Question: finance question: does anyone know how to solve the folkowing problem step-by-step ? thank you so much! 7. Suppose you work for an investment firm.

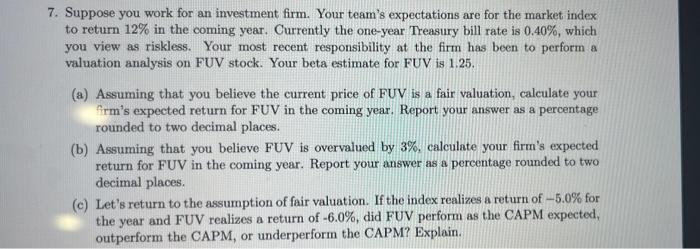

7. Suppose you work for an investment firm. Your team's expectations are for the market index to return 12% in the coming year. Currently the one-year Treasury bill rate is 0.40%, which you view as riskless. Your most recent responsibility at the firm has been to perform a valuation analysis on FUV stock. Your beta estimate for FUV is 1.25. (a) Assuming that you believe the current price of FUV is a fair valuation, calculate your Arm's expected return for FUV in the coming year. Report your answer as a percentage rounded to two decimal places. (b) Assuming that you believe FUV is overvalued by 3%, calculate your firm's expected return for FUV in the coming year. Report your answer as a percentage rounded to two decimal places (c) Let's return to the assumption of fair valuation. If the index realizes a return of -5.0% for the year and FUV realizes a return of -6.0%, did FUV perform as the CAPM expected, outperform the CAPM, or underperform the CAPM? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts