Question: Financial Derivatives Analysis - Options Contracts (32 marks) Consider the Call option on the Canada 6s of 2038 which expires (matures) in July 2021. Suppose

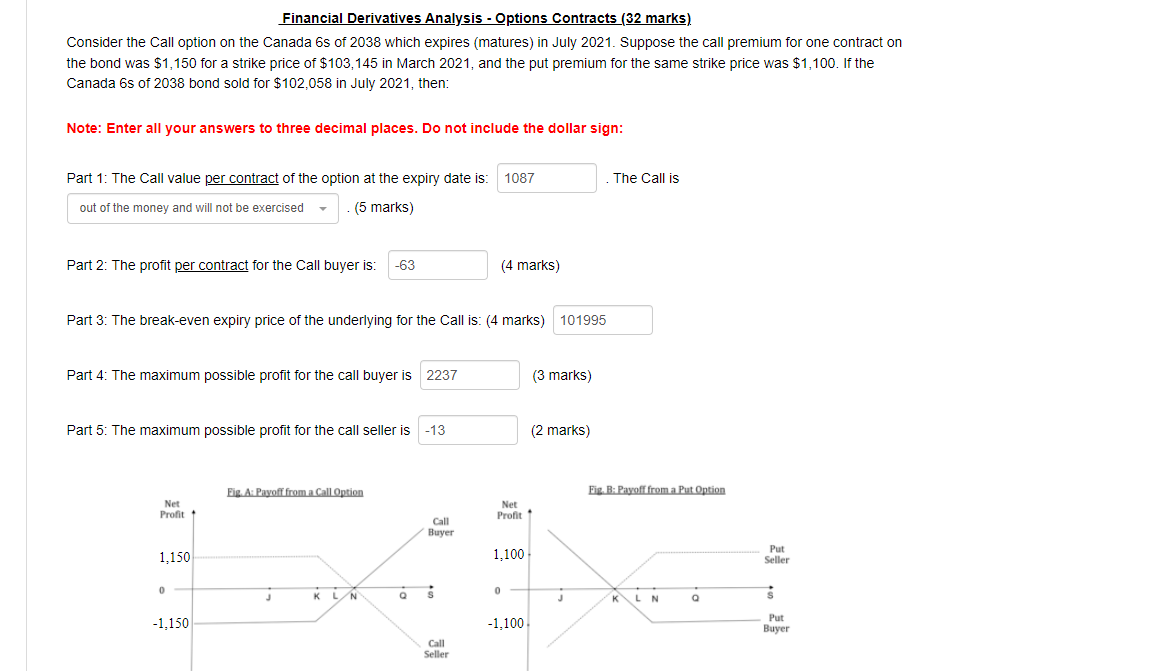

Financial Derivatives Analysis - Options Contracts (32 marks) Consider the Call option on the Canada 6s of 2038 which expires (matures) in July 2021. Suppose the call premium for one contract on the bond was $1,150 for a strike price of $103,145 in March 2021, and the put premium for the same strike price was $1,100. If the Canada 6s of 2038 bond sold for $102,058 in July 2021, then: Note: Enter all your answers to three decimal places. Do not include the dollar sign: Part 1: The Call value per contract of the option at the expiry date is: 1087 The Call is out of the money and will not be exercised (5 marks) Part 2: The profit per contract for the Call buyer is: -63 (4 marks) Part 3: The break-even expiry price of the underlying for the Call is: (4 marks) 101995 Part 4: The maximum possible profit for the call buyer is 2237 (3 marks) Part 5: The maximum possible profit for the call seller is -13 (2 marks) Eig. A: Payoff from a Call Option Fig. B: Payoff from a Put Option Net Profit Net Profit Call Buyer 1,150 1.100 Put Seller 0 KN Q s 0 K LN Q $ -1,150 -1,100 Put Buyer Call Seller

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts