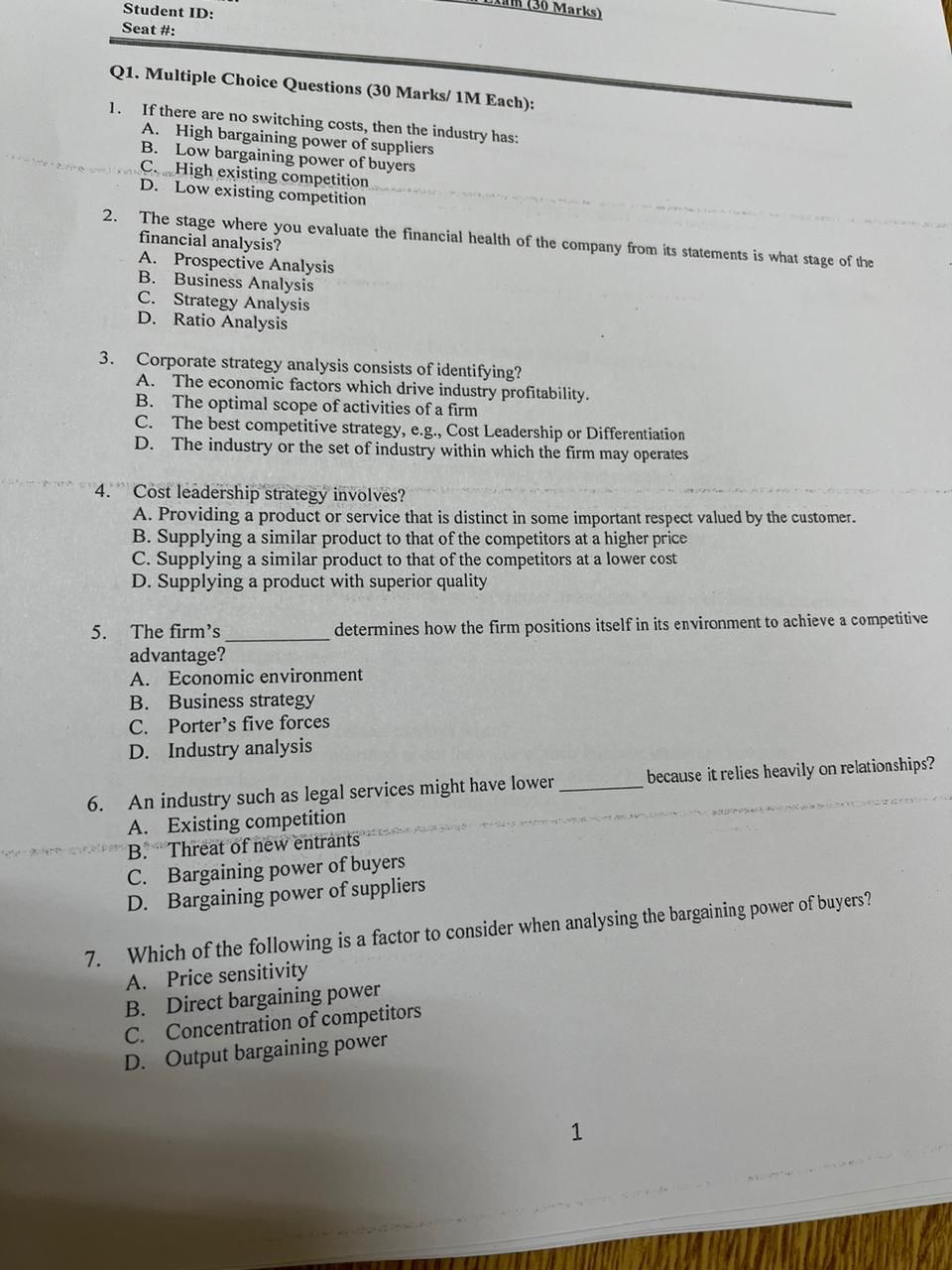

Question: financial analysis Q 1 . Multiple Choice Questions ( 3 0 Marks / 1 M Each ) : If there are no switching costs, then

financial analysis Q Multiple Choice Questions MarksM Each:

If there are no switching costs, then the industry has:

A High bargaining power of suppliers

B Low bargaining power of buyers

C High existing competition

D Low existing competition

The stage where you evaluate the financial health of the company from its statements is what stage of the

financial analysis?

A Prospective Analysis

B Business Analysis

C Strategy Analysis

D Ratio Analysis

Corporate strategy analysis consists of identifying?

A The economic factors which drive industry profitability.

B The optimal scope of activities of a firm

C The best competitive strategy, eg Cost Leadership or Differentiation

D The industry or the set of industry within which the firm may operates

Cost leadership strategy involves?

A Providing a product or service that is distinct in some important respect valued by the customer.

B Supplying a similar product to that of the competitors at a higher price

C Supplying a similar product to that of the competitors at a lower cost

D Supplying a product with superior quality

The firm's

determines how the firm positions itself in its environment to achieve a competitive

advantage?

A Economic environment

B Business strategy

C Porter's five forces

D Industry analysis

An industry such as legal services might have lower

because it relies heavily on relationships?

A Existing competition

B Threat of new entrants

C Bargaining power of buyers

D Bargaining power of suppliers

Which of the following is a factor to consider when analysing the bargaining power of buyers?

A Price sensitivity

B Direct bargaining power

C Concentration of competitors

D Output bargaining power The firm's vale is determined by its ability to carn a return on its capital, in excess of

A Cost of debt

B Cost of equity

C Cost of capital

D Cost of sales

Energy conservation technologies that allow customers to reduce their consumption of electricity and fossil

fuels is an example of

A Threat of new entrants

B Rivalry among existing firms

C Threat of substitute products

D Bargaining power of buyers

Regardless of the broad overview that the financial market function effieciently, the need for the financial

statement analysis can be justified by

A The potentail mispricing of the indivdual secutrites by the investor

B The absnse of transaction cost

C The absence of "lemeon problem"

D Inability of the indivdual investors to undresatand the rpeorted financial numbers

Corprate managemnt can create value for the firms' investros when the return on its capital is

A Higher than inflation

B Lower than the cost of debt

C Higher than the cost of capital

D Highet than the cost of sale

Assessing the degree of distortion in a firm's reported finacial sateement is part of

A Finacial analysis

B Accounting analysis

C Business stategey analysis

D Industy analysis

The process of evaluating the firm performance using ratios and cash flow analysis is

A Prospective analysis

B Business strategy analysis

C Financial ratio analysis

D Operation business analysis

Industry choice, competitive positioning, and corporate strategy are strategic choices that determines...

A Firm's Profitability

B Firm's Success

C Firm's Competition

D Firm's Risk

Lemons problems arise in capital markets when?

A Managers are better informed about the value of their business ideas than investors

B Managers have an incentive to understate the value of their business ideas

C Managers and investors have conflicting interests

D A and C

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock