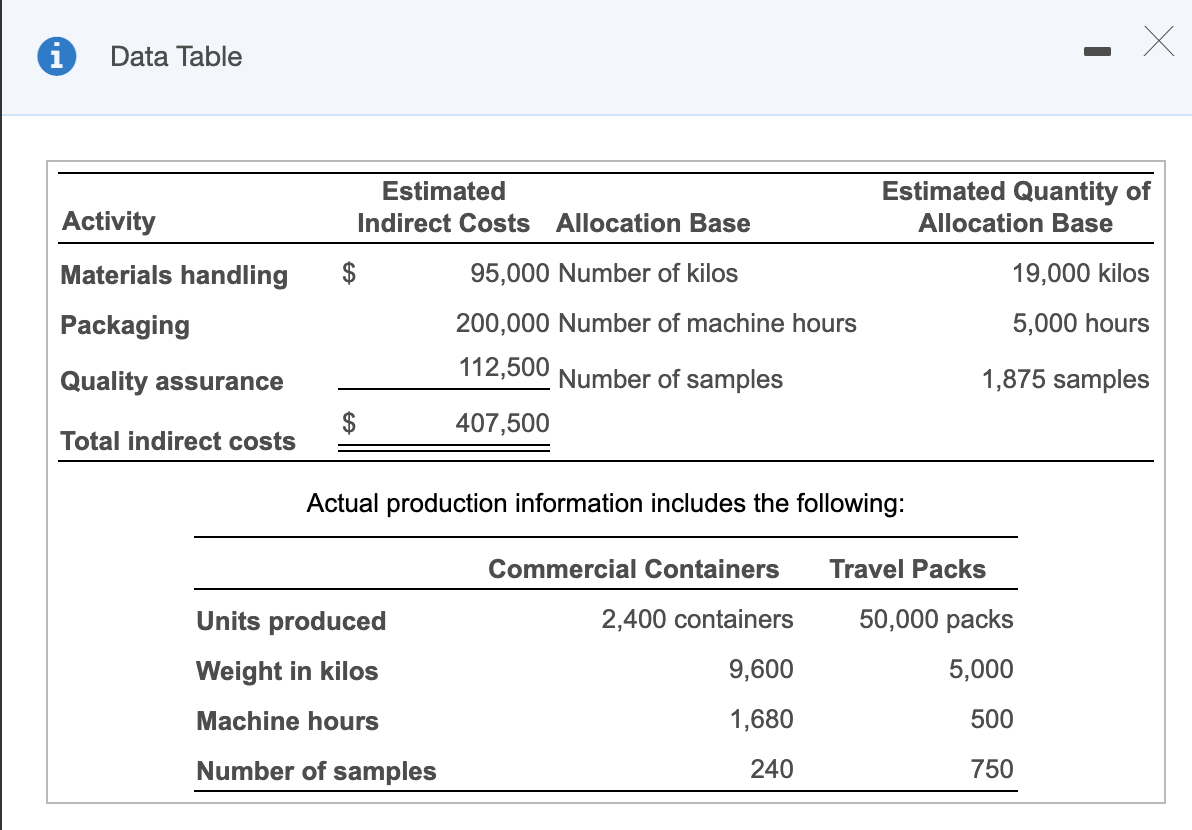

Question: Finance hw question: Data Table Estimated Indirect Costs Allocation Base Estimated Quantity of Allocation Base Activity Materials handling 19,000 kilos 95,000 Number of kilos 200,000

Finance hw question:

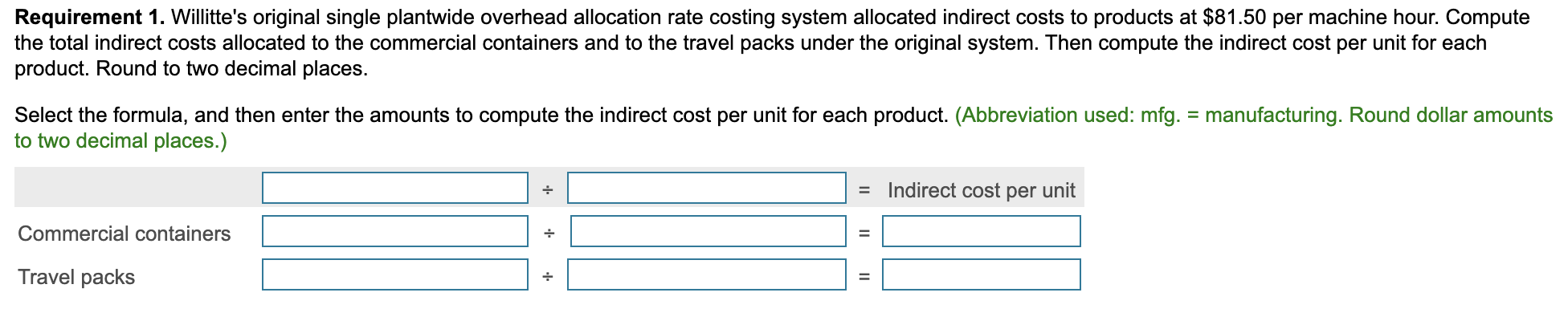

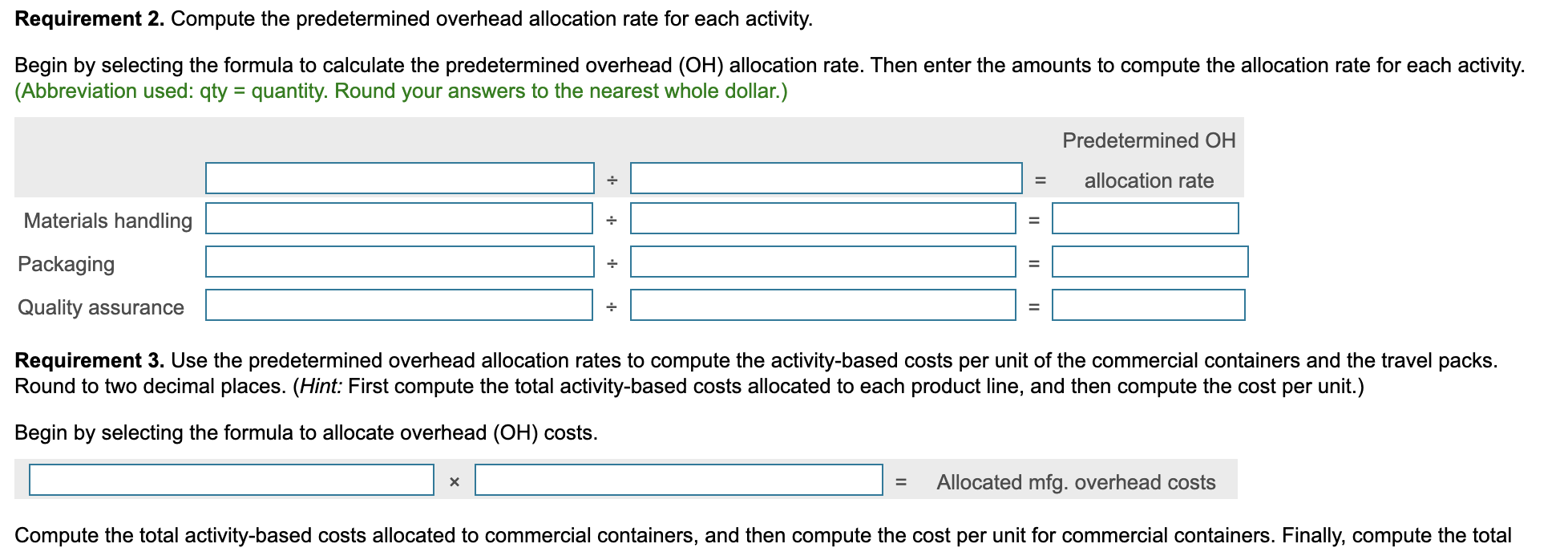

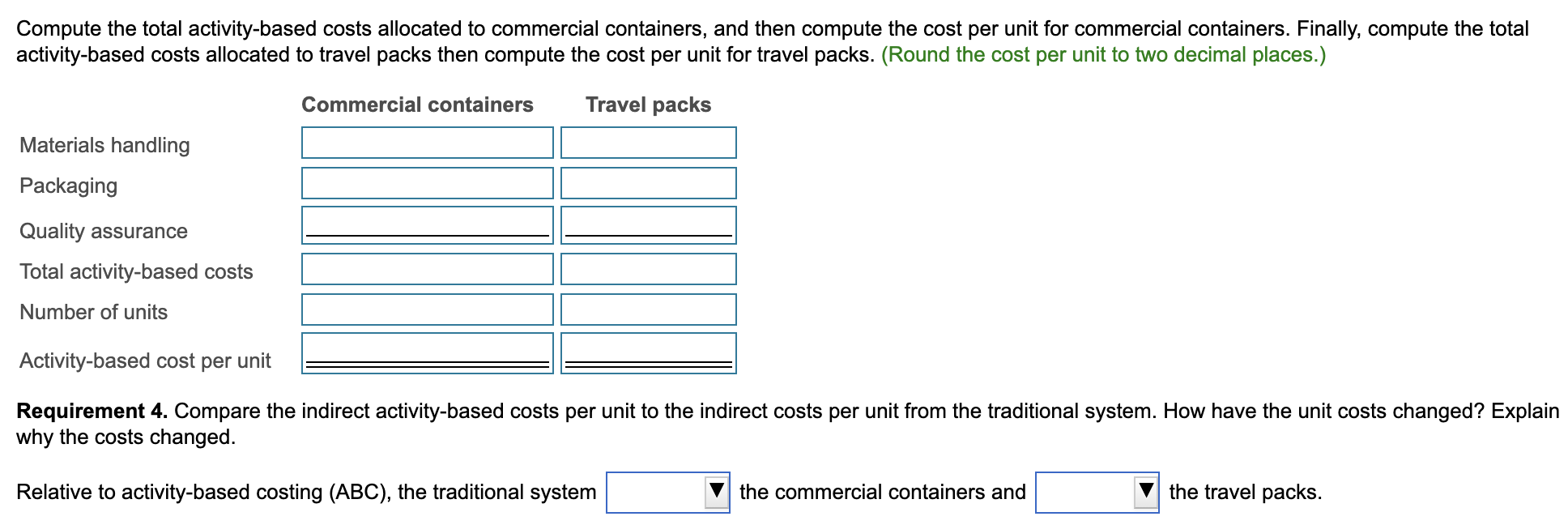

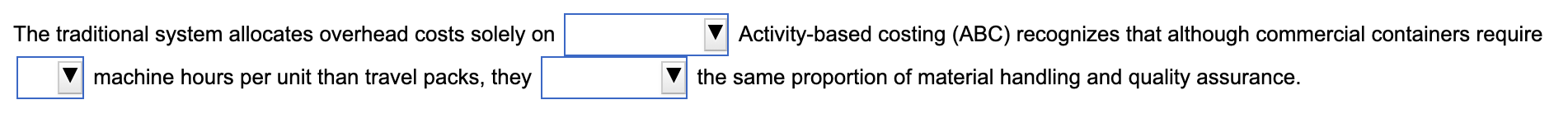

Data Table Estimated Indirect Costs Allocation Base Estimated Quantity of Allocation Base Activity Materials handling 19,000 kilos 95,000 Number of kilos 200,000 Number of machine hours Packaging 5,000 hours Quality assurance 112,500 Number of samples 1,875 samples $ 407,500 Total indirect costs Actual production information includes the following: Commercial Containers Travel Packs 2,400 containers Units produced Weight in kilos 50,000 packs 5,000 9,600 Machine hours 1,680 500 Number of samples 240 750 Requirement 1. Willitte's original single plantwide overhead allocation rate costing system allocated indirect costs to products at $81.50 per machine hour. Compute the total indirect costs allocated to the commercial containers and to the travel packs under the original system. Then compute the indirect cost per unit for each product. Round to two decimal places. Select the formula, and then enter the amounts to compute the indirect cost per unit for each product. (Abbreviation used: mfg. = manufacturing. Round dollar amounts to two decimal places.) = Indirect cost per unit Commercial containers Travel packs Requirement 2. Compute the predetermined overhead allocation rate for each activity. Begin by selecting the formula to calculate the predetermined overhead (OH) allocation rate. Then enter the amounts to compute the allocation rate for each activity. (Abbreviation used: qty = quantity. Round your answers to the nearest whole dollar.) Predetermined OH allocation rate Materials handling = Packaging Quality assurance Requirement 3. Use the predetermined overhead allocation rates to compute the activity-based costs per unit of the commercial containers and the travel packs. Round to two decimal places. (Hint: First compute the total activity-based costs allocated to each product line, and then compute the cost per unit.) Begin by selecting the formula to allocate overhead (OH) costs. Allocated mfg. overhead costs Compute the total activity-based costs allocated to commercial containers, and then compute the cost per unit for commercial containers. Finally, compute the total Compute the total activity-based costs allocated to commercial containers, and then compute the cost per unit for commercial containers. Finally, compute the total activity-based costs allocated to travel packs then compute the cost per unit for travel packs. (Round the cost per unit to two decimal places.) Commercial containers Travel packs Materials handling Packaging Quality assurance Total activity-based costs Number of units Activity-based cost per unit Requirement 4. Compare the indirect activity-based costs per unit to the indirect costs per unit from the traditional system. How have the unit costs changed? Explain why the costs changed. Relative to activity-based costing (ABC), the traditional system the commercial containers and the travel packs. The traditional system allocates overhead costs solely on Activity-based costing (ABC) recognizes that although commercial containers require the same proportion of material handling and quality assurance. machine hours per unit than travel packs, they

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts