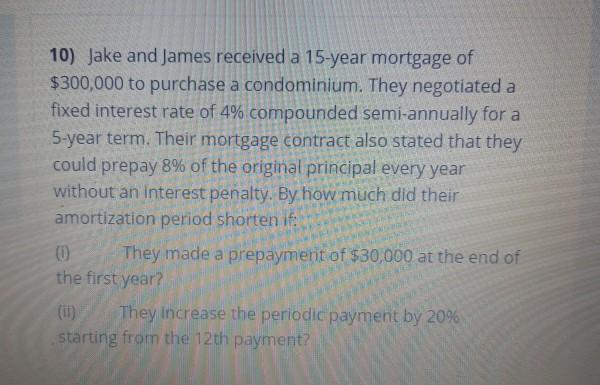

Question: 10) Jake and James received a 15-year mortgage of $300,000 to purchase a condominium. They negotiated a fixed interest rate of 4% compounded semi-annually

10) Jake and James received a 15-year mortgage of $300,000 to purchase a condominium. They negotiated a fixed interest rate of 4% compounded semi-annually for a 5-year term. Their mortgage contract also stated that they could prepay 8% of the original principal every year without an interest penalty. By how much did their amortization period shorten if: (0) They made a prepayment of $30,000 at the end of the first year? They Increase the periodic payment by 20% starting from the 12th payment? (i)

Step by Step Solution

3.39 Rating (158 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts