Question: ( Financial forecasting - discretionary financing needs ) ( 6 out of the last 7 questions that were done were wrong, dont agree to do

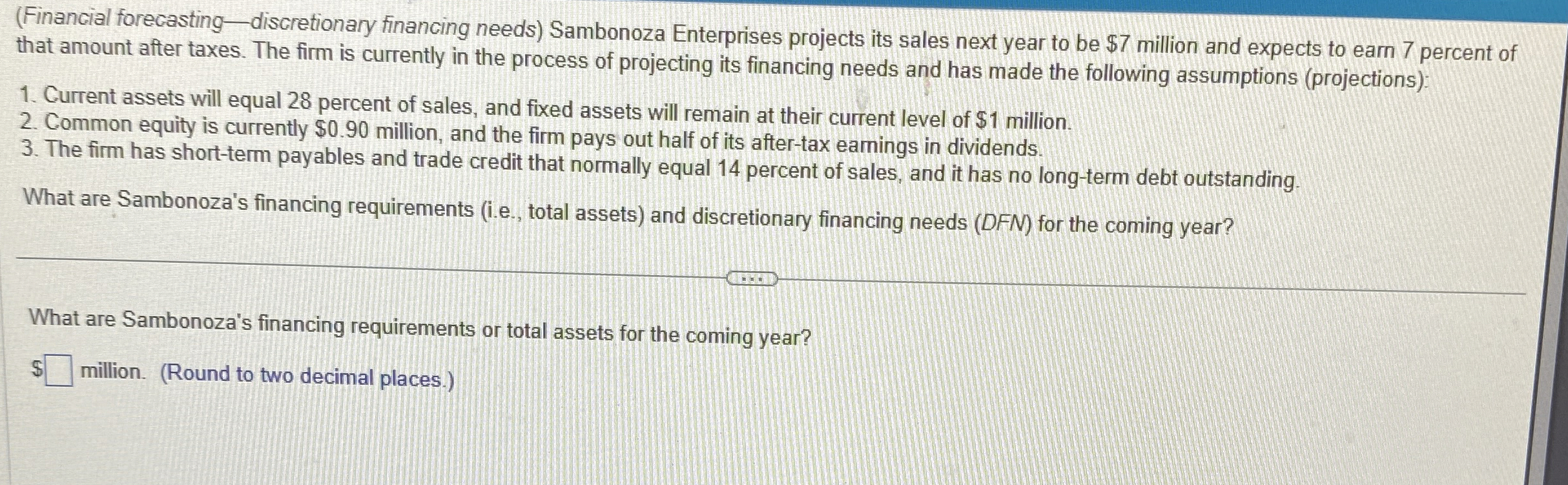

Financial forecastingdiscretionary financing needs out of the last questions that were done were wrong, dont agree to do it if you dont know how your wasting everyones time, i can do it my self but im outsourcing it to save time i will thumbs down and call customer service evrytime, please stop wasting ny time. Sambonoza Enterprises projects its sales next year to be $ million and expects to earn percent of that amount after taxes. The firm is currently in the process of projecting its financing needs and has made the following assumptions projections:

Current assets will equal percent of sales, and fixed assets will remain at their current level of $ million.

Common equity is currently $ million, and the firm pays out half of its aftertax eamings in dividends.

The firm has shortterm payables and trade credit that normally equal percent of sales, and it has no longterm debt outstanding.

What are Sambonoza's financing requirements ie total assets and discretionary financing needs DFN for the coming year?

What are Sambonoza's financing requirements or total assets for the coming year?

$ million. Round to two decimal places.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock