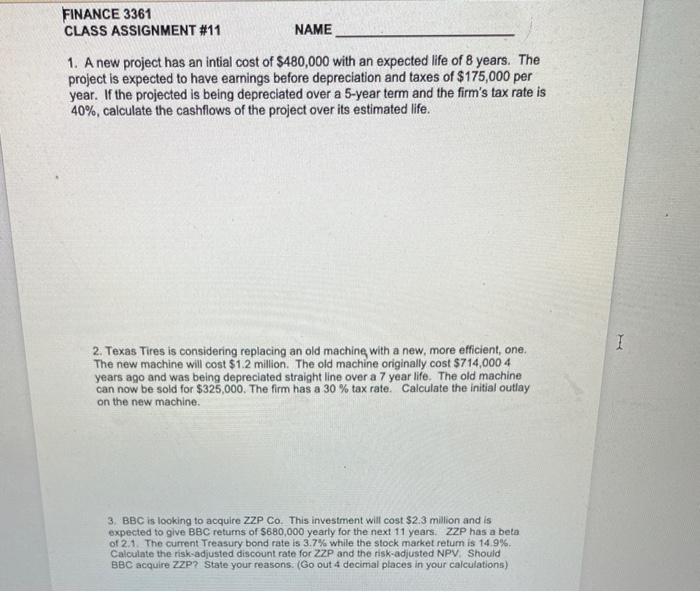

Question: FINANCE 3361 CLASS ASSIGNMENT #11 NAME 1. A new project has an intial cost of $480,000 with an expected life of 8 years. The project

FINANCE 3361 CLASS ASSIGNMENT #11 NAME 1. A new project has an intial cost of $480,000 with an expected life of 8 years. The project is expected to have earnings before depreciation and taxes of $175,000 per year. If the projected is being depreciated over a 5-year term and the firm's tax rate is 40%, calculate the cashflows of the project over its estimated life. I 2. Texas Tires is considering replacing an old machine with a new, more efficient, one, The new machine will cost $1.2 million. The old machine originally cost $714,000 4 years ago and was being depreciated straight line over a 7 year life. The old machine can now be sold for $325,000. The firm has a 30 % tax rate. Calculate the initial outlay on the new machine 3. BBC is looking to acquire ZZP Co. This investment will cost $2.3 million and is expected to give BBC returns of $680,000 yearly for the next 11 years. ZZP has a beta of 2.1. The current Treasury bond rate is 3.7% while the stock market return is 14.9%. Calculate the risk-adjusted discount rate for ZZP and the risk-adjusted NPV Should BBC acquire ZZP? State your reasons. (Go out 4 decimal places in your calculations)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts