Question: finance Question 5 (1 point) In practice, a common way to value a share of stock when a company pays dividends is to value the

finance

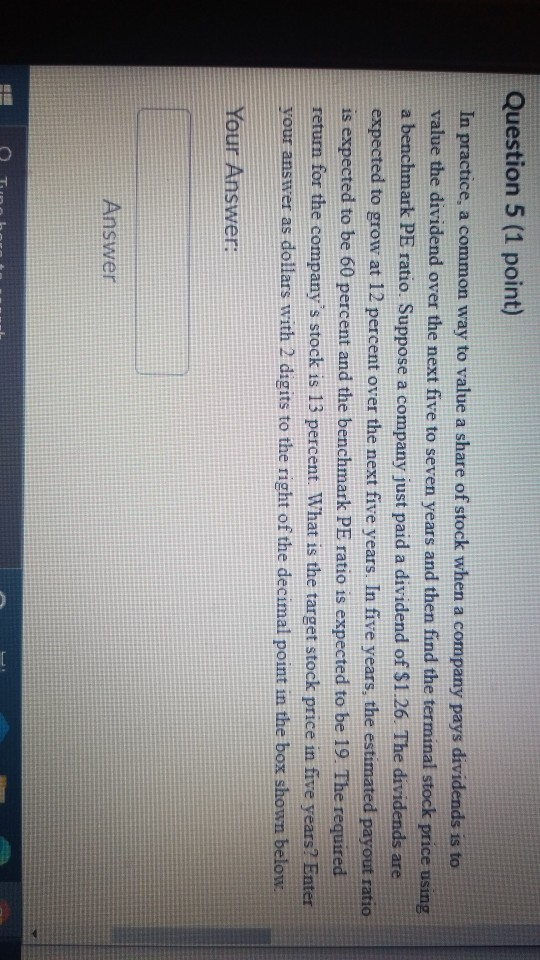

Question 5 (1 point) In practice, a common way to value a share of stock when a company pays dividends is to value the dividend over the next five to seven years and then find the terminal stock price using a benchmark PE ratio. Suppose a company just paid a dividend of $1.26. The dividends are expected to grow at 12 percent over the next five years. In five years, the estimated payout ratio is expected to be 60 percent and the benchmark PE ratio is expected to be 19. The required return for the company's stock is 13 percent. What is the target stock price in five years? Enter your answer as dollars with 2 digits to the right of the decimal point in the box shown below Your Answer: Answer 1 T

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts