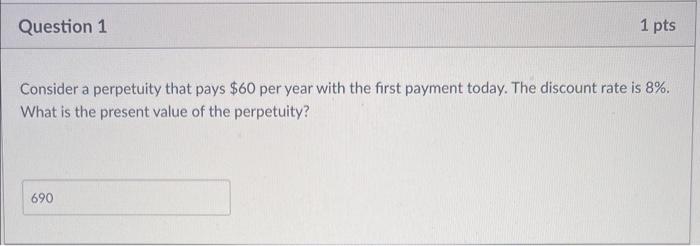

Question: Finance practice Qs Consider a perpetuity that pays $60 per year with the first payment today. The discount rate is 8%. What is the present

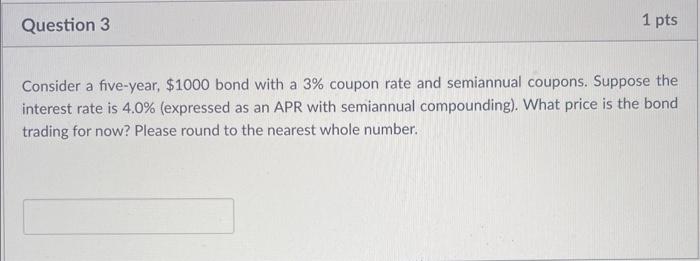

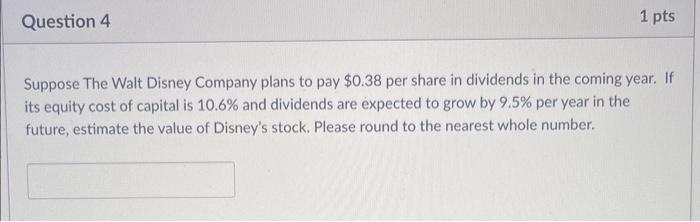

Consider a perpetuity that pays $60 per year with the first payment today. The discount rate is 8%. What is the present value of the perpetuity? Consider a five-year, $1000 bond with a 3% coupon rate and semiannual coupons. Suppose the interest rate is 4.0% (expressed as an APR with semiannual compounding). What price is the bond trading for now? Please round to the nearest whole number. Suppose The Walt Disney Company plans to pay $0.38 per share in dividends in the coming year. If its equity cost of capital is 10.6% and dividends are expected to grow by 9.5% per year in the future, estimate the value of Disney's stock. Please round to the nearest whole number

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts