Question: FINANCE MULTIPLE CHOICE QUESTIONS 14 - 17. [Set your calculator on four decimal places for the calculations of this question.] The current market price per

FINANCE

MULTIPLE CHOICE QUESTIONS

![decimal places for the calculations of this question.] The current market price](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/66fe4f883496c_53566fe4f87c3203.jpg)

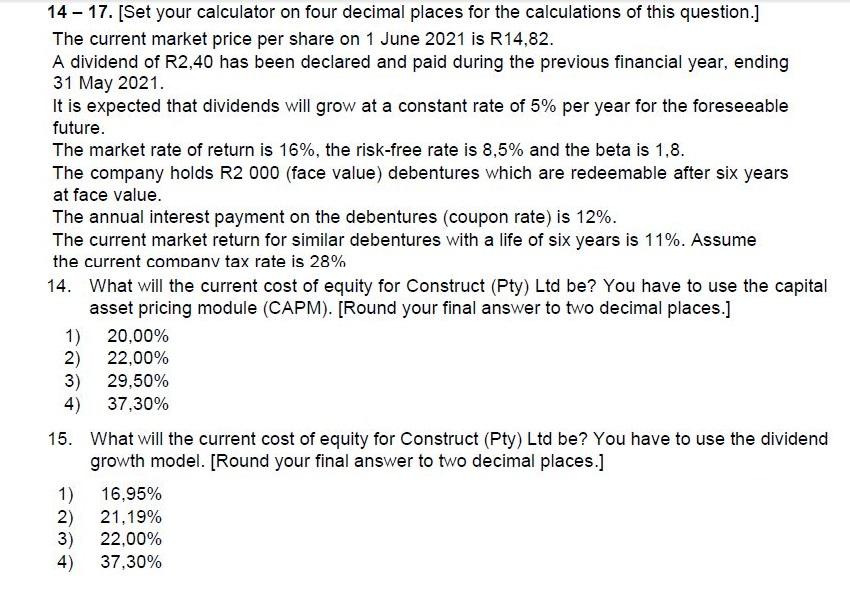

14 - 17. [Set your calculator on four decimal places for the calculations of this question.] The current market price per share on 1 June 2021 is R14,82. A dividend of R2,40 has been declared and paid during the previous financial year, ending 31 May 2021. It is expected that dividends will grow at a constant rate of 5% per year for the foreseeable future. The market rate of return is 16%, the risk-free rate is 8,5% and the beta is 1.8. The company holds R2 000 (face value) debentures which are redeemable after six years at face value. The annual interest payment on the debentures (coupon rate) is 12%. The current market return for similar debentures with a life of six years is 11%. Assume the current companv tax rate is 28% 14. What will the current cost of equity for Construct (Pty) Ltd be? You have to use the capital asset pricing module (CAPM). [Round your final answer to two decimal places.] 1) 20,00% 2) 22,00% 3) 29,50% 4) 37,30% 15. What will the current cost of equity for Construct (Pty) Ltd be? You have to use the dividend growth model. [Round your final answer to two decimal places.] 1) 16,95% 2) 21,19% 3) 22.00% 4) 37,30% 16. What is the current market value of the debentures of Construct (Pty) Ltd? [Round your final answer to the nearest rand.] 1) R 1918 2) R 2000 3) R 2 085 4) R 9531 17. What will the effective after tax cost of debt (IRR/YTM) be? Calculate your answer by mathematically computing the IRR by interpolating between 10% and 12%. The net present value (NPV) at 10% was correctly calculated as R88 and at 12% at (R84). 1) 7,57% 2) 7,92% 3) 9,38% 4) 38,88%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts