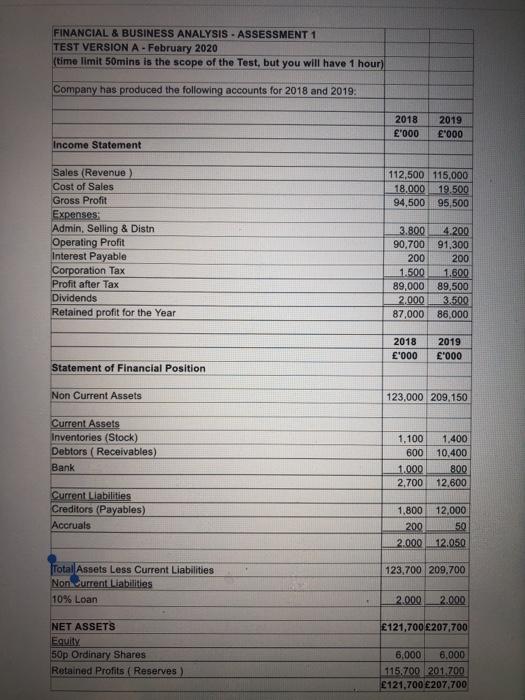

Question: FINANCIAL & BUSINESS ANALYSIS - ASSESSMENT 1 TEST VERSION A - February 2020 (time limit 50mins is the scope of the Test, but you will

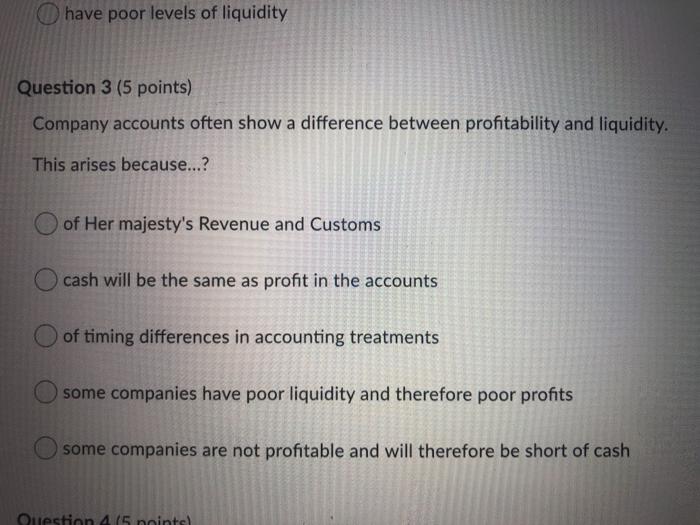

FINANCIAL & BUSINESS ANALYSIS - ASSESSMENT 1 TEST VERSION A - February 2020 (time limit 50mins is the scope of the Test, but you will have 1 hour) Company has produced the following accounts for 2018 and 2019. 2018 '000 2019 '000 Income Statement 112,500 115,000 18,000 19.500 94,500 95,500 Sales (Revenue) Cost of Sales Gross Profit Expenses Admin, Selling & Distn Operating Profit Interest Payable Corporation Tax Profit after Tax Dividends Retained profit for the Year 3.800 90,700 200 1.500 89,000 2.000 87,000 4200 91,300 200 1.600 89,500 3.500 86,000 2018 '000 2019 '000 Statement of Financial Position Non Current Assets 123,000 209.150 Current Assets Inventories (Stock) Debtors (Receivables) Bank 1.100 1.400 600 10,400 1.000 800 2,700 12.600 Current Liabilities Creditors (Payables) Accruals 1.800 12,000 200 50 2.000 12.050 123,700 209.700 Total Assets Less Current Liabilities Non current Liabilities 10% Loan 2.000 2.000 121,700 207,700 NET ASSETS Equity 50p Ordinary Shares Retained Profits Reserves ) 6.000 6,000 115.700 201, 700 121.700 207,700 have poor levels of liquidity Question 3 (5 points) Company accounts often show a difference between profitability and liquidity. This arises because...? of Her majesty's Revenue and Customs cash will be the same as profit in the accounts of timing differences in accounting treatments some companies have poor liquidity and therefore poor profits some companies are not profitable and will therefore be short of cash Question 4/5 noints)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts