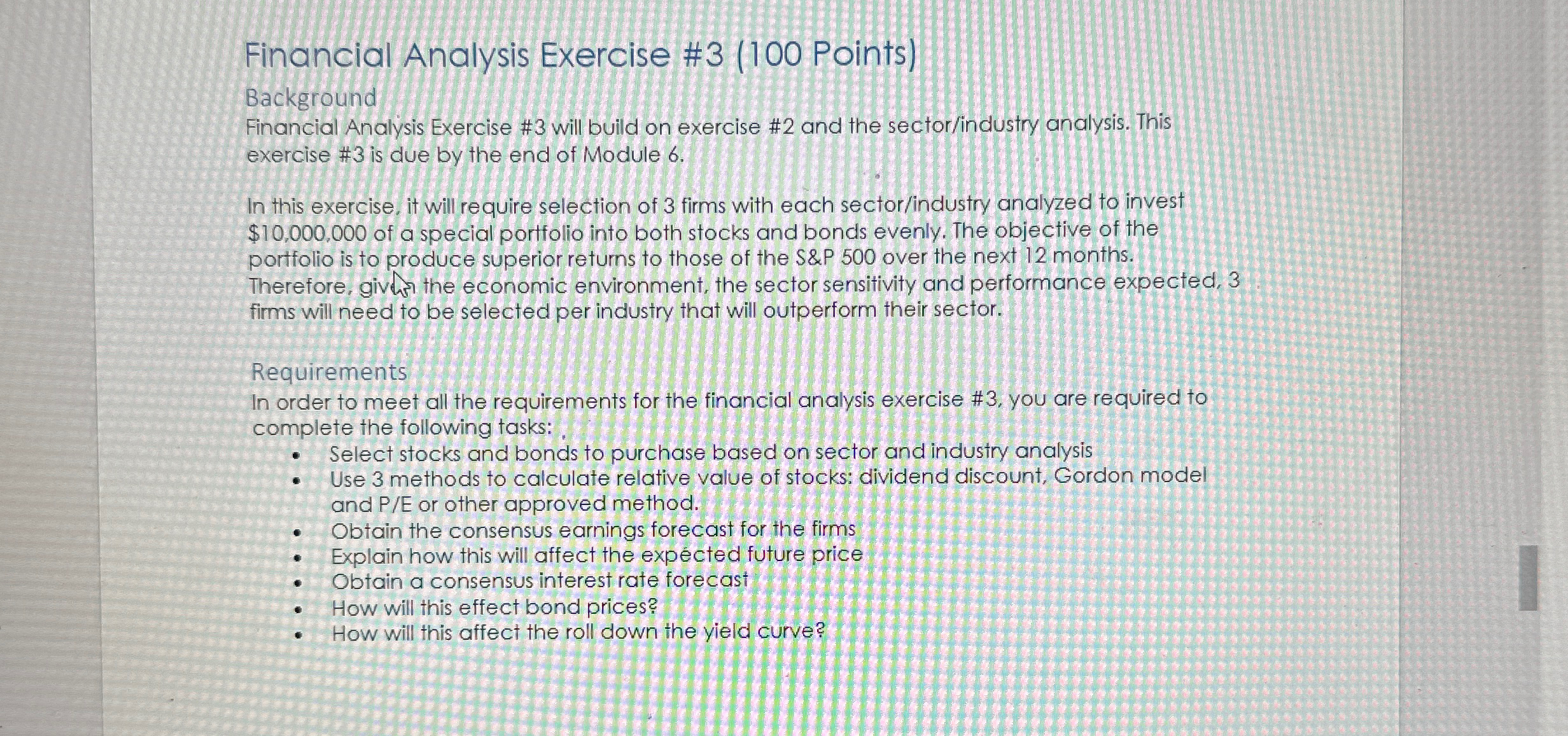

Question: Financial Analysis Exercise # 3 ( 1 0 0 Points ) Background Financial Analysis Exercise # 3 will build on exercise # 2 and the

Financial Analysis Exercise # Points

Background

Financial Analysis Exercise # will build on exercise # and the sectorindustry analysis. This exercise # is due by the end of Module

In this exercise, it will require selection of firms with each sectorindustry analyzed to invest $ of a special portfolio into both stocks and bonds evenly. The objective of the portfolio is to produce superior returns to those of the S&P over the next months.

Therefore, givh the economic environment, the sector sensitivity and performance expected, firms will need to be selected per industry that will outperform their sector.

Requirements

In order to meet all the requirements for the financial analysis exercise # you are required to complete the following tasks:

Select stocks and bonds to purchase based on sector and industry analysis

Use methods to calculate relative value of stocks: dividend discount, Gordon model and or other approved method.

Obtain the consensus earnings forecast for the firms

Explain how this will affect the expected future price

Obtain a consensus interest rate forecast

How will this effect bond prices?

How will this affect the roll down the yield curve?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock