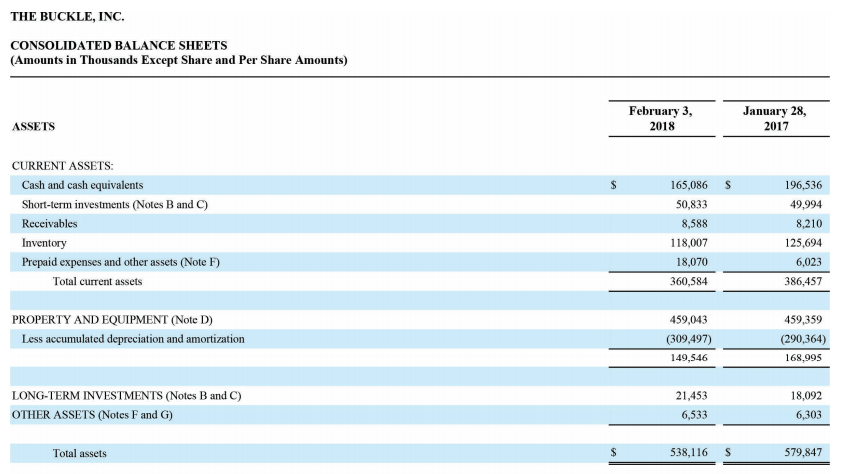

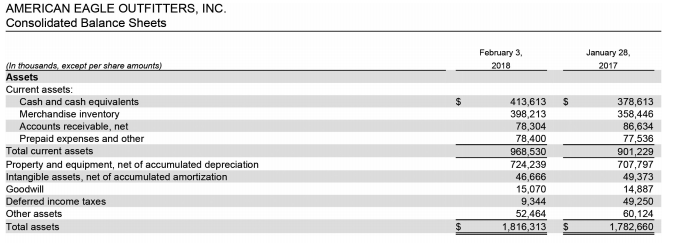

Question: Financial Information for American Eagle is presented in Appendix A, and financial information for Buckle Presented in Appendix B Try to estimate each companys ratio

Financial Information for American Eagle is presented in Appendix A, and financial information for Buckle Presented in Appendix B

Try to estimate each companys ratio of total current receivables to total current assets. (round your answers to 2 decimal places. (5th Edition)

THE BUCKLE, INC. CONSOLIDATED BALANCE SHEETS (Amounts in Thousands Except Share and Per Share Amounts) February 3, 2018 January 28, 2017 ASSETS CURRENT ASSETS: 165,086 S 196,536 49,994 8,210 125,694 6,023 386,457 Cash and cash equivalents Short-term investments (Notes B and C) 50,833 8,588 118,007 18,070 360,584 Inventory Prepaid expenses and other assets (Note F) Total current assets 459,359 (290,364) 168,995 PROPERTY AND EQUIPMENT (Note D) 459,043 (309,497) 149,546 Less d depreciation and amortization LONG-TERM INVESTMENTS (Notes B and C) OTHER ASSETS (Notes F and G) 21,453 6,533 18,092 6,303 Total assets 538,116 S 579,847 AMERICAN EAGLE OUTFITTERS, INC Consolidated Balance Sheets February 3, January 28, r shere Assets Current assets 378,613 358,446 86,634 77,536 901,229 707,797 Cash and cash equivalents 413,613 $ Merchandise inventory 398,213 78,304 78,400 968,530 724,239 46,666 15,070 9,344 52,464 1,816,313 S Accounts receivable, net Prepaid expenses and other Total current assets Property and equipment, net of accumulated depreciation Intangible assets, net of accumulated amortization Goodwill Deferred income taxes Other assets Total assets 14,887 49,250 60,124 1,782,660

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts