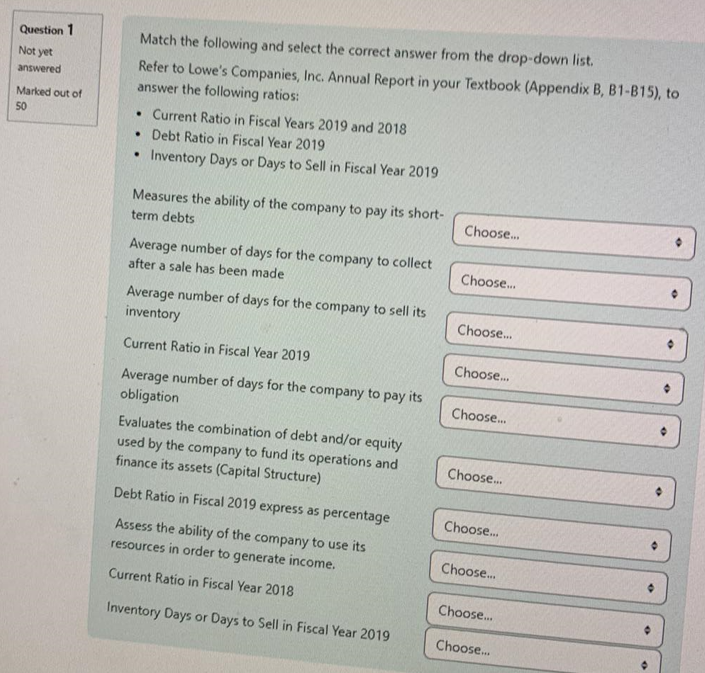

Question: Financial Analysis (first Image is the test question) Question 1 Match the following and select the correct answer from the drop-down list. Not yet Refer

Financial Analysis (first Image is the test question)

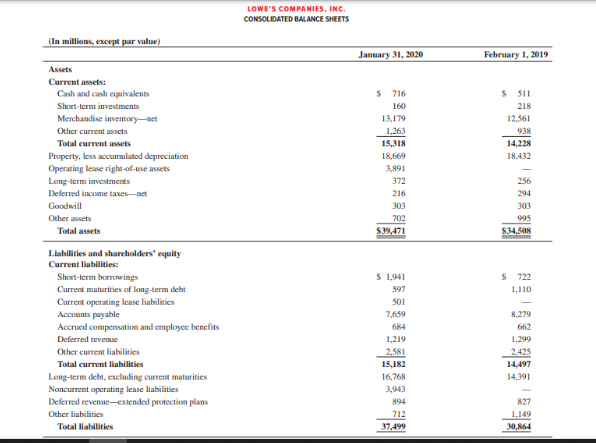

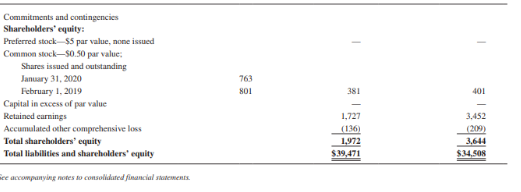

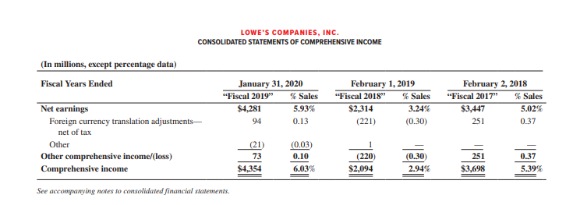

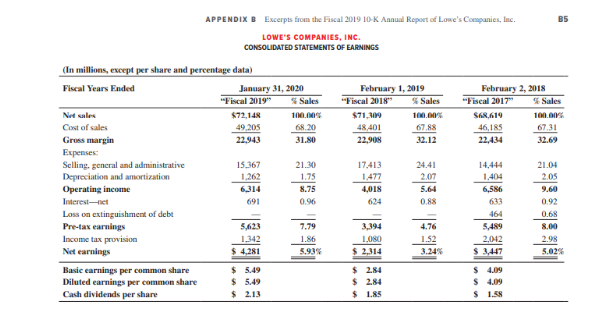

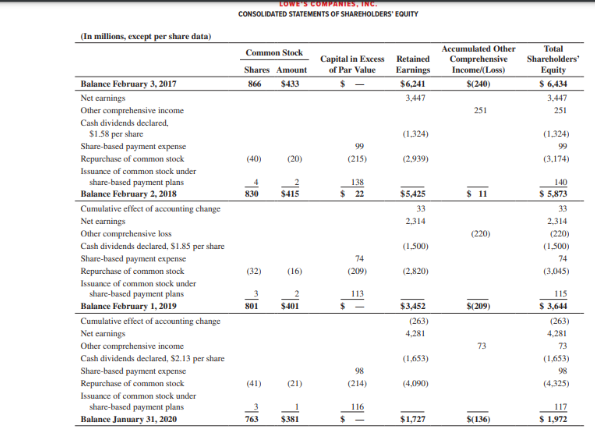

Question 1 Match the following and select the correct answer from the drop-down list. Not yet Refer to Lowe's Companies, Inc. Annual Report in your Textbook (Appendix B, B1-815), to answered answer the following ratios: Marked out of 50 . Current Ratio in Fiscal Years 2019 and 2018 . Debt Ratio in Fiscal Year 2019 . Inventory Days or Days to Sell in Fiscal Year 2019 Measures the ability of the company to pay its short- term debts Choose. Average number of days for the company to collect after a sale has been made Choose.. Average number of days for the company to sell its inventory Choose.. Current Ratio in Fiscal Year 2019 Choose.. Average number of days for the company to pay its obligation Choose. Evaluates the combination of debt and/or equity used by the company to fund its operations and Choose.. finance its assets (Capital Structure) Debt Ratio in Fiscal 2019 express as percentage Choose.. Assess the ability of the company to use its resources in order to generate income. Choose. Current Ratio in Fiscal Year 2018 Choose. Inventory Days or Days to Sell in Fiscal Year 2019 Choose..LOWE'S COMPANIES, INC. CONSOLIDATED BALANCE SHEETS (In millions, except par value) January 31, 2020 February 1, 2019 Assets Current asicks: Cash and cash equivalents $ 716 $ 511 Short-term investments 160 218 Merchandise inventory-net 13,179 12.561 Other current assets 1,263 Total current assets 15,318 14,128 Property, less accumulated depreciation 18,669 18.432 Operating lease right-of-use assets 3,891 Long-term investments 372 256 Deferred income taxes-net 216 294 Goodwill 303 303 Other assets 702 995 Total assets $39.471 Liabilities and shareholders' equity Current liabilities: Short-term borrowings $ 1,941 722 Current maturities of long-term debt 597 1,110 Current operating lease liabilities 501 Accounts payable 7,659 8,279 Accrued compensation and employee benefits 684 662 Deferred revenue 1,219 1.299 Other current liabilities 2.581 2.425 Total current liabilities 15,182 14,497 Long-term debt, excluding current maturities 16.768 14.391 Noncurrent operating lease liabilities 3,943 Deferred revenue-extended protection plans 827 Other liabilities 712 1.149 Total liabilities 37,499 30,864Commitments and contingencies Shareholders' equity: Preferred stock-$5 par value, none issued Common stock-$0.50 par value: Shares issued and outstanding January 31, 2020 763 February 1. 2019 381 401 Capital in excess of par value Retained earnings 1,727 3.452 Accumulated other comprehensive loss (136) Total shareholders' equity 1.972 3.644 Total Iabilities and shareholders' equity $14,471 ke accompanying notes to consolidared financial movementsLOWE'S COMPANIES, ING. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (In millions, except percentage data) Fiscal Years Ended January 31, 2020 February 1, 2019 February 2, 2018 "Fiscal 2019" Sales "Fiscal 2018" F Sales "Fiscal 2017" & Sides Net earnings $4,281 5.91% $1.314 $3.447 Foreign currency translation adjustments 0.13 (221) 10.30 251 0.37 net of tax Other Other comprehensive income/(loss) 73 0.10 (220) 10.30 251 037 Comprehensive income $2.094 $1.698 5.395 See accompanying meet to consolidated financial chavementsAPPENDIX B Excerpts from the Fiscal 2019 10-K. Annual Report of Lowe's Companies, Inc. 05 LOWE'S COMPANIES, INC. CONSOLIDATED STATEMENTS OF EARNINGS (In millions, except per share and percentage data) Fiscal Years Ended January 31, 2020 February 1, 2019 February 2, 2018 "Fiscal 2019" Sales "Fiscal 2018" Sales "Fiscal 2017" Sales Net sales $71,148 $71 10 SAR,619 Cost of sales 49 205 48 401 67.88 46,185 67.31 Gross margin 22943 31.80 22,908 32.12 22,434 32.69 Expenses: Selling. general and administrative 15.367 21.30 17.413 24.41 14.444 21.04 Depreciation and amortization 1.262 1.75 1.477 2.07 1.404 2.05 Operating income 6314 8.75 5.64 6,586 9.60 Interest-net 691 0.96 624 0.88 0.92 Loss on extinguishment of debt 464 0.68 Pre-tax earnings 7.79 3.194 4.76 5,489 8.00 Income tax provision 1.342 1.86 1.080 1.52 2,042 2.98 Net earnings $ 4.281 $ 2,314 3.24% 5.02% Basic earnings per common share 5.49 2.84 4.09 Diluted earnings per common share 5.49 2.8 Cash dividends per share 2.13 1.85LOWE'S COMPANIES, INC. CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY (In millions, except per share data) Common Stock Accumulated Other Total Capital in Excess Retained Comprehensive Shareholders' Shares Amount of Par Value Earnings Income Loss) Equity Balance February 3. 2017 866 $433 $ - $6.241 8(240 Net earnings 3.447 3.447 Other comprehensive income 251 251 Cash dividends declared, $1.58 per share (1.324) (1.324) Share-based payment expense 90 Repurchase of common stock 140) (20) (215) (2.939) (3.174) Issuance of common stock under share-based payment plans 138 140 Balance February 2, 2018 $415 $ 12 $5.425 $ 11 $ 5.873 Cumulative effect of accounting change 33 Net earnings 2,314 2.314 Other comprehensive loss (220) (220) Cash dividends declared, $1.85 per share (1.500) (1.500) Share-based payment expense 74 74 Repurchase of common stock (32) (16) (209) (2.820) (3.045) Issuance of common stock under share-based payment plans 2 113 115 Balance February 1, 2019 HOT $3.452 $(209) $ 3641 Cumulative effect of accounting change (263) (263) Net earnings 4,281 4.281 Other comprehensive income 73 73 Cash dividends declared, $2.13 per share (1,653) (1,653) Share-based payment capense 98 Repurchase of common stock 141) (21) (214) (4,090) (4,325) Issuance of common stock under share-based payment plans 116 117 Balance January 31, 2020 $1,727 5(136) $ 1,972

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts