Question: finance question please include all working Problem 2 Suppose you have two stocks in your portfolio, Maximus and Minimus. The expected return of Maximus is

finance question please include all working

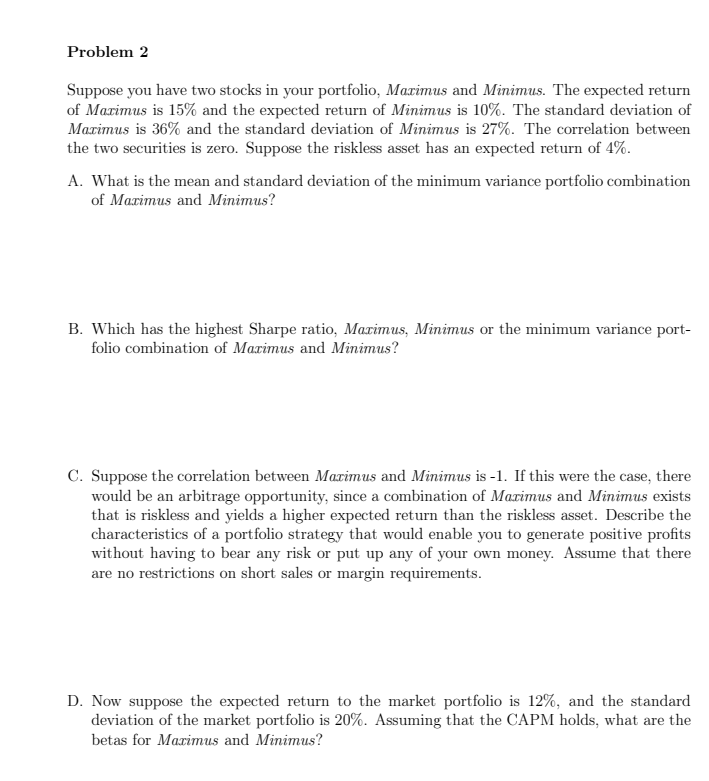

Problem 2 Suppose you have two stocks in your portfolio, Maximus and Minimus. The expected return of Maximus is 15% and the expected return of Minimus is 10%. The standard deviation of Marimus is 36% and the standard deviation of Minimus is 27%. The correlation between the two securities is zero. Suppose the riskless asset has an expected return of 4%. A. What is the mean and standard deviation of the minimum variance portfolio combination of Marimus and Minimus? B. Which has the highest Sharpe ratio, Maximus, Minimus or the minimum variance port- folio combination of Marimus and Minimus? C. Suppose the correlation between Marimus and Minimus is -1. If this were the case, there would be an arbitrage opportunity, since a combination of Maximus and Minimus exists that is riskless and yields a higher expected return than the riskless asset. Describe the characteristics of a portfolio strategy that would enable you to generate positive profits without having to bear any risk or put up any of your own money. Assume that there are no restrictions on short sales or margin requirements. D. Now suppose the expected return to the market portfolio is 12%, and the standard deviation of the market portfolio is 20%. Assuming that the CAPM holds, what are the betas for Marimus and Minimus? Problem 2 Suppose you have two stocks in your portfolio, Maximus and Minimus. The expected return of Maximus is 15% and the expected return of Minimus is 10%. The standard deviation of Marimus is 36% and the standard deviation of Minimus is 27%. The correlation between the two securities is zero. Suppose the riskless asset has an expected return of 4%. A. What is the mean and standard deviation of the minimum variance portfolio combination of Marimus and Minimus? B. Which has the highest Sharpe ratio, Maximus, Minimus or the minimum variance port- folio combination of Marimus and Minimus? C. Suppose the correlation between Marimus and Minimus is -1. If this were the case, there would be an arbitrage opportunity, since a combination of Maximus and Minimus exists that is riskless and yields a higher expected return than the riskless asset. Describe the characteristics of a portfolio strategy that would enable you to generate positive profits without having to bear any risk or put up any of your own money. Assume that there are no restrictions on short sales or margin requirements. D. Now suppose the expected return to the market portfolio is 12%, and the standard deviation of the market portfolio is 20%. Assuming that the CAPM holds, what are the betas for Marimus and Minimus

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts