Question: finance problems thx! A stock has an expected return of 6% and a volatility of 8%. Assume that the risk-free rate is 8% and the

finance problems thx!

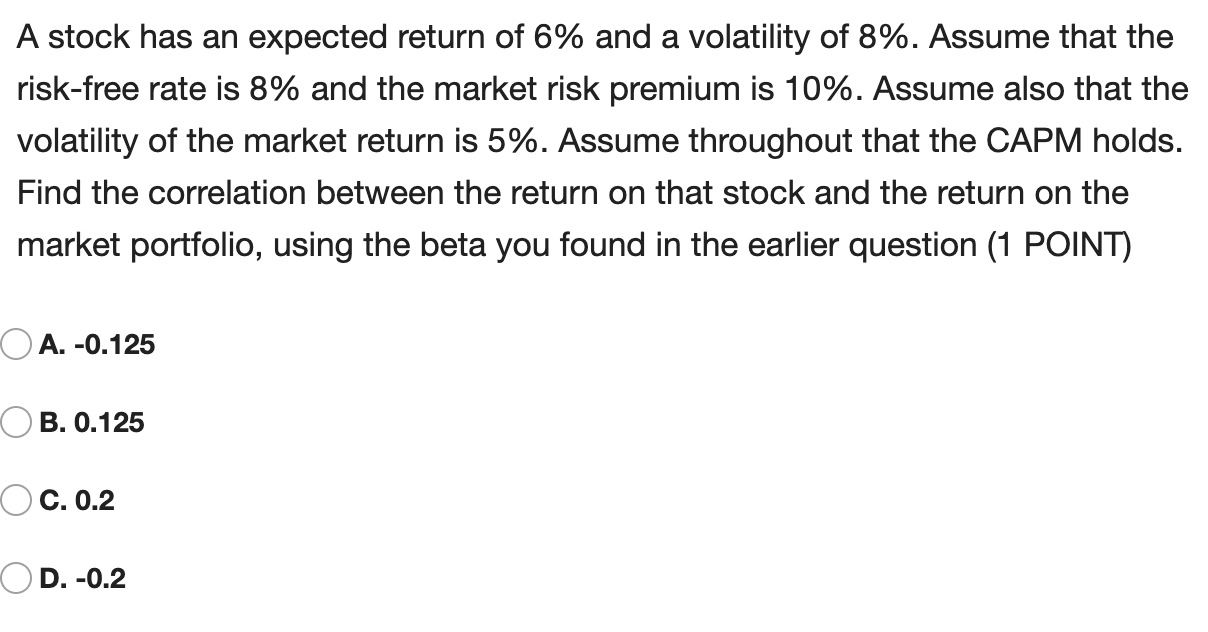

A stock has an expected return of 6% and a volatility of 8%. Assume that the risk-free rate is 8% and the market risk premium is 10%. Assume also that the volatility of the market return is 5%. Assume throughout that the CAPM holds. Find the correlation between the return on that stock and the return on the market portfolio, using the beta you found in the earlier question (1 POINT) O A. -0.125 OB. 0.125 O c.0.2 OD. -0.2 A stock has an expected return of 6% and a volatility of 8%. Assume that the risk-free rate is 8% and the market risk premium is 10%. Assume also that the volatility of the market return is 5%. Assume throughout that the CAPM holds. Find the correlation between the return on that stock and the return on the market portfolio, using the beta you found in the earlier question (1 POINT) O A. -0.125 OB. 0.125 O c.0.2 OD. -0.2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts