Question: Finance math problems 6 You plan to deposit $4,500 at the end of each of the next 20 years into an account paying 9.7 percent

Finance math problems

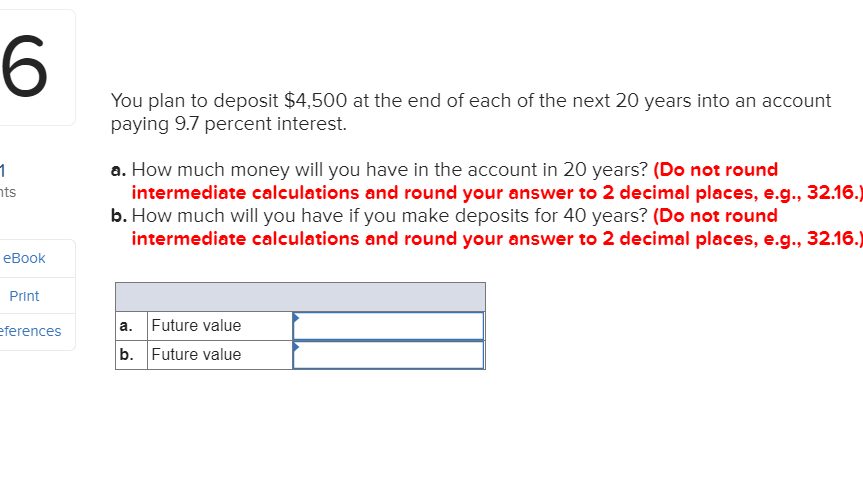

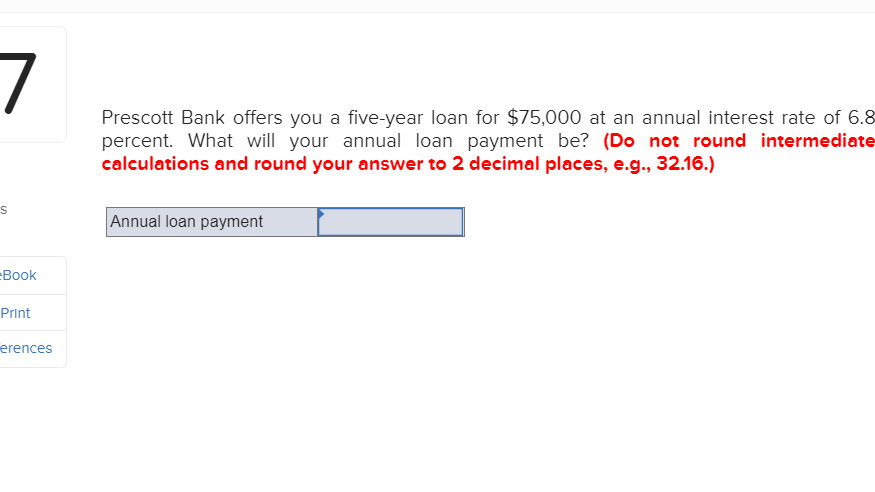

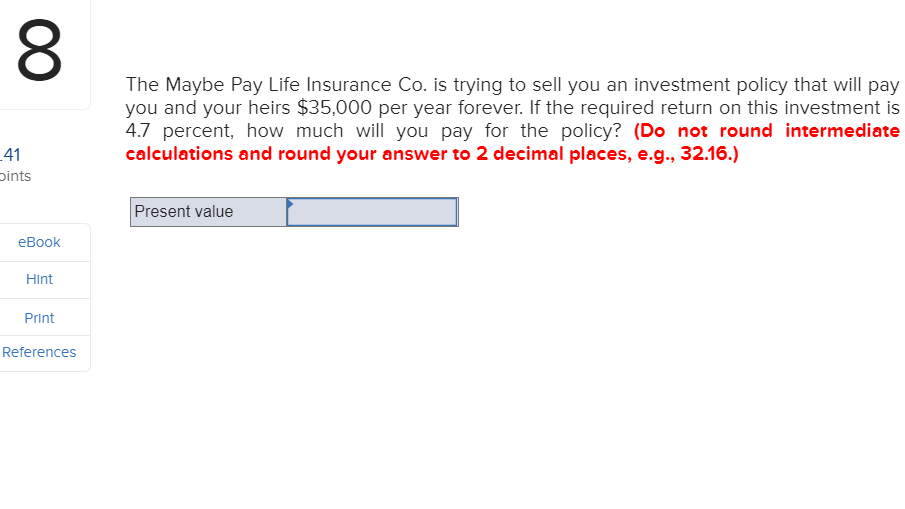

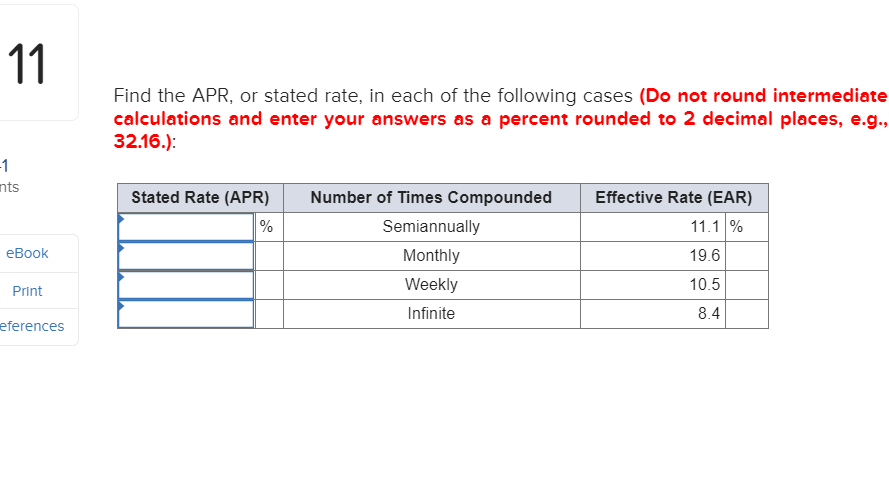

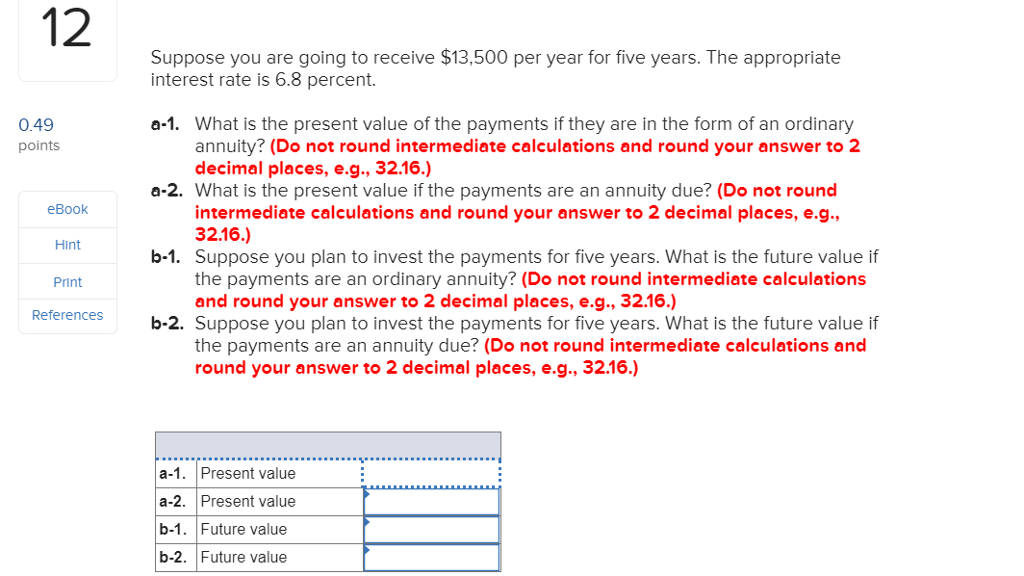

6 You plan to deposit $4,500 at the end of each of the next 20 years into an account paying 9.7 percent interest a. How much money will you have in the account in 20 years? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. How much will you have if you make deposits for 40 years? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) eBook Print ferences a. Future value b. Future value Prescott Bank offers you a five-year loan for $75,000 at an annual interest rate of 6.8 percent. What will your annual loan payment be? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g, 32.16.) Annual loan payment Book Print erences 8 The Maybe Pay Life Insurance Co. is trying to sell you an investment policy that will pay you and your heirs $35,000 per year forever. If the required return on this investment is 4.7 percent, how much will you pay for the policy? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) 41 ints Present value eBook Hint Print References Find the APR, or stated rate, in each of the following cases (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g. 32.16.): nts Stated Rate (APR) Number of Times Compounded Effective Rate (EAR) Semiannually Monthly Weekly Infinite 11.1 % 19.6 10.5 8.4 eBook Print eferences 12 Suppose you are going to receive $13,500 per year for five years. The appropriate interest rate is 6.8 percent. 0.49 points a-1. What is the present value of the payments if they are in the form of an ordinary annuity? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) a-2. What is the present value if the payments are an annuity due? (Do not round eBook intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Suppose you plan to invest the payments for five years. What is the future value if the payments are an ordinary annuity? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Hint b-1. Print References b-2. Suppose you plan to invest the payments for five years. What is the future value if the payments are an annuity due? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) a-1. Present value a-2. Present value b-1. Future value b-2. Future value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts