Question: Finance Question very hard please help Attached are a set of Financial Statements (Balance Sheet and Income Statement) for a sample corporation. The assignment is

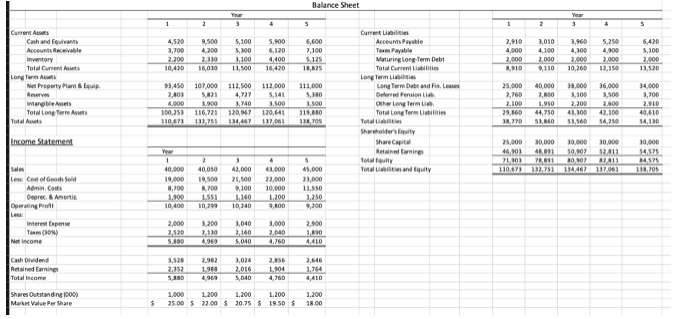

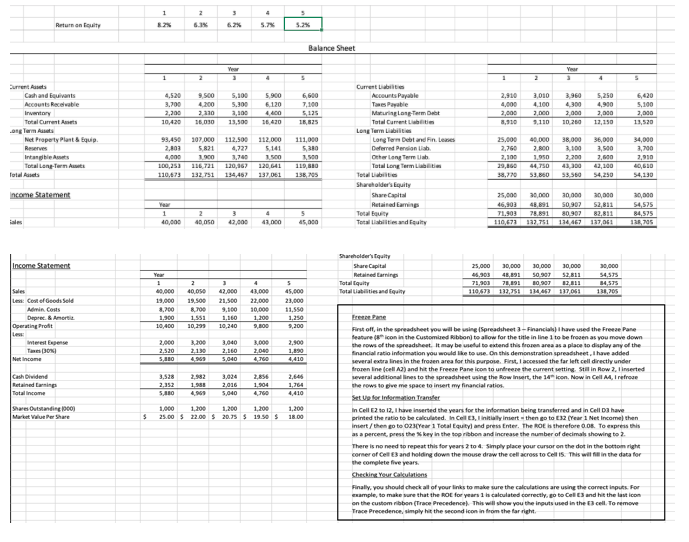

Finance Question very hard please help Attached are a set of Financial Statements (Balance Sheet and Income Statement) for a sample corporation. The assignment is to analyze and document what has transpired over this period both in terms of actions taken and any resulted that have occurred. While you might examine financial ratios over the period, do not just comment on individual ratio changes. Your submission needs to critically examine the interrelationship of outcomes. Are they the result of discrete actions undertaken by management and if so, is there an indication that the intended results were achieved? For example: Were major capital investments made during the period? If so, how were they finance and how did this impact the statements? Has the financing of capital assets introduced additional risk to any investor group? Did the investment in new capital assets generate enhanced profits and if so to which group of investors? What decisions did the owners (equity investors) make regarding net income generated each year? The assignment should include technical backup but be centered around a written assessment of what has transpired over the period examined. The written text should be 1 to 1 1/2 pages in length and all material will be submitted to the CourseLink dropbox by Sunday March 28 at 11:59 PM. Please note - you will need to have covered the material in Chapters 3 & 4 before you begin the assignment. This can bela personal or group assignment with up to three students in a group. In either case, be sure the submission reflects your analysis of the material provided and not that of another individual or group.Balance Sheet 1 Currer Asset Carrere Liabilities Catch and Egalante 4.520 9.501 5,100 5.500 Accounts Payable 2.910 1,010 3.965 5.254 5,420 Accounts Receivable 1.708 4.120 7,190 4.800 4,180 1.100 2.200 3.010 1,100 4,400 5.125 Maturing Long Term Debt 2.800 3,080 2.800 10,430 16 010 11,500 16,430 10,825 Total Current Liabilities 10.360 13,130 Long Term Auto Long Term Liabilities No Property Plant & Equip. 107 080 112,500 112,600 111,030 Long Term Debt and Fin, Lease 25,606 45,080 36,008 34,006 4, TIT 5,141 Belowvol Ponion Lich 3.108 imarble Assets I MO 1.500 Onhow Long Term Lich. 2.109 1.950 Toin Long Term Askis 116731 170,141 Total Long Term Liabilities 44, 750 41.109 40,610 Total Aimita 14,130 Income Statement Share Capital 15,800 30,080 10 400 10 000 Artainal farming Total Equity 10 808 40 050 43,030 45,030 Total Uchilitin and Equity Com of Good Sold 21,500 12,600 9.100 10,000 19.850 1.140 1.100 1,150 Opening Froll 10,400 10 389 10,240 9,300 Last Interest Copmse 2.808 1,040 2,580 1,140 2.640 Net income 5.040 1.760 Cash Dividend 2.646 Artaired Fuming 2.157 1.904 Total Iscome 4,040 4,760 4,410 Shares OutHanding 1909) 1.400 1.200 1,200 1.200 1,100 Market Value Per Share $ 25 00 27:00 5 20.75 $ 19 50 $ 18.001 Return an Poulty 6.31 Balance Sheet Current Liabilities Cash and Equhyannis 4.520 9.900 5.10 5,900 6,680 Accounts Payable 2.410 3,010 3,960 5,250 6,420 3.700 BOE'S 6.120 7.190 4.809 5.10 3.300 3.310 4,400 Maturing Long-Term Debt 3,800 3.000 3.000 3.080 Total Current Asist 10,420 16 030 13,109 LB, 625 Total Current Lichilition 8,910 3.110 10 280 11,150 13,520 Not Properly Plant & Equip 107 000 112.508 112 000 111,080 Long Term Debt and Fin. Lenes 15.808 98 040 2.101 5141 Befored Persian Lish 2.760 Intangble Assets 4,800 1.900 1,580 The Long Term lich 2,109 1.950 3.201 7.030 7.910 Total Lang-Term Anti 100,350 106 721 130,167 120,641 Total Long Term Lichities 44, 750 43,380 43,120 40, 610 Total Aids 110.479 192 751 197 041 59.860 54,250 54,190 Showholder's Equity Income Statement Share Capital 35,808 30 000 46.103 50 907 $4,575 71.903 80 907 82,811 84,575 40,908 40,050 43,908 43,000 45,080 140,671 432 751 134 467 Shareholder's Iquity Income Statement Share Capital 75,000 10 030 10,000 30 600 53 811 71-200 71 191 10207 31 fale Love Cow of Goodisold 19.060 15,509 21.500 20.00 Mmin Cous 11.554 1.900 1501 1.180 1,250 Operating Profit 10,400 10 309 10,240 5,300 Firy off, in the spreadsher sing (Spreadsheet ] - Financials) I have used the Freeze Pase Measure ," icon in the Customized Ribbon] to allow for the title in line 1 to be frogen as you move down the rows of the spreadsheet. It may be wudal to exband this Me rea as a place to display any of the 2.520 1.159 1.160 "nandal ratio information you would I ke to wut. On this demonstrate tion spreadsheet , I have added Hit Income 5.040 4,410 weveral cadre lines in the frozen area for this purgout, First, Lacoesued the far left cell directly under Mronen line (cell AJ) and hit the Freeze Parse Icon to underare the current witting. Still in Row , Timerted Cash Gluidad 9.518 2.641 weveral additional lines to the spreadsheet using the Wow Invert, the 18" Icon, Now In Cell A, I refroge 2.352 2.310 1 904 1,304 the rows to put me space to invent my financial ratios Tatal Income 4,410 atunter inter 1.480 1.709 1.209 In Cell FX to 17, I have inserted the years for the information being transferred and in Cell DJ have 25.00 5 12.00 9 20.23 5 1950 5 18:00 printed the ratio to be calculated. In Cell E], Iinitialy invert = then go to $32 (Year 1 Net Income]than inbert / thego to 023(Year 1 Total Equity) and press Enter. The ROE h therefore 0 08. To espre is this as a percent, press the " key In the top number of decimals showing to ] There is no need to repeat this for years ] tod, Simply place your cursor on the dot in the bottom right corner of Cell ES and holding down the movie drew the pell across to Cell IS. This will fill in the data for The complete five years Checking Your Calculations Finally, you should check all of your links to make sure the calculations are using the correct inputs. For nsample, to make sure that the ROC for yours 1 is calculated correctly, go to Call (3 and hit the last icon on the custom ribbon (Trace Precedencek This will show you the inputs uped in the cell. To remove Trace Precedence, simply hit the second Icon in from the far right