Question: Finance management : pls answer all the question Answer ALL questions. 1. Which one of the following is the financial statement that summarizes a firm's

Finance management : pls answer all the question

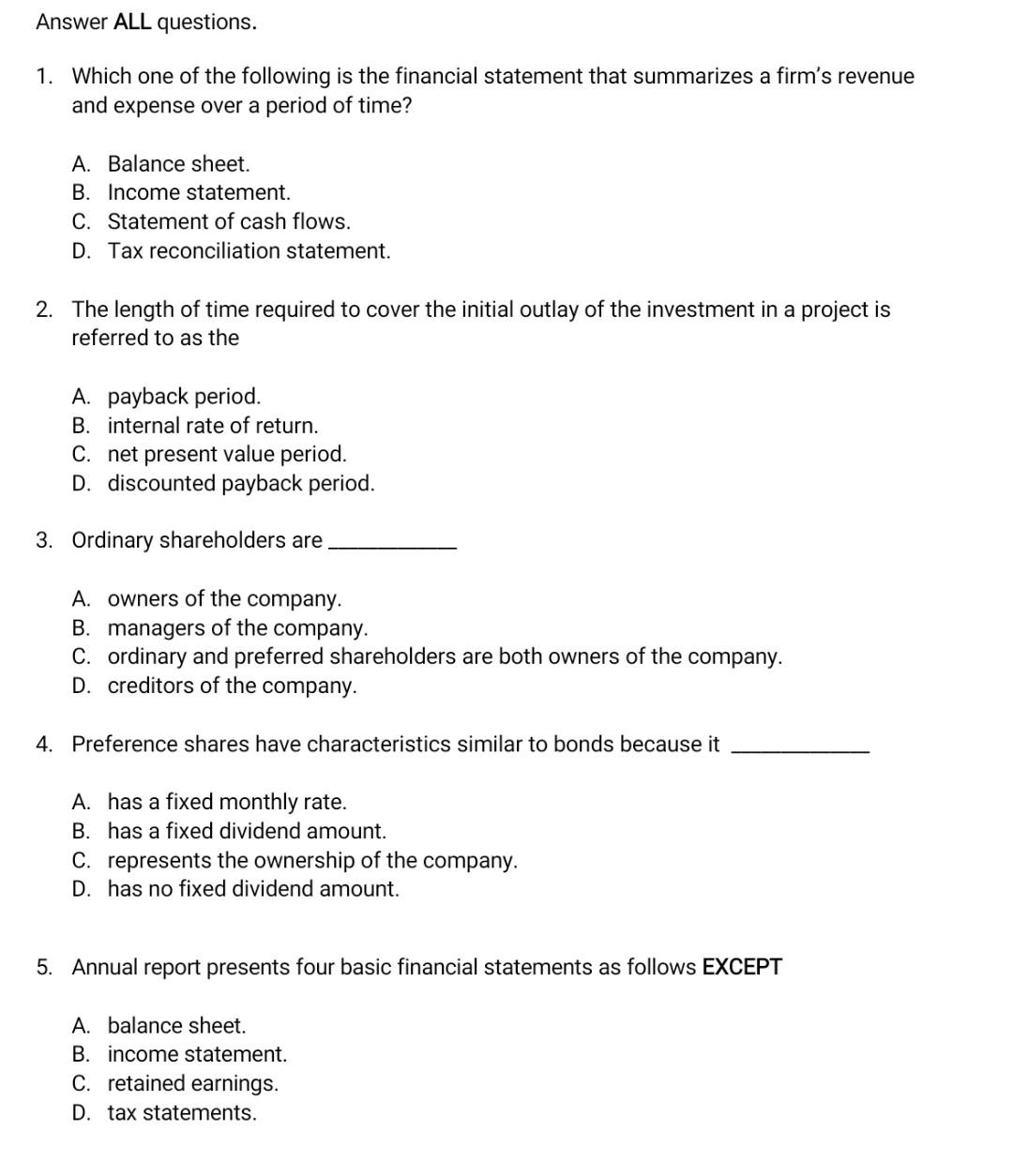

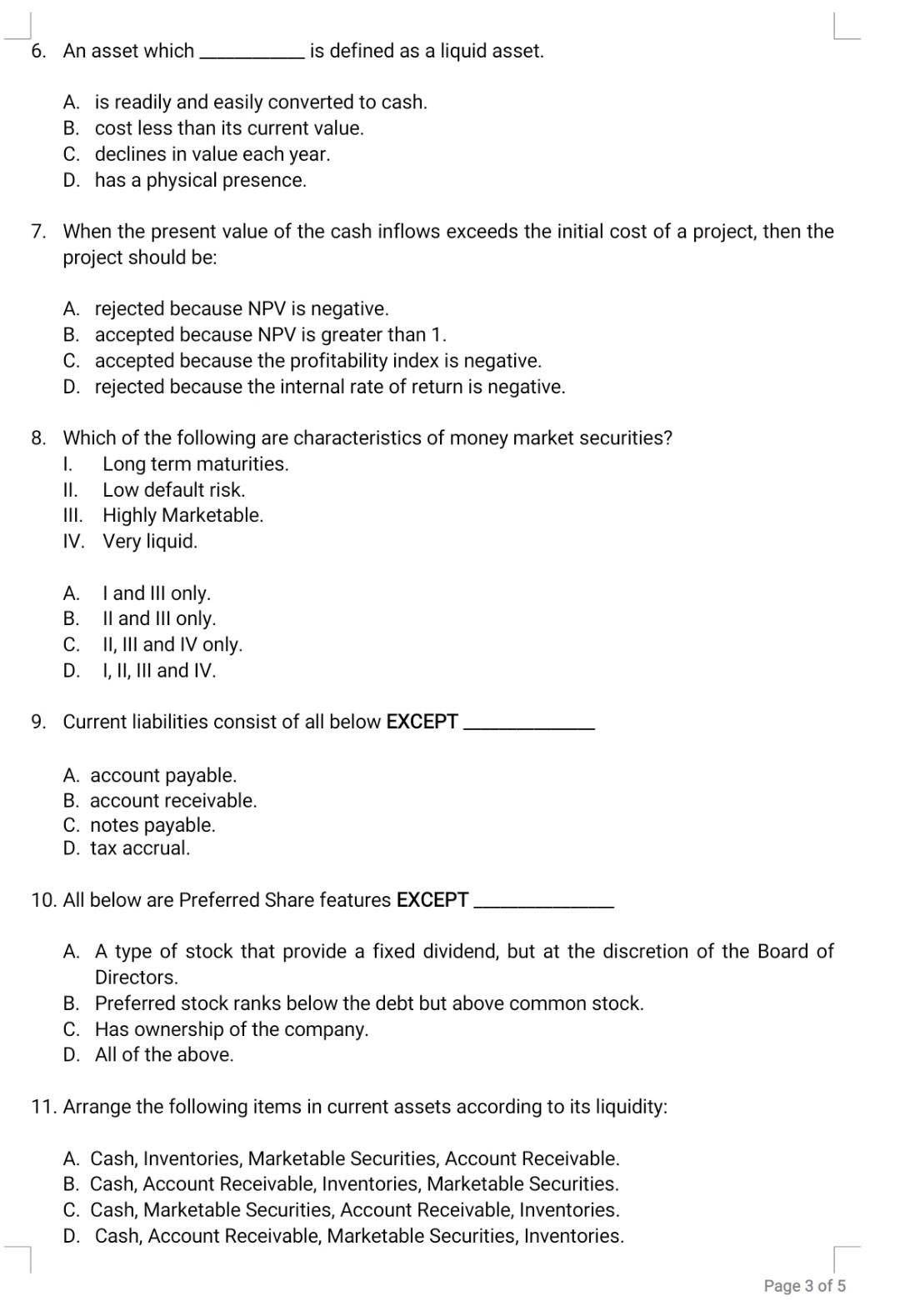

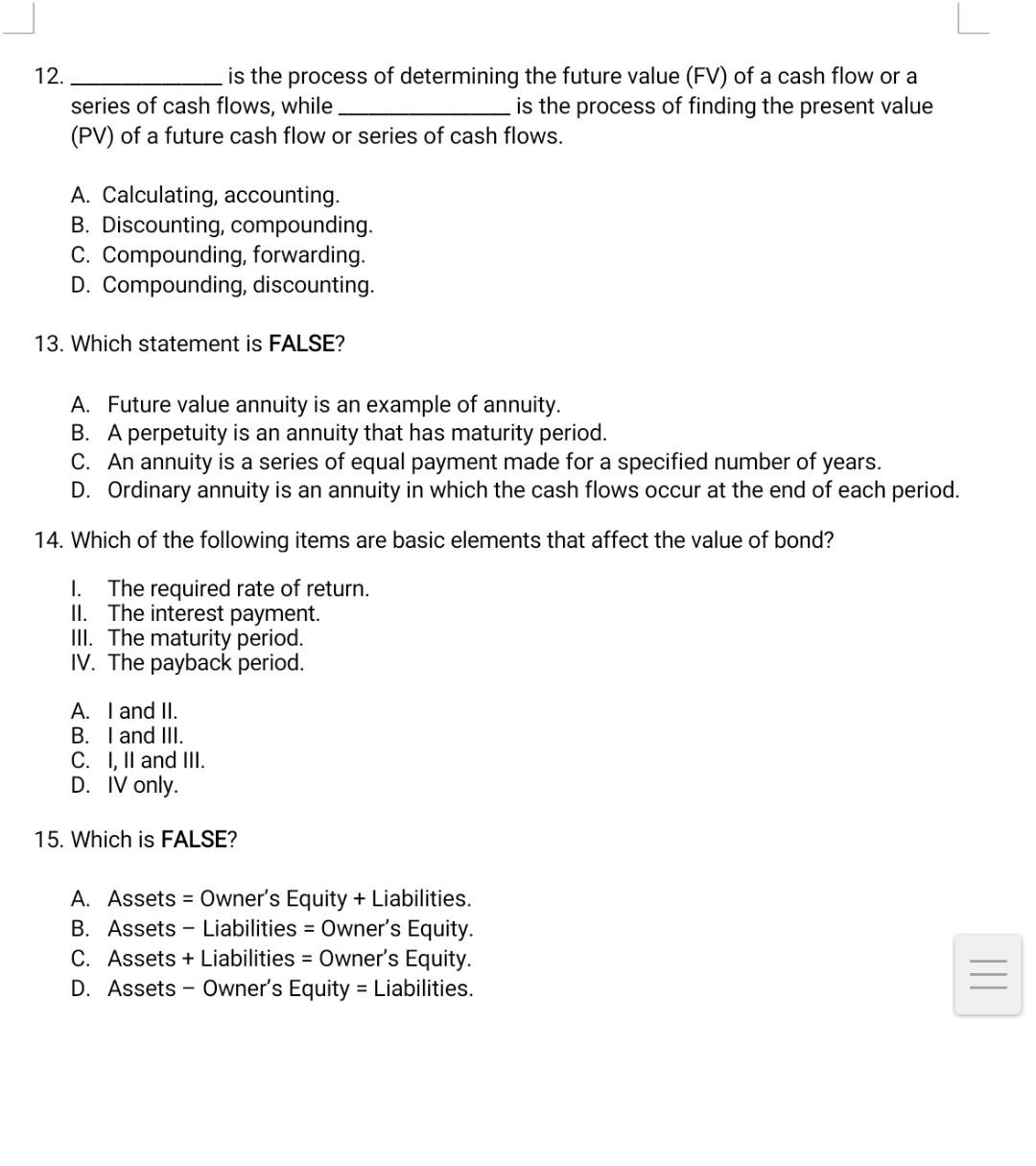

Answer ALL questions. 1. Which one of the following is the financial statement that summarizes a firm's revenue and expense over a period of time? A. Balance sheet. B. Income statement. C. Statement of cash flows. D. Tax reconciliation statement. 2. The length of time required to cover the initial outlay of the investment in a project is referred to as the A. payback period. B. internal rate of return. C. net present value period. D. discounted payback period. 3. Ordinary shareholders are A. owners of the company. B. managers of the company. C. ordinary and preferred shareholders are both owners of the company. D. creditors of the company. 4. Preference shares have characteristics similar to bonds because it A. has a fixed monthly rate. B. has a fixed dividend amount. C. represents the ownership of the company. D. has no fixed dividend amount. 5. Annual report presents four basic financial statements as follows EXCEPT A. balance sheet. B. income statement. C. retained earnings. D. tax statements. 6. An asset which is defined as a liquid asset. A. is readily and easily converted to cash. B. cost less than its current value. C. declines in value each year. D. has a physical presence. 7. When the present value of the cash inflows exceeds the initial cost of a project, then the project should be: A. rejected because NPV is negative. B. accepted because NPV is greater than 1. C. accepted because the profitability index is negative. D. rejected because the internal rate return is negative. 8. Which of the following are characteristics of money market securities? 1. Long term maturities. II. Low default risk. III. Highly Marketable. IV. Very liquid. A. I and III only. B. II and III only. C. II, III and IV only. D. I, II, III and IV. 9. Current liabilities consist of all below EXCEPT A. account payable. B. account receivable. C. notes payable. D. tax accrual. 10. All below are Preferred Share features EXCEPT A. A type of stock that provide a fixed dividend, but at the discretion of the Board of Directors. B. Preferred stock ranks below the debt but above common stock. C. Has ownership of the company. D. All of the above. 11. Arrange the following items in current assets according to its liquidity: A. Cash, Inventories, Marketable Securities, Account Receivable. B. Cash, Account Receivable, Inventories, Marketable Securities. C. Cash, Marketable Securities, Account Receivable, Inventories. D. Cash, Account Receivable, Marketable Securities, Inventories. Page 3 of 5 12. is the process of determining the future value (FV) of a cash flow or a series of cash flows, while is the process of finding the present value (PV) of a future cash flow or series of cash flows. A. Calculating, accounting. B. Discounting, compounding. C. Compounding, forwarding. D. Compounding, discounting. 13. Which statement is FALSE? A. Future value annuity is an example of annuity. B. A perpetuity is an annuity that has maturity period. C. An annuity is a series of equal payment made for a specified number of years. D. Ordinary annuity is an annuity in which the cash flows occur at the end of each period. 14. Which of the following items are basic elements that affect the value of bond? 1. The required rate of return. II. The interest payment. III. The maturity period. IV. The payback period. A. I and II. B. I and III. C. I, II and III. D. I only. 15. Which is FALSE? A. Assets = Owner's Equity + Liabilities. B. Assets - Liabilities = Owner's Equity. C. Assets + Liabilities = Owner's Equity. D. Assets - Owner's Equity = Liabilities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts