Question: Financial Accounting & Reporting 2. Chapter : Intangible Assets Round your answer to whole number 1. Intangible assets are subsequently measured at the cost model

Financial Accounting & Reporting 2. Chapter : Intangible Assets

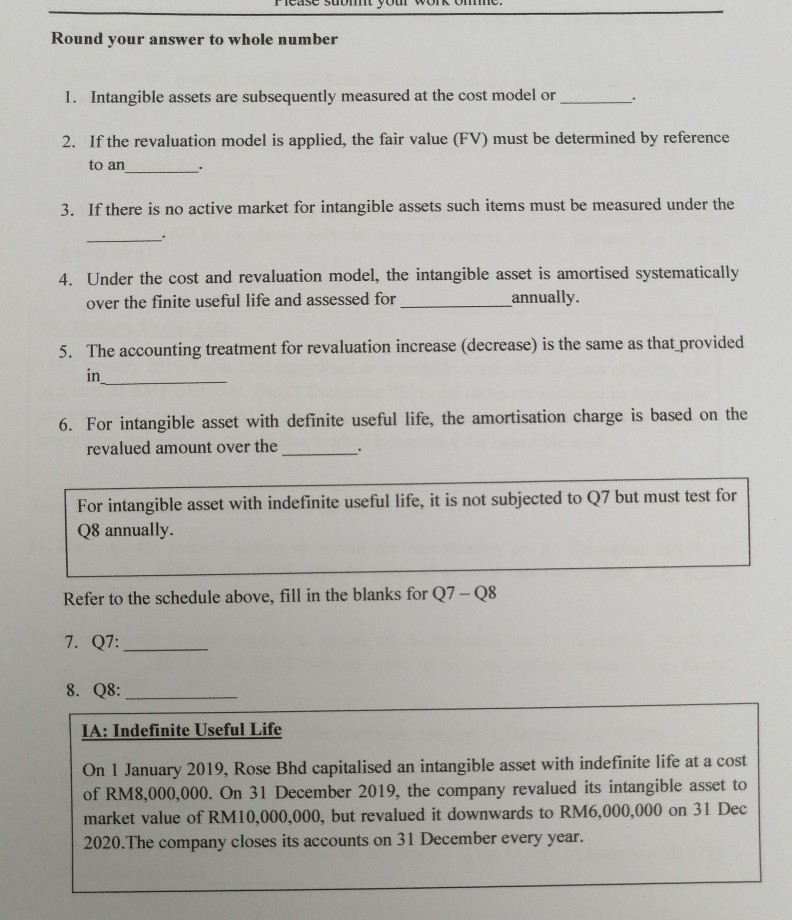

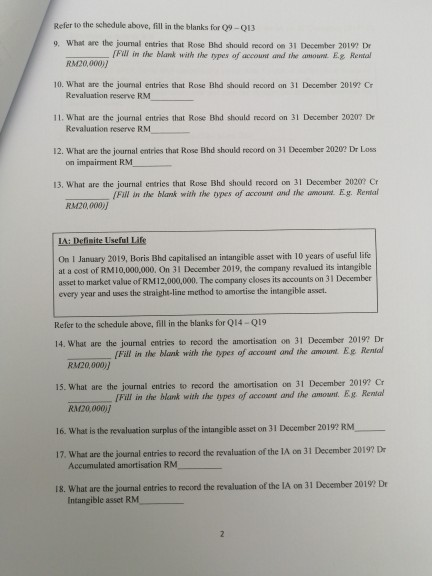

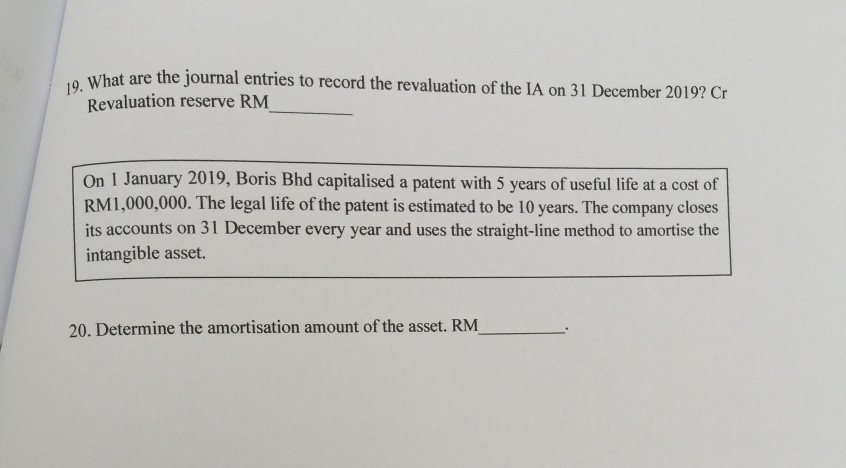

Round your answer to whole number 1. Intangible assets are subsequently measured at the cost model or 2. If the revaluation model is applied, the fair value (FV) must be determined by reference to an 3. If there is no active market for intangible assets such items must be measured under the 4. Under the cost and revaluation model, the intangible asset is amortised systematically over the finite useful life and assessed for annually. 5. The accounting treatment for revaluation increase (decrease) is the same as that provided in 6. For intangible asset with definite useful life, the amortisation charge is based on the revalued amount over the For intangible asset with indefinite useful life, it is not subjected to Q7 but must test for Q8 annually. Refer to the schedule above, fill in the blanks for Q7 -Q8 7. 07: 8. 08: IA: Indefinite Useful Life On 1 January 2019, Rose Bhd capitalised an intangible asset with indefinite life at a cost of RM8,000,000. On 31 December 2019, the company revalued its intangible asset to market value of RM10,000,000, but revalued it downwards to RM6,000,000 on 31 Dec 2020. The company closes its accounts on 31 December every year. Refer to the schedule above, fill in the blanks for 09-013 9. What are the journal entries that Rose Bhd should record on 31 December 2014 De [FW in the Man with the types of account and the amou. Eg Rental RM20,000) 10. What are the journal entries that Rose Bhd should record on 31 December 2019 Cr Revaluation reserve RM 11. What are the journal entries that Rose Bhd should record on 31 December 2007 De Revaluation reserve RM 12. What are the journal entries that Rose Bhd should record on 31 December 2020? Dr Loss on impairment RM 13. What are the journal entries that Rose Bhd should record on 31 December 20207 C Fill in the Mark with the opes of account and the amoun. Ey Rental RM20,000) IA: Definite Useful Life On 1 January 2019, Boris Bhd capitalised an intangible asset with 10 years of useful life at a cost of RM10,000,000. On 31 December 2019, the company revalued its intangible asset to market value of RM12,000,000. The company closes its accounts on 31 December every year and uses the straight-line method to amortise the intangible asset. Refer to the schedule above, fill in the blanks for Q14-019 14. What are the journal entries to record the amortisation on 31 December 2019? Dr Fill in the Wank with the types of account and the amouw. Eg Rental RM20,000) 15. What are the journal entries to record the amortisation on 31 December 2019? Cr Fill in the blank with the types of account and the amount. Ex Rental RA120,0001/ 16. What is the revaluation surplus of the intangible asset on 31 December 2019? RM 17. What are the journal entries to record the revaluation of the 1A on 31 December 2019? De Accumulated amortisation RM 18. What are the journal entries to record the revaluation of the IA on 31 December 2019? De Intangible asset RM 2 19. What are the journal entries to record the revaluation of the IA on 31 December 2019? Cr Revaluation reserve RM On 1 January 2019, Boris Bhd capitalised a patent with 5 years of useful life at a cost of RM1,000,000. The legal life of the patent is estimated to be 10 years. The company closes its accounts on 31 December every year and uses the straight-line method to amortise the intangible asset. 20. Determine the amortisation amount of the asset. RM

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts