Question: FINANCIAL ACCOUNTING HELP! Answer (C) Please. Exercise 10-23 (Part Level Submission) Blossom Company issued $350,000, 6%, 10-year bonds on January 1, 2017, for $377,026. This

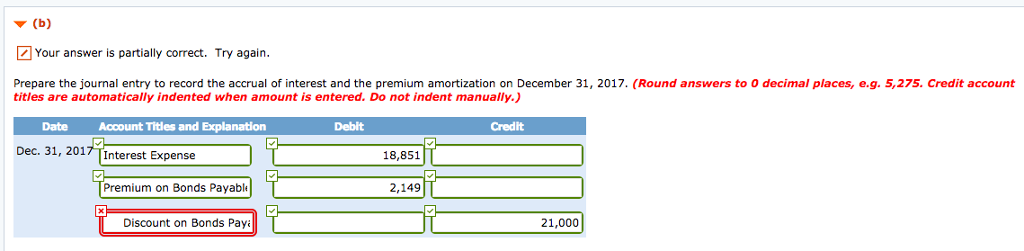

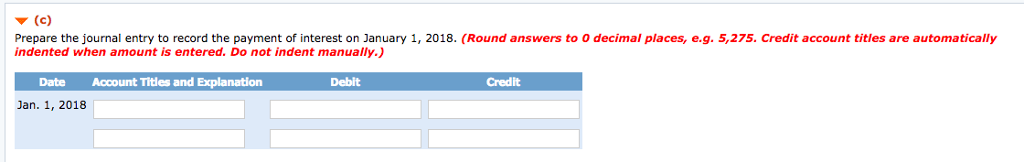

FINANCIAL ACCOUNTING HELP! Answer (C) Please.

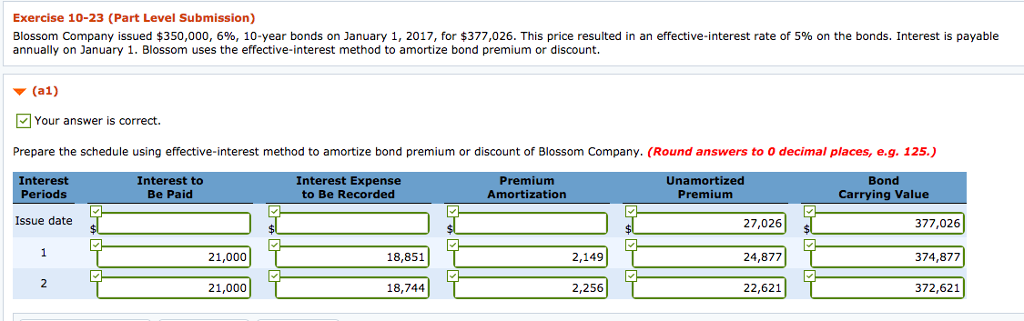

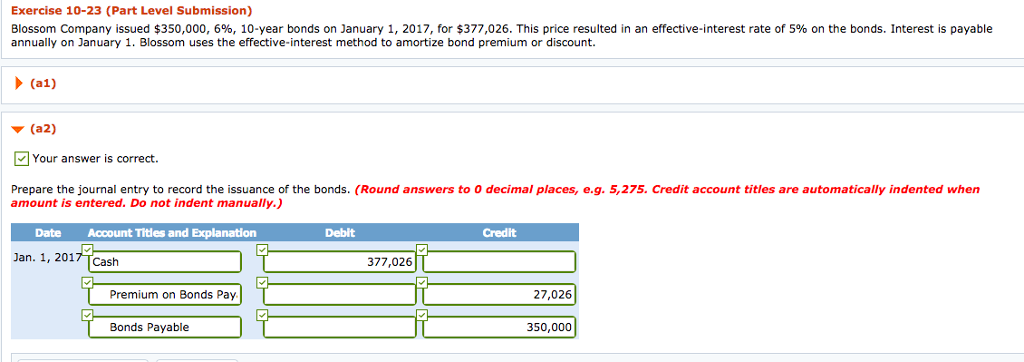

Exercise 10-23 (Part Level Submission) Blossom Company issued $350,000, 6%, 10-year bonds on January 1, 2017, for $377,026. This price resulted in an effective-interest rate of 5% on the bonds. Interest is payable annually on January 1. Blossom uses the effective-interest method to amortize bond premium or discount. (a1) Your answer is correct. Prepare the schedule using effective-interest method to amortize bond premium or discount of Blossom Company. (Round answers to o decimal places, e.g. 125.) Interest Expense Interest to Premium Unamortized Bond Interest Be Paid Periods to Be Recorded Premium Carrying Value Issue date 377,026 27,026 T 18,851 T 2,149 T 21,000 24,877 374,877 T 21,000 22,621 18,744 2,256 372,621

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts