Question: Finance 8 6 0 - Problem Set # 2 This individual problem set is due in Blackboard by 1 1 : 5 9 pm on

Finance Problem Set #

This individual problem set is due in Blackboard by :pm on Mondav, October

On the companion Excel spreadsheet for PS# you are provided financial information and

projections for XYZ Inc. Using that data, answer the following questions. Do your

calculations and answers in the Excel spreadsheet and then UPLOAD the Excel

spreadsheet file into Blackboard.

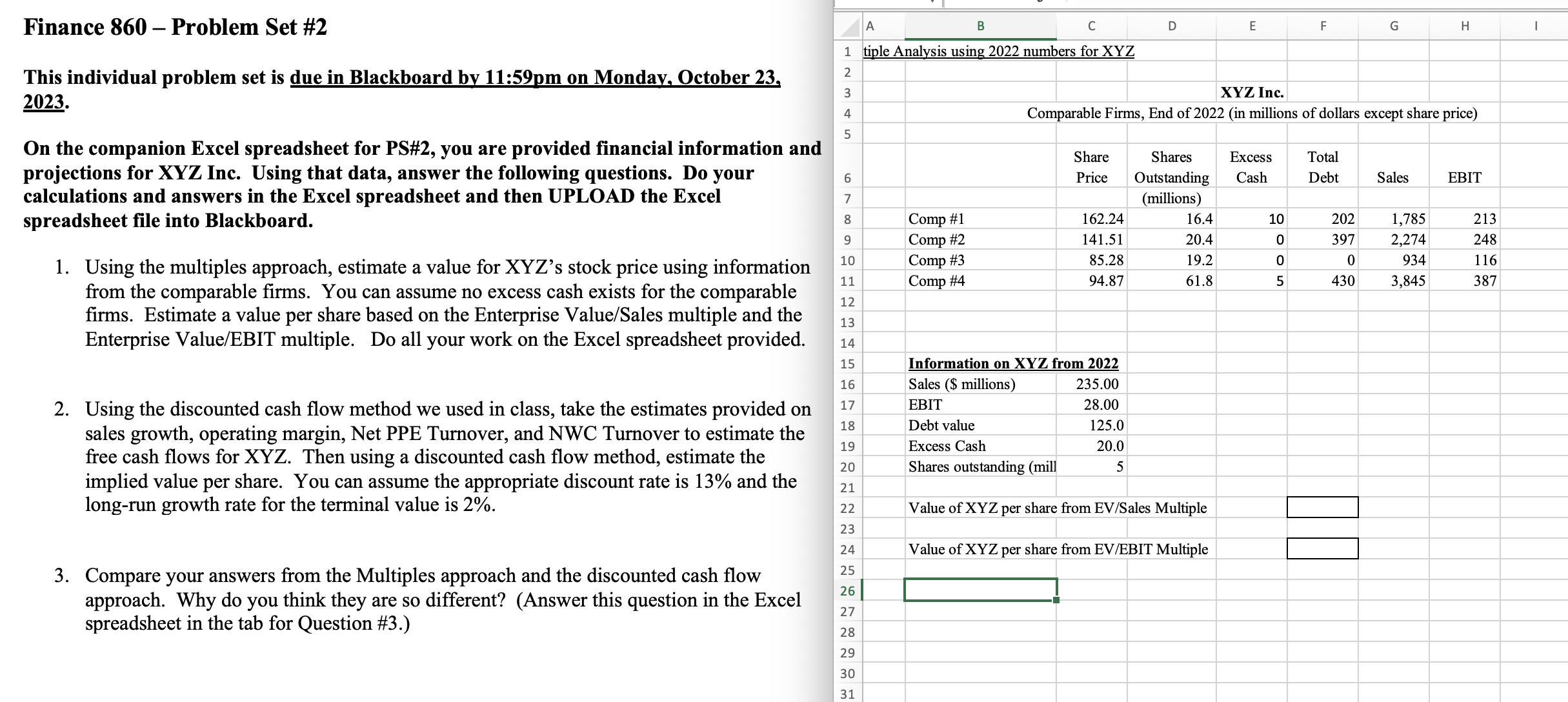

Using the multiples approach, estimate a value for XYZs stock price using information

from the comparable firms. You can assume no excess cash exists for the comparable

firms. Estimate a value per share based on the Enterprise ValueSales multiple and the

Enterprise ValueEBIT multiple. Do all your work on the Excel spreadsheet provided.

Using the discounted cash flow method we used in class, take the estimates provided on

sales growth, operating margin, Net PPE Turnover, and NWC Turnover to estimate the

free cash flows for XYZ Then using a discounted cash flow method, estimate the

implied value per share. You can assume the appropriate discount rate is and the

longrun growth rate for the terminal value is

Compare your answers from the Multiples approach and the discounted cash flow

approach. Why do you think they are so different? Answer this question in the Excel

spreadsheet in the tab for Question #

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock