Question: Financial Chapter 5 HW Calculator eBook Cornerstone Exercise 5-26 (Algorithmic) Write-Off of Uncollectible Accounts 1. MC.05.11 2. MC.05.12 3. CE0531 4. BE.05.49 5. BE.05.46 6.

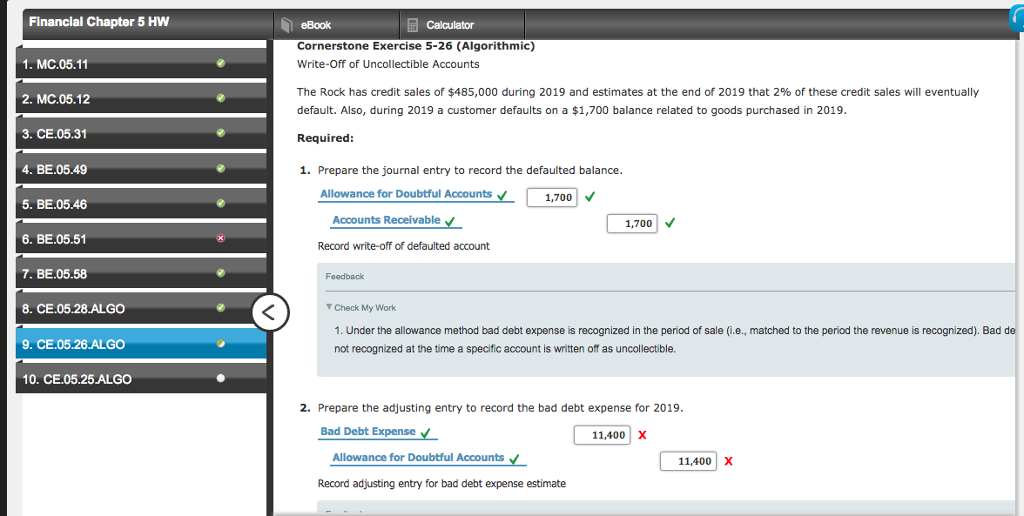

Financial Chapter 5 HW Calculator eBook Cornerstone Exercise 5-26 (Algorithmic) Write-Off of Uncollectible Accounts 1. MC.05.11 2. MC.05.12 3. CE0531 4. BE.05.49 5. BE.05.46 6. BE.05.51 The Rock has credit sales of $485,000 during 2019 and estimates at the end of 2019 that 296 of these credit sales will eventually default. Also, during 2019 a customer defaults on a $1,700 balance related to goods purchased in 2019 Required: 1. Prepare the journal entry to record the defaulted balance Allowance for Doubtful Accounts 1,700 Accounts Receivable 1,700 Record write-off of defaulted account 7. BE.05.58 8. CE.05.28 ALGO 9. .05.26ALGO 10. .05.25ALGO Foodback Y Check My Work 1. Under the allowance method bad debt expense is recognized in the period of sale (i.e., matched to the period the revenue is recognized). Bad de not recognized at the time a specific account is written off as uncollectible. 2. Prepare the adjusting entry to record the bad debt expense for 2019 Bad Debt Expense 11,400 X Allowance for Doubtful Accounts 11,400 X Record adjusting entry for bad debt expense estimate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts