Question: Finance questions 8. COB Ltd has decided to draw down a 180-day Australian bank accepted bill to meet its short-term liquidity needs. The company's bank

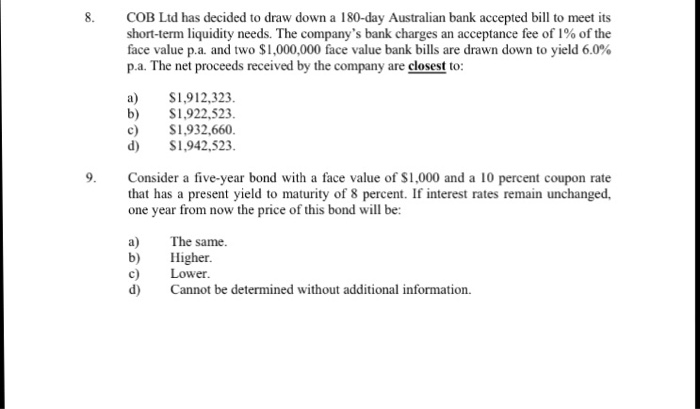

8. COB Ltd has decided to draw down a 180-day Australian bank accepted bill to meet its short-term liquidity needs. The company's bank charges an acceptance fee of l% of the face value p.a. and two SI,000,000 face value bank bills are drawn down to yield 6.0% p.a. The net proceeds received by the company are closest to: a) S1,912,323 b) S1,922,523. c) SI 932.660 S1,942,523 9. Consider a five-year bond with a face value of SI,000 and a 10 percent coupon rate that has a present yield to maturity of 8 percent. If interest rates remain unchanged, one year from now the price of this bond will be: a) The same b) Higher. c) Lower d) Cannot be determined without additional information

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts