Question: FINANCE PLEASE HELP Use Table 3.6. (Do not round intermediate calculations. Enter the average tax rate as a percent rounded to 1 decimal place.) a.

FINANCE PLEASE HELP

FINANCE PLEASE HELP

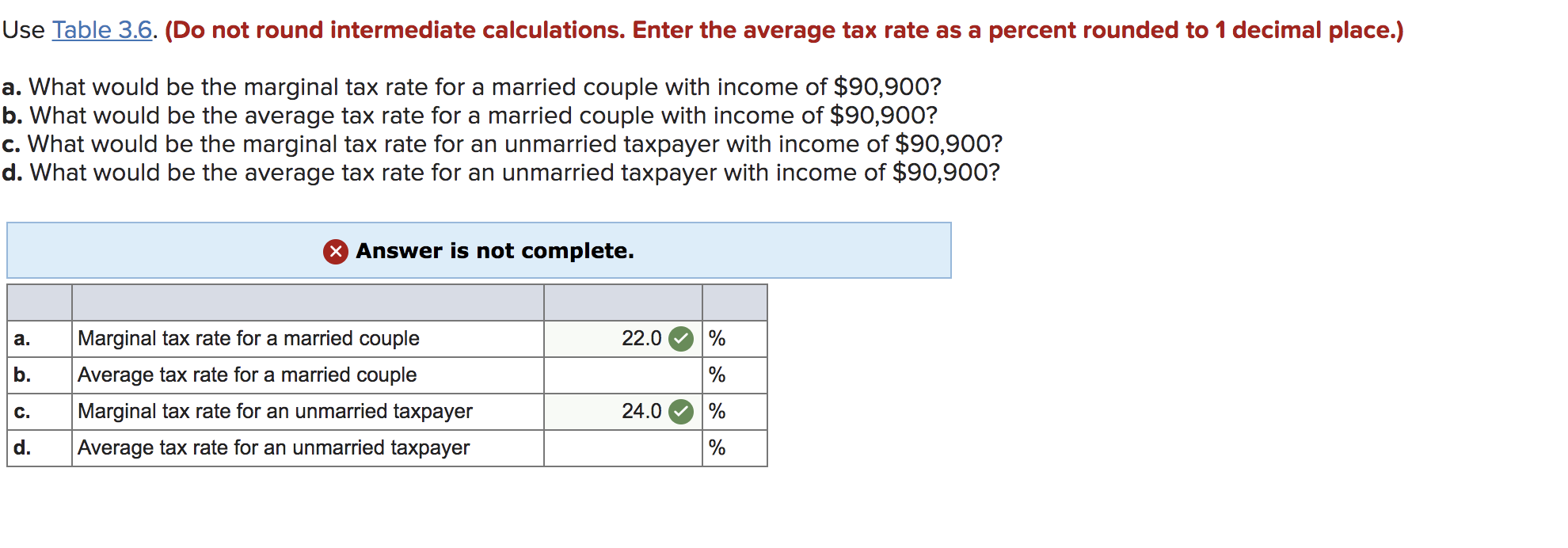

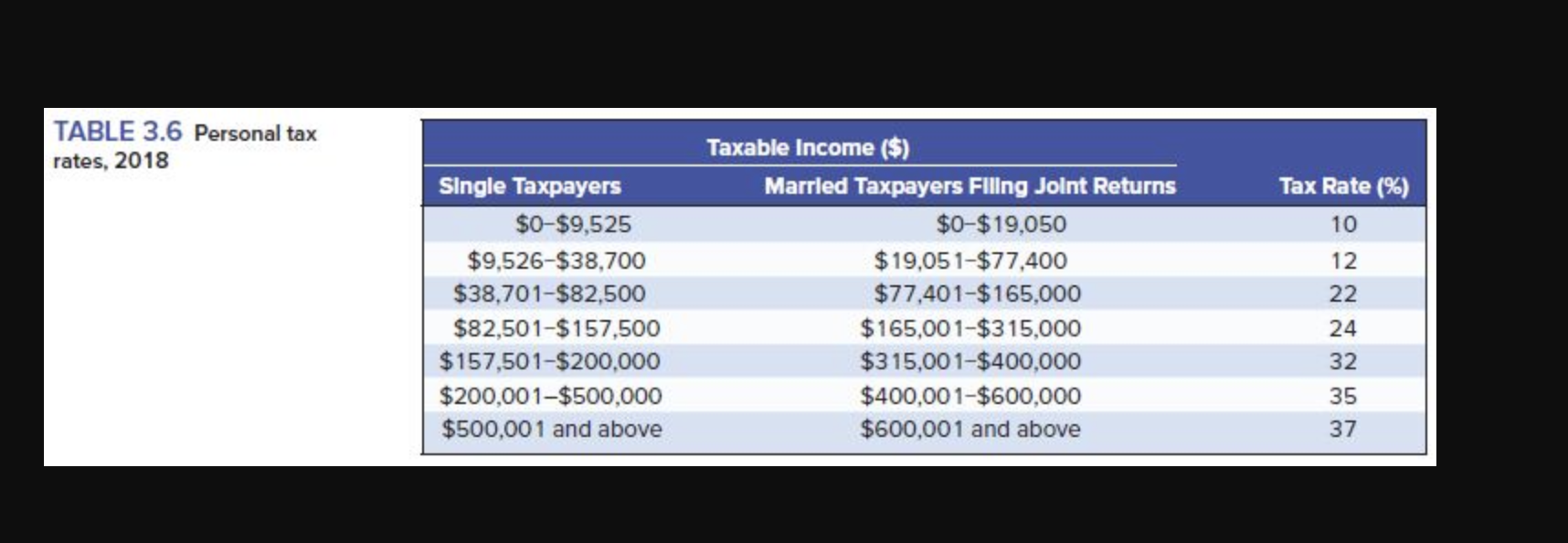

Use Table 3.6. (Do not round intermediate calculations. Enter the average tax rate as a percent rounded to 1 decimal place.) a. What would be the marginal tax rate for a married couple with income of $90,900? b. What would be the average tax rate for a married couple with income of $90,900? c. What would be the marginal tax rate for an unmarried taxpayer with income of $90,900? d. What would be the average tax rate for an unmarried taxpayer with income of $90,900? Answer is not complete. a. 22.0 % b. Marginal tax rate for a married couple Average tax rate for a married couple Marginal tax rate for an unmarried taxpayer Average tax rate for an unmarried taxpayer C. 24.0 % d. TABLE 3.6 Personal tax rates, 2018 Tax Rate (%) 10 Taxable Income ($) Married Taxpayers Flling Joint Returns $0-$19,050 $19,051-$77,400 $77,401-$165,000 $165,00 1-$315,000 $315,001-$400,000 $400,00 1-$600,000 $600,001 and above Single Taxpayers $0-$9,525 $9,526-$38,700 $38,701-$82,500 $82,501-$157,500 $157,501-$200,000 $200,001-$500,000 $500,001 and above 12 22 24 32 35 37

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts