Question: Finance Question CASE 1 (20 points) You work for a medical research laboratory that is contemplating leasing a diagnostic scanner (leasing is a common practice

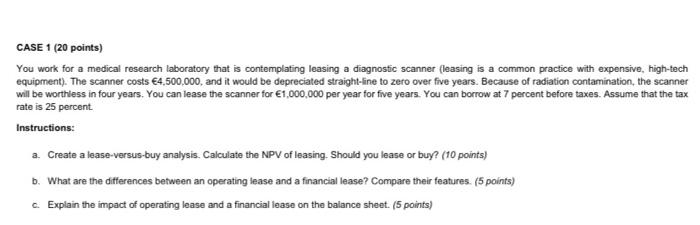

CASE 1 (20 points) You work for a medical research laboratory that is contemplating leasing a diagnostic scanner (leasing is a common practice with expensive, high-tech equipment). The scanner costs 4,500,000, and it would be depreciated straight-line to zero over five years. Because of radiation contamination, the scanner will be worthless in four years. You can lease the scanner for 1,000,000 per year for five years. You can borrow at 7 percent before taxes. Assume that the tax rate is 25 percent Instructions: a. Create a lease-versus-buy analysis. Calculate the NPV of leasing. Should you lease or buy? (10 points) b. What are the differences between an operating tease and a financial lease? Compare their features. (5 points) c Explain the impact of operating lease and a financial lease on the balance sheet. (5 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts