Question: Finance Please show working not in excel and answer all questions (a, b, c, d, e) Assume that three large capitalisation stocks, Berkshire Hathaway, Apple,

Finance Please show working not in excel and answer all questions (a, b, c, d, e)

Assume that three large capitalisation stocks, Berkshire Hathaway, Apple, and Microsoft, have the following risk measures:

Berkshire Hathaway (BRK) Beta () = 0.69 Standard Deviation = 0.2350

Apple (APPL) Beta () = 1.15 Standard Deviation = 0.2400

Microsoft (MSFT) Beta () = 1.28 Standard Deviation = 0.2280

The standard deviation of the market portfolio is M = 15.3.

(a) Calculate the systematic and unsystematic risk of BRK, APPL and MSFT.

(b) What is BRKs covariance and correlation with the market portfolios return?

(c) Estimate the following covariances: Cov(BRK,APPL),Cov(BRK,MSFT),andCov(APPL,MSFT). Assume all unsystematic return components are uncorrelated across stocks.

N

N

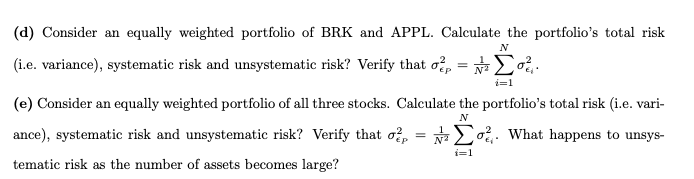

(d) Consider an equally weighted portfolio of BRK and APPL. Calculate the portfolio's total risk (i.e. variance), systematic risk and unsystematic risk? Verify that P2=N21i=1Ni2. (e) Consider an equally weighted portfolio of all three stocks. Calculate the portfolio's total risk (i.e. variance), systematic risk and unsystematic risk? Verify that P2=N21i=1Ni2. What happens to unsystematic risk as the number of assets becomes large

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts