Question: FINANCE ASSIGNMENT - PLEAS HELP ME !!!! 3. Wildcat's stock is volatile, you expect its stock price either increases or decreases by 30% over a

FINANCE ASSIGNMENT - PLEAS HELP ME !!!!

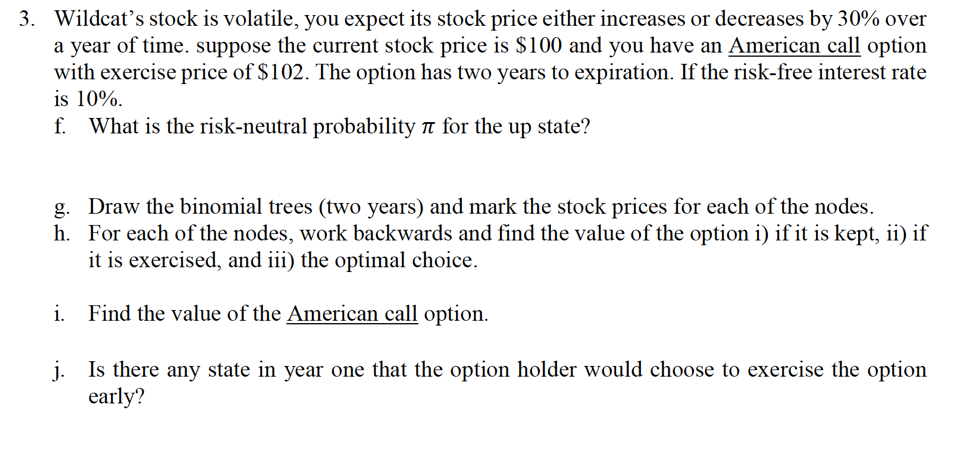

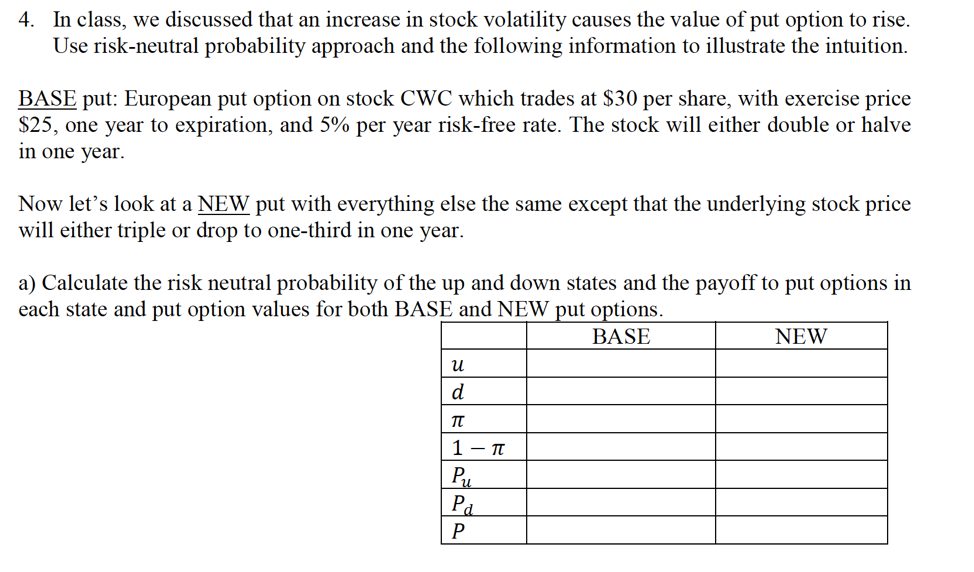

3. Wildcat's stock is volatile, you expect its stock price either increases or decreases by 30% over a year of time. suppose the current stock price is S100 and you have an American call option with exercise price of S102. The option has two years to expiration. If the risk-free interest rate is 10%. f. What is the risk-neutral probability t for the up state? g. Draw the binomial trees (two years) and mark the stock prices for each of the nodes. h. For each of the nodes, work backwards and find the value of the optioni) ifit is kept, ii) if it is exercised, and ii) the optimal choice. Find the value of the American call option. Is there any state in year one that the option holder would choose to exercise the option i. j. early? 4. In class, we discussed that an increase in stock volatility causes the value of put option to rise Use risk-neutral probability approach and the following information to illustrate the intuition BASE put: European put option on stock CWC which trades at S30 per share, with exercise price $25, one year to expiration, and 5% per year risk-free rate. "The stock will either double or halve in one year. Now let's look at a NEW put with everything else the same except that the underlying stock price will either triple or drop to one-third in one year. a) Calculate the risk neutral probability of the up and down states and the payoff to put options in each state and put option values for both BASE and NEW put options BASE NEW

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts