Question: Financial Accounting 2 Hello can you please explain how to do this. I need the answers as well but I want to understand it as

Financial Accounting 2

Hello can you please explain how to do this. I need the answers as well but I want to understand it as well so I am asking for a little explanation. I don't understand my lecturer

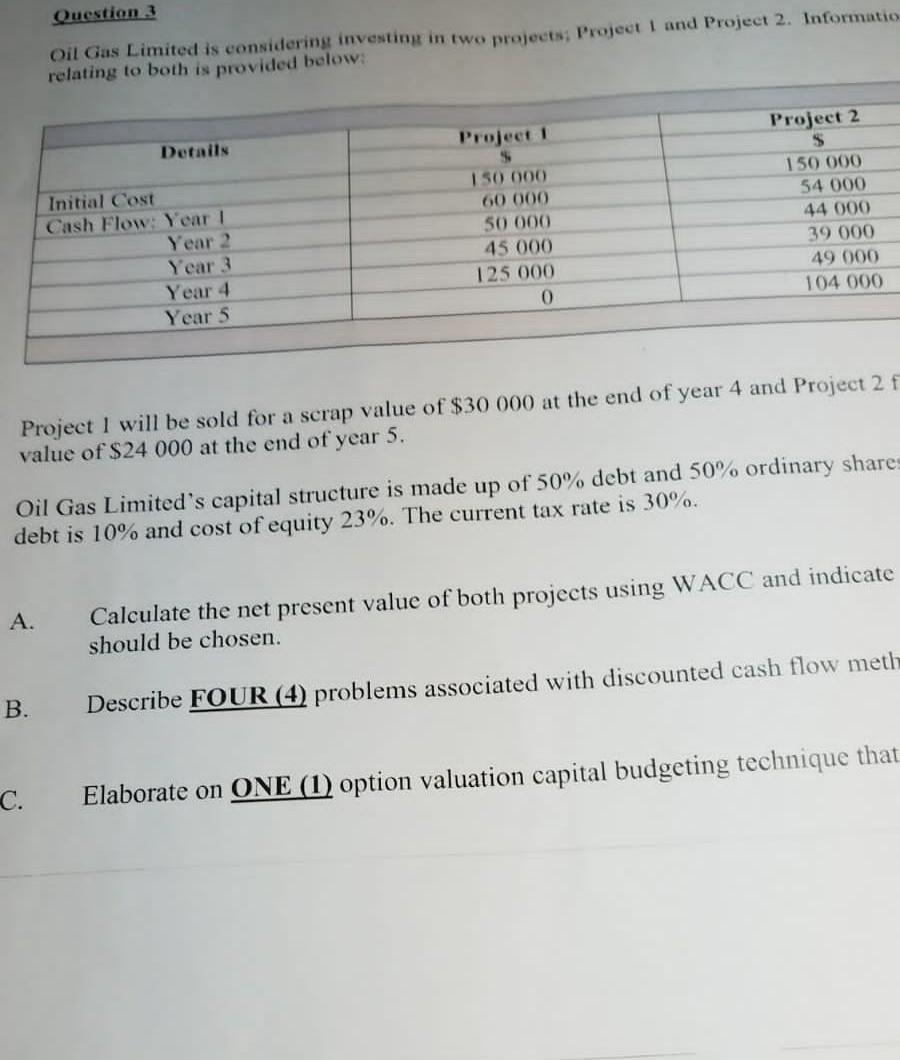

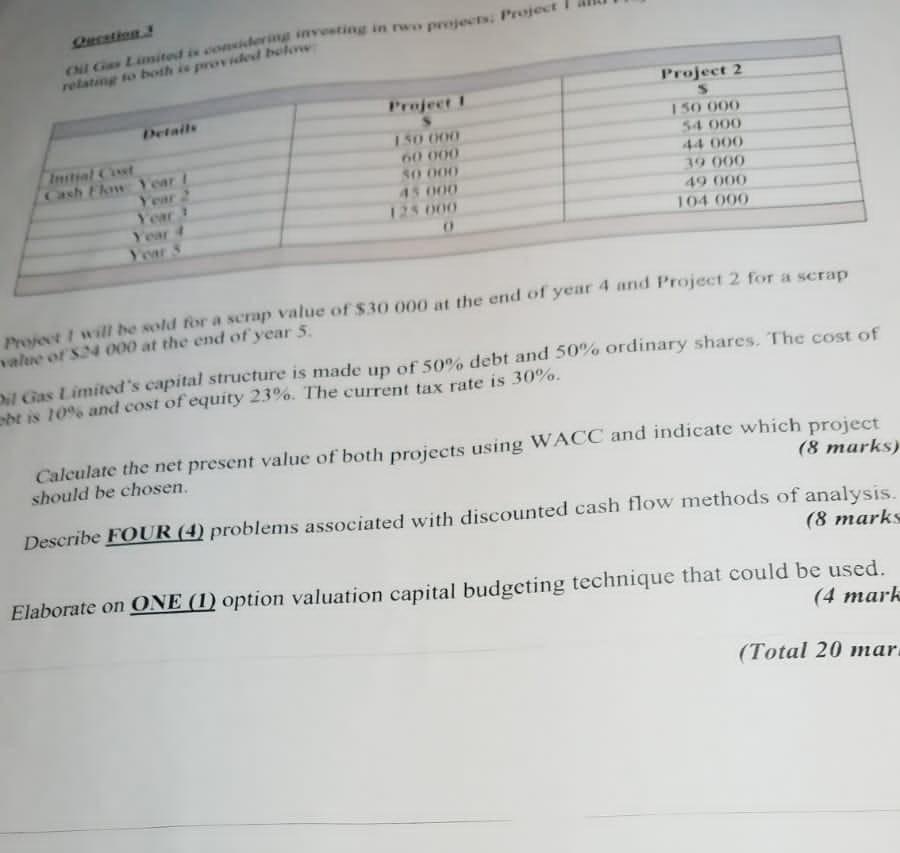

Question 3 Oil Gas Limited is consideringt investing in two projects; Project 1 and Project 2. Informatio relating to both is provided bolow: Project 1 will be sold for a scrap value of $30000 at the end of year 4 and Project 2 f value of \$24000 at the end of year 5. Oil Gas Limited's capital structure is made up of 50% debt and 50% ordinary share debt is 10% and cost of equity 23%. The current tax rate is 30%. A. Calculate the net present value of both projects using WACC and indicate should be chosen. B. Describe FOUR (4) problems associated with discounted cash flow meth C. Elaborate on ONE (1) option valuation capital budgeting technique that Proper 1 will the whl for a scrap value of $30000 at the end of year 4 and Project To a rermp. Malese of 54000 at the end of year 5 . Whas 1 imited's capital structure is made up of 50% debt and 50% ordinary shares. The cost of bet is 10% and cost of equity 23%. The current tax rate is 30%. Calculate the net present value of both projects using WACC and indicate which project should be chosen. (8 marks) Describe FOUR (4) problems associated with discounted cash flow methods of analysis, (8 marks Elaborate on ONE (1) option valuation capital budgcting technique that could be used. (4marh (Total 20 mar

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts