy back common stock shares in the open market. Operating Income, Total Assets, & Tax Rate will not change. Which of the following will occur as a result of the recapitalization? A. ACME's Return On Equity (ROE) will increase & Return On Assets (ROA) will decrease. B. ACME's Stock Price will increase & Operating Leverage decrease. C. Neither ROE nor ROA will change since Operating Income, Total Assets, & Tax Rate are the same. D. Since debt financing raises Financial Risk, increasing the Debt Ratio will always increase WACC. 4, 5. Which of the following statements is correct? A. Companies with lower Fixed Costs tend to have greater Operating Leverage. B. Increasing Financial Leverage is one way to increase a company's Basic Earning Power (BEP). C. The Debt Ratio (D/A) that maximizes Earnings Per Share (EPS) generally exceeds the Debt Ratio that maximizes stock price D. The Capital Structure that maximizes stock price also maximizes the Times Interest Earned Ratio. Which of the following statements is correct? A. Increasing a company's Debt Ratio will decrease its WACC up to the point where risk outweighs return B. Since debt financing is less expensive than equity fi 6. nancing, increasing a company's Debt Ratio will always decrease its WACC C. Increasing a company's Debt Ratio will typically decrease the incremental costs of both debt and equity financing; however, it still may increase the company's WACC Since debt financing raises a company's financial risk, incre increase its WACC D. asing its Debt Ratio will always

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts