Question: Financial information for American Eagle is presented in Appendix A at the end of the book, and financial information for Buckle is presented in Appendix

Financial information for American Eagle is presented in Appendix A at the end of the book, and financial information for Buckle is presented in Appendix B at the end of the book.

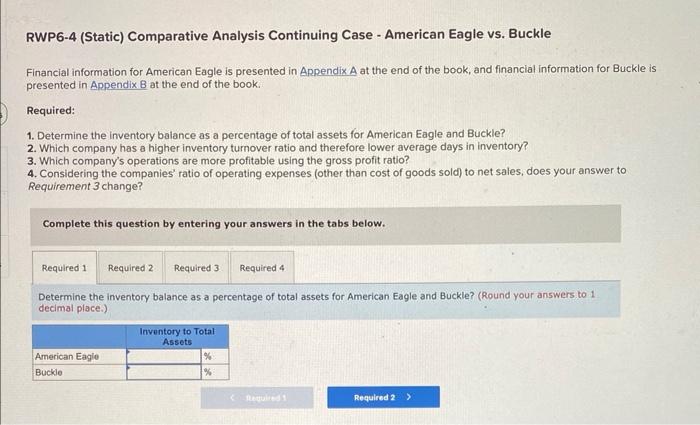

Required: 1. Determine the inventory balance as a percentage of total assets for American Eagle and Buckle?

2. Which company has a higher inventory turnover ratio and therefore lower average days in inventory?

3. Which companys operations are more profitable using the gross profit ratio?

4. Considering the companies ratio of operating expenses (other than cost of goods sold) to net sales, does your answer to Requirement 3 change?

RWP6-4 (Static) Comparative Analysis Continuing Case - American Eagle vs. Buckle Financial information for American Eagle is presented in Appendix A at the end of the book, and financial information for Buckle is presented in Appendix B at the end of the book. Required: 1. Determine the inventory balance as a percentage of total assets for American Eagle and Buckle? 2. Which company has a higher inventory turnover ratio and therefore lower average days in inventory? 3. Which company's operations are more profitable using the gross profit ratio? 4. Considering the companies' ratio of operating expenses (other than cost of goods sold) to net sales, does your answer to Requirement 3 change? Complete this question by entering your answers in the tabs below. Determine the inventory balance as a percentage of total assets for American Eagle and Buckle? (Round your answers to 1 decimal place.) RWP6-4 (Static) Comparative Analysis Continuing Case - American Eagle vs. Buckle Financial information for American Eagle is presented in Appendix A at the end of the book, and financial information for Buckle is presented in Appendix B at the end of the book. Required: 1. Determine the inventory balance as a percentage of total assets for American Eagle and Buckle? 2. Which company has a higher inventory turnover ratio and therefore lower average days in inventory? 3. Which company's operations are more profitable using the gross profit ratio? 4. Considering the companies' ratio of operating expenses (other than cost of goods sold) to net sales, does your answer to Requirement 3 change? Complete this question by entering your answers in the tabs below. Which company has a higher inventory turnover ratio and therefore lower average days in inventory? RWP6-4 (Static) Comparative Analysis Continuing Case - American Eagle vs. Buckle Financial information for American Eagle is presented in Appendix A at the end of the book, and financial information for Buckle is presented in Appendix B at the end of the book. Required: 1. Determine the inventory balance as a percentage of total assets for American Eagle and Buckle? 2. Which company has a higher inventory turnover ratio and therefore lower average days in inventory? 3. Which company's operations are more profitable using the gross profit ratio? 4. Considering the companies' ratio of operating expenses (other than cost of goods sold) to net sales, does your answer to Requirement 3 change? Complete this question by entering your answers in the tabs below. Which company's operations are more profitable using the gross profit ratio? 3. Which company's operations are more proftablo using the gross profit ratio? RWP6-4 (Static) Comparative Analysis Continuing Case - American Eagle vs. Buckle Financial information for American Eagle is presented in Appendix A at the end of the book, and financial information for Buckle is presented in Appendix B at the end of the book. Required: 1. Determine the inventory balance as a percentage of total assets for American Eagle and Buckle? 2. Which company has a higher inventory tumover ratio and therefore lower average days in inventory? 3. Which company's operations are more profitable using the gross profit ratio? 4. Considering the companies' ratio of operating expenses (other than cost of goods sold) to net sales, does your answer to Requirement 3 change? Complete this question by entering your answers in the tabs below. Considering the companies' ratio of operating expenses (other than cost of goods sold) to net sales, does your answer to Requirement 3 change? Considering the companies' ratio of operating expenses (other than cost of goods sold) to net sales, does your answer to Requirement 3 chonge? RWP6-4 (Static) Comparative Analysis Continuing Case - American Eagle vs. Buckle Financial information for American Eagle is presented in Appendix A at the end of the book, and financial information for Buckle is presented in Appendix B at the end of the book. Required: 1. Determine the inventory balance as a percentage of total assets for American Eagle and Buckle? 2. Which company has a higher inventory turnover ratio and therefore lower average days in inventory? 3. Which company's operations are more profitable using the gross profit ratio? 4. Considering the companies' ratio of operating expenses (other than cost of goods sold) to net sales, does your answer to Requirement 3 change? Complete this question by entering your answers in the tabs below. Determine the inventory balance as a percentage of total assets for American Eagle and Buckle? (Round your answers to 1 decimal place.) RWP6-4 (Static) Comparative Analysis Continuing Case - American Eagle vs. Buckle Financial information for American Eagle is presented in Appendix A at the end of the book, and financial information for Buckle is presented in Appendix B at the end of the book. Required: 1. Determine the inventory balance as a percentage of total assets for American Eagle and Buckle? 2. Which company has a higher inventory turnover ratio and therefore lower average days in inventory? 3. Which company's operations are more profitable using the gross profit ratio? 4. Considering the companies' ratio of operating expenses (other than cost of goods sold) to net sales, does your answer to Requirement 3 change? Complete this question by entering your answers in the tabs below. Which company has a higher inventory turnover ratio and therefore lower average days in inventory? RWP6-4 (Static) Comparative Analysis Continuing Case - American Eagle vs. Buckle Financial information for American Eagle is presented in Appendix A at the end of the book, and financial information for Buckle is presented in Appendix B at the end of the book. Required: 1. Determine the inventory balance as a percentage of total assets for American Eagle and Buckle? 2. Which company has a higher inventory turnover ratio and therefore lower average days in inventory? 3. Which company's operations are more profitable using the gross profit ratio? 4. Considering the companies' ratio of operating expenses (other than cost of goods sold) to net sales, does your answer to Requirement 3 change? Complete this question by entering your answers in the tabs below. Which company's operations are more profitable using the gross profit ratio? 3. Which company's operations are more proftablo using the gross profit ratio? RWP6-4 (Static) Comparative Analysis Continuing Case - American Eagle vs. Buckle Financial information for American Eagle is presented in Appendix A at the end of the book, and financial information for Buckle is presented in Appendix B at the end of the book. Required: 1. Determine the inventory balance as a percentage of total assets for American Eagle and Buckle? 2. Which company has a higher inventory tumover ratio and therefore lower average days in inventory? 3. Which company's operations are more profitable using the gross profit ratio? 4. Considering the companies' ratio of operating expenses (other than cost of goods sold) to net sales, does your answer to Requirement 3 change? Complete this question by entering your answers in the tabs below. Considering the companies' ratio of operating expenses (other than cost of goods sold) to net sales, does your answer to Requirement 3 change? Considering the companies' ratio of operating expenses (other than cost of goods sold) to net sales, does your answer to Requirement 3 chonge

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts