Question: finance HW QUESION NO.2 does the of Th eve( v, is 2. You are an analyst for Rushmore Investment Bank and you are trying to

finance HW QUESION NO.2

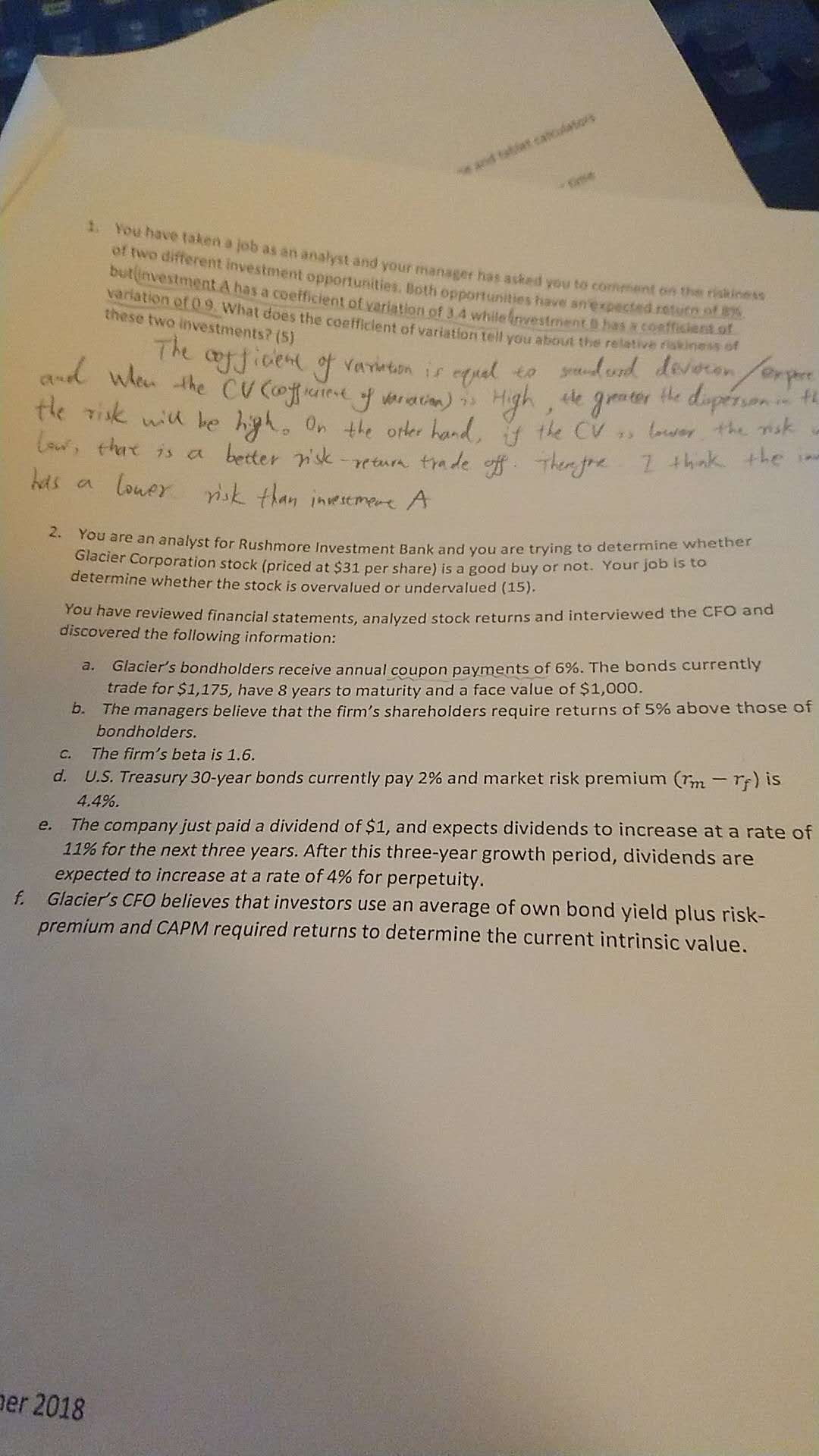

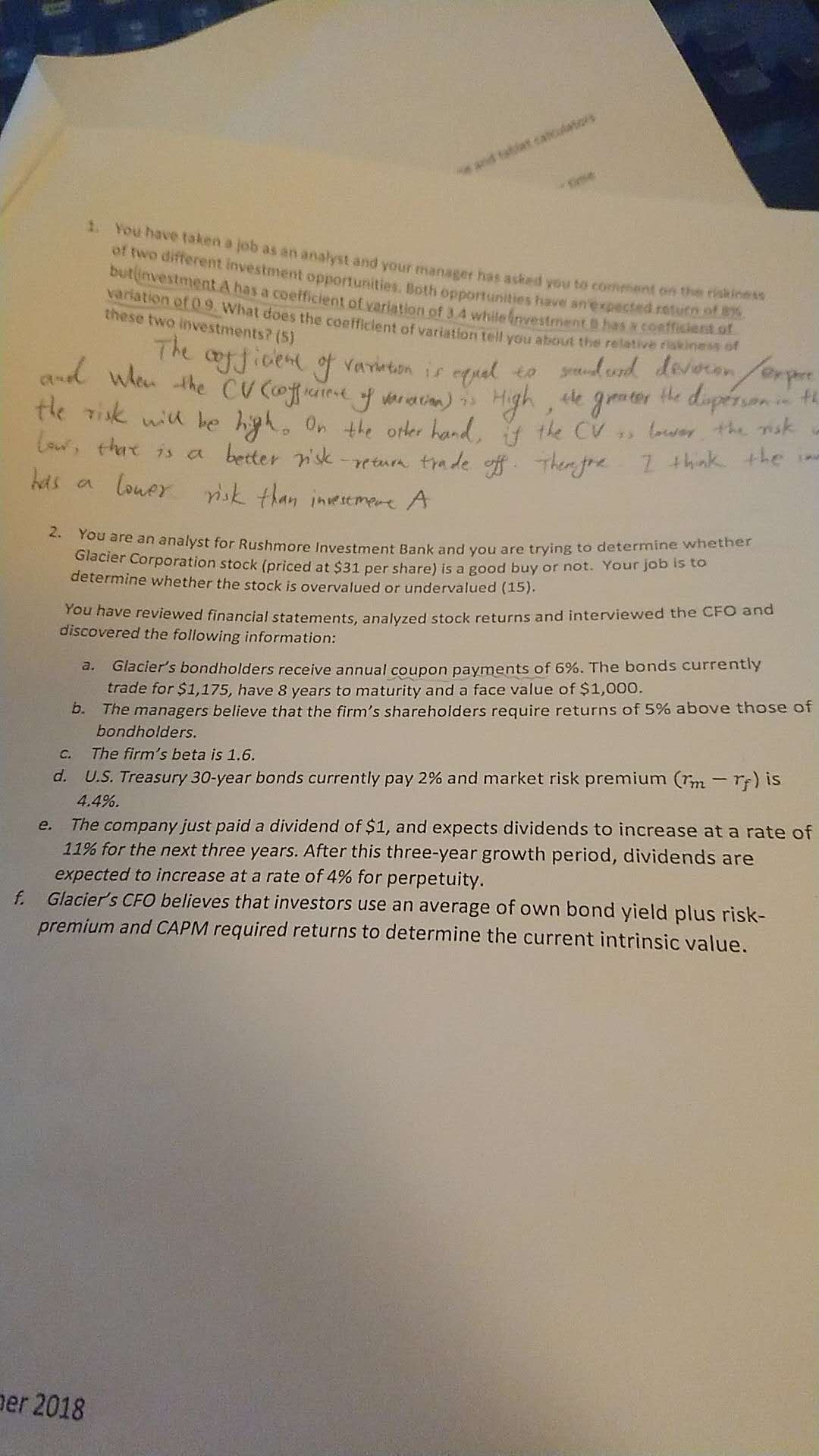

does the of Th eve( v, is 2. You are an analyst for Rushmore Investment Bank and you are trying to determine whether Glacier Corporation stock (priced at $31 per share) is a good buy or not. Your job iS to determine Whether the stock is overvalued or undervalued (15). You have reviewed financial statements, analyzed stock returns and interviewed the CFO and discovered the following information: a. Glacier's bondholders receive annual ceupon payments of 6%. The bonds currently trade for $1,175, have 8 years to maturity and a face value Of $1,000. b. The managers believe that the firm's shareholders require returns of 5% above those Of bondholders. c. The firm's beta is 1.6. d. U.S. Treasury 30-year bonds currently pay 2% and market risk premium (r m is 4.4%. e. The company just paid a dividend of $1, and expects dividends to increase at a rate of for the next three years. After this three-year growth period, dividends are expected to increase at a rate of 4% for perpetuity. f. Glacier's CFO believes that investors use an average of own bond yield plus risk- premium and CAPM required returns to determine the current intrinsic value. W 2018

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts