Question: Financial accounting please answer all, will leave a like :) Jim purchased a stock at $100 per share last year and sold it today for

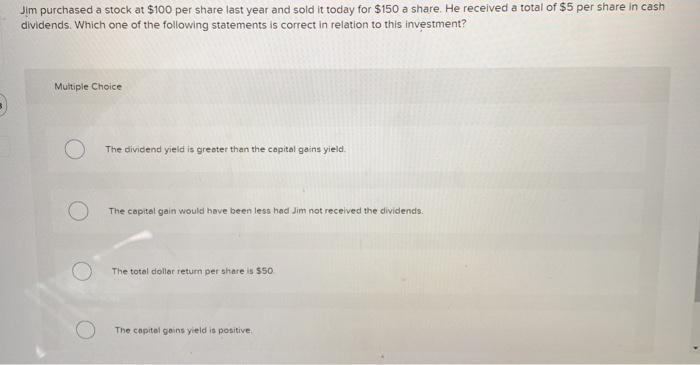

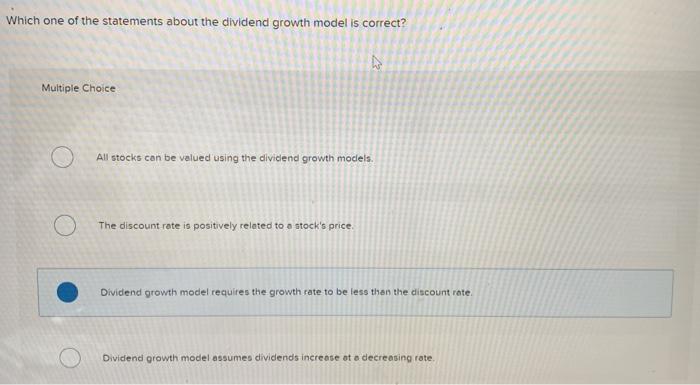

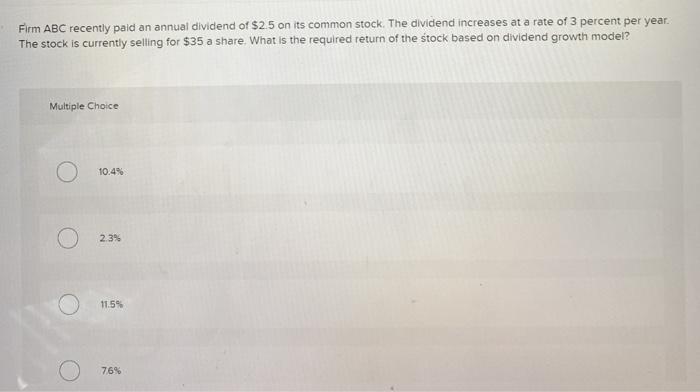

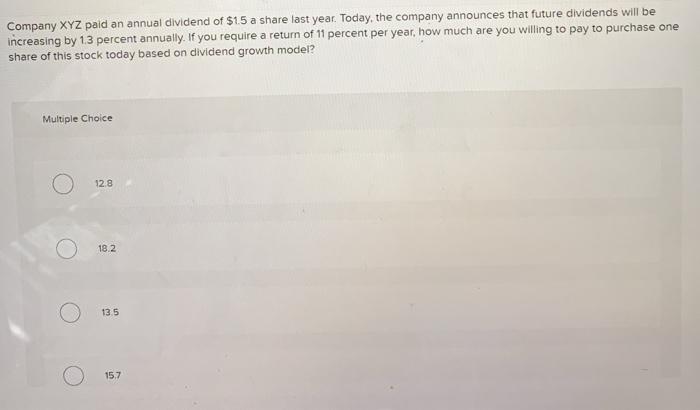

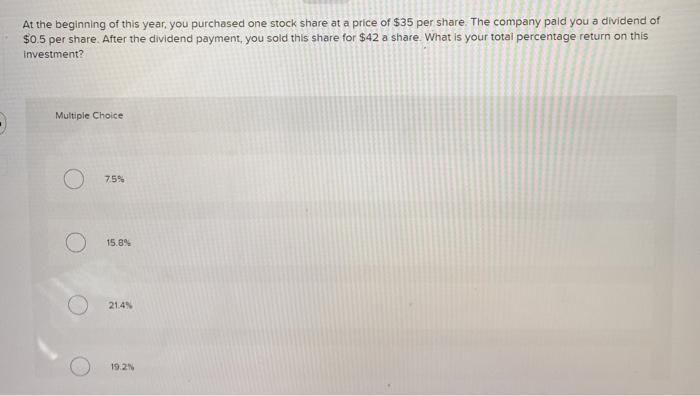

Jim purchased a stock at $100 per share last year and sold it today for $150 a share. He received a total of $5 per share in cash dividends. Which one of the following statements is correct in relation to this investment? Multiple Choice The dividend yield is greater than the capital gains yield The capital gain would have been less had Jim not received the dividends. The total dollar return per share is $50 The capital gains yield is positive Which one of the statements about the dividend growth model is correct? Multiple Choice All stocks can be valued using the dividend growth models. O The discount rate is positively related to a stock's price Dividend growth model requires the growth rate to be less than the discount rate Dividend growth model assumes dividends increase at a decreasing rate. Firm ABC recently paid an annual dividend of $2.5 on its common stock. The dividend increases at a rate of 3 percent per year. The stock is currently selling for $35 a share What is the required return of the stock based on dividend growth model? Multiple Choice 10.4% 2.3% 11.5% 76% Company XYZ paid an annual dividend of $15 a share last year. Today, the company announces that future dividends will be increasing by 13 percent annually. If you require a return of 11 percent per year, how much are you willing to pay to purchase one share of this stock today based on dividend growth model? Multiple Choice 12.8 18.2 13.5 15.7 At the beginning of this year, you purchased one stock share at a price of $35 per share. The company paid you a dividend of $0.5 per share. After the dividend payment, you sold this share for $42 a share. What is your total percentage return on this investment? Multiple Choice 7.5% 15.89 21.4% 19.2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts