Question: Financial information for American Eagle is presented in Appendix A, and financial information for Buckle is presented in Appendix B. Required: 1. Calculate American Eagle's

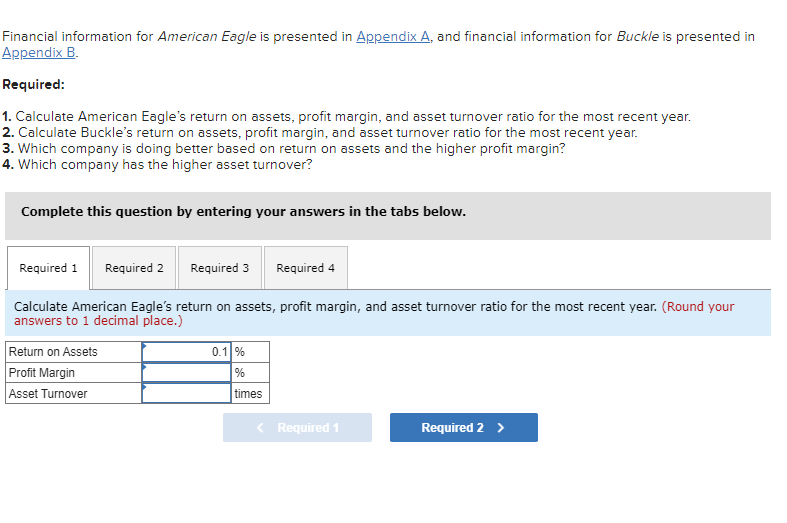

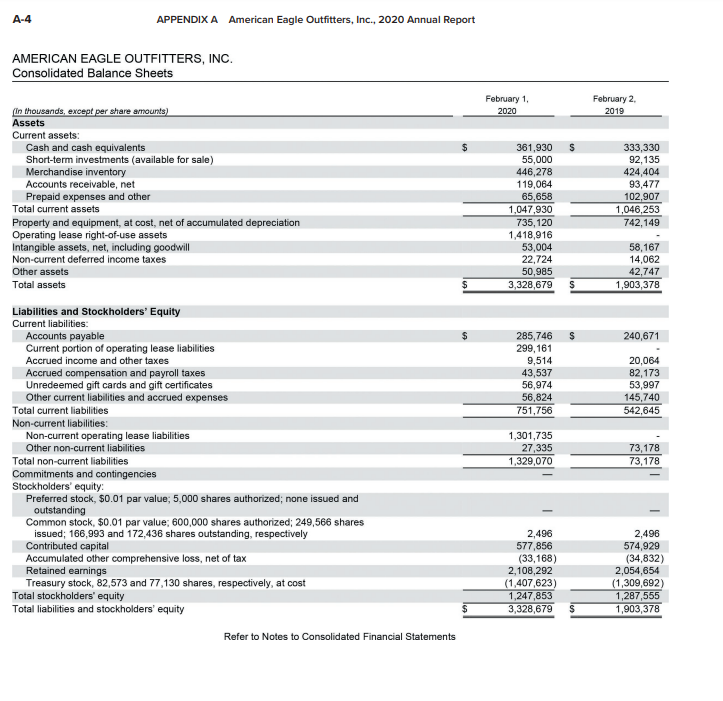

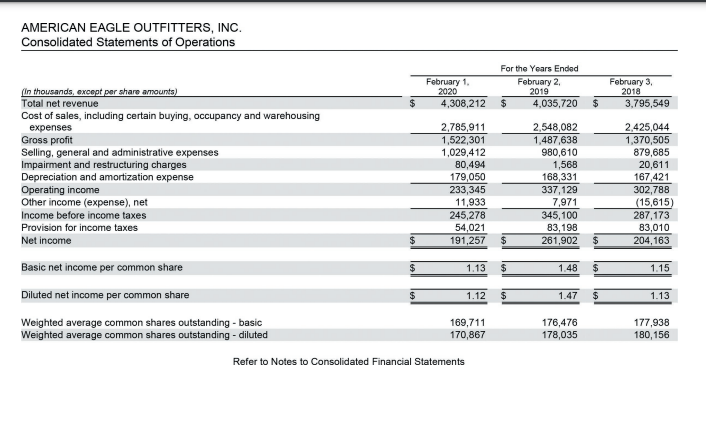

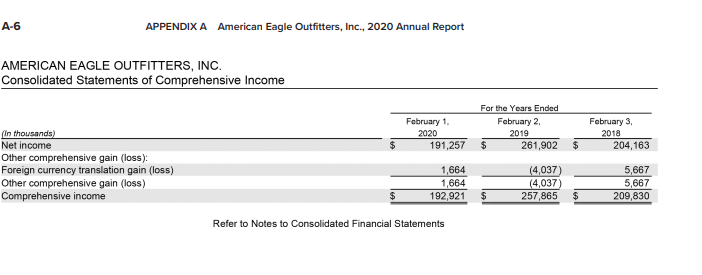

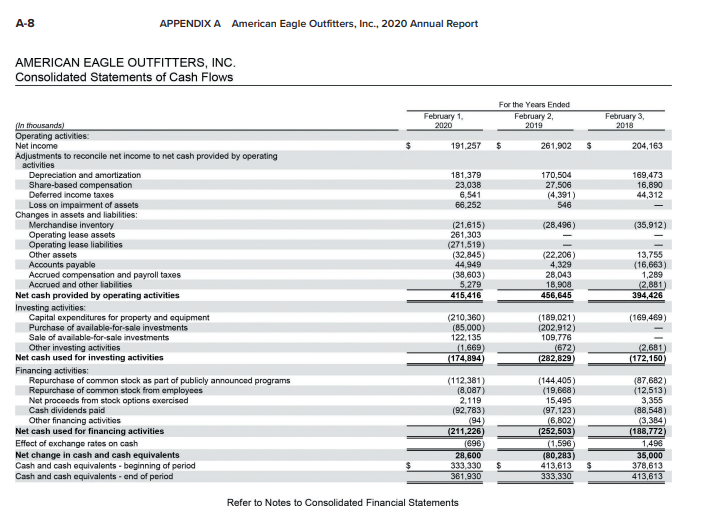

Financial information for American Eagle is presented in Appendix A, and financial information for Buckle is presented in Appendix B. Required: 1. Calculate American Eagle's return on assets, profit margin, and asset turnover ratio for the most recent year. 2. Calculate Buckle's return on assets, profit margin, and asset turnover ratio for the most recent year. 3. Which company is doing better based on return on assets and the higher profit margin? 4. Which company has the higher asset turnover? Complete this question by entering your answers in the tabs below. Calculate American Eagle's return on assets, profit margin, and asset turnover ratio for the most recent year. (Round your answers to 1 decimal place.) AMERICAN EAGLE OUTFITTERS, INC. Keter to Notes to Consolidated rinancial Statements Refer to Notes to Consolidated Financial Statements A-8 APPENDIX A American Eagle Outfitters, Inc., 2020 Annual Report AMERICAN EAGLE OUTFITTERS, INC. Consolidated Statements of Cash Flows \begin{tabular}{|c|c|c|c|c|c|c|} \hline \multirow[b]{2}{*}{ (In thousands) } & \multicolumn{6}{|c|}{ For the Years Ended } \\ \hline & \multicolumn{2}{|c|}{\begin{tabular}{l} February 1, \\ 2020 \end{tabular}} & \multicolumn{2}{|c|}{\begin{tabular}{c} February 2 \\ 2019 \end{tabular}} & \multicolumn{2}{|r|}{\begin{tabular}{l} February 3 \\ 2018 \end{tabular}} \\ \hline Operating activities: & & & & & & \\ \hline Net income & $ & 191,257 & $ & 261,902 & $ & 204,163 \\ \hline \multicolumn{7}{|l|}{\begin{tabular}{l} Adjustments to reconcile net income to net cash provided by operating \\ activities \end{tabular}} \\ \hline Depreciation and amortization & & 181,379 & & 170,504 & & 169,473 \\ \hline Share-based compensation & & 23,038 & & 27,506 & & 16,890 \\ \hline Deferred income taxes & & 6.541 & & (4,391) & & 44,312 \\ \hline Loss on impaiment of assets & & 66,252 & & 546 & & - \\ \hline \multicolumn{7}{|l|}{ Changes in assets and liabilities: } \\ \hline Merchandise imventory & & (21,615) & & (28,496) & & (35,912) \\ \hline Operating lease assets & & 261,303 & & - & & \\ \hline Operating lease liabilities & & (271,519) & & & & \\ \hline Other assets & & (32.845) & & (22,206) & & 13,755 \\ \hline Acoounts payable & & 44,949 & & 4,329 & & (16,663) \\ \hline Accrued compensation and payroll taxes & & (38,603) & & 28,043 & & 1,289 \\ \hline Accrued and other liabilities & & 5,279 & & 18,908 & & (2,881) \\ \hline Net cash provided by operating activities & & 415,416 & & 456,645 & & 394,426 \\ \hline \multicolumn{7}{|l|}{ Investing activities: } \\ \hline Capital expenditures for property and equipment & & (210,360) & & (189,021) & & (169,469) \\ \hline Purchase of available-for-sale investments & & (85,000) & & (202,912) & & \\ \hline Sale of available-for-sale investments & & 122,135 & & 109,776 & & - \\ \hline Other inwesting activities & & (1,669) & & (672) & & (2,681) \\ \hline Net cash used for investing activities & & (174,894) & & (282,829) & & (172,150) \\ \hline \multicolumn{7}{|l|}{ Financing activities: } \\ \hline Repurchase of common stock as part of publicly announoed programs & & (112,381) & & (144,405) & & (87,682) \\ \hline Repurchase of common stock from employees & & (8,087) & & (19,688) & & (12,513) \\ \hline Not proceeds from stock options exercised & & 2,119 & & 15,495 & & 3,355 \\ \hline Cash dividends paid & & (92,783) & & (97,123) & & (88,548) \\ \hline Other financing activitios & & (94) & & (6,802) & & (3,384) \\ \hline Net cash used for financing activities & & (211,226) & & (252,503) & & (188,772) \\ \hline Effect of exchange rates on cash & & & & (1,596) & & 1,496 \\ \hline Net change in cash and cash equivalents & & 28,600 & & (80,283) & & 35,000 \\ \hline Cash and cash equivalents - beginning of period & $ & 333,330 & $ & 413,613 & $ & 378,613 \\ \hline Cash and cash equivalents - end of period & & 381,930 & & 333,330 & & 413,613 \\ \hline \end{tabular} Refer to Notes to Consolidated Financial Statements Financial information for American Eagle is presented in Appendix A, and financial information for Buckle is presented in Appendix B. Required: 1. Calculate American Eagle's return on assets, profit margin, and asset turnover ratio for the most recent year. 2. Calculate Buckle's return on assets, profit margin, and asset turnover ratio for the most recent year. 3. Which company is doing better based on return on assets and the higher profit margin? 4. Which company has the higher asset turnover? Complete this question by entering your answers in the tabs below. Calculate American Eagle's return on assets, profit margin, and asset turnover ratio for the most recent year. (Round your answers to 1 decimal place.) AMERICAN EAGLE OUTFITTERS, INC. Keter to Notes to Consolidated rinancial Statements Refer to Notes to Consolidated Financial Statements A-8 APPENDIX A American Eagle Outfitters, Inc., 2020 Annual Report AMERICAN EAGLE OUTFITTERS, INC. Consolidated Statements of Cash Flows \begin{tabular}{|c|c|c|c|c|c|c|} \hline \multirow[b]{2}{*}{ (In thousands) } & \multicolumn{6}{|c|}{ For the Years Ended } \\ \hline & \multicolumn{2}{|c|}{\begin{tabular}{l} February 1, \\ 2020 \end{tabular}} & \multicolumn{2}{|c|}{\begin{tabular}{c} February 2 \\ 2019 \end{tabular}} & \multicolumn{2}{|r|}{\begin{tabular}{l} February 3 \\ 2018 \end{tabular}} \\ \hline Operating activities: & & & & & & \\ \hline Net income & $ & 191,257 & $ & 261,902 & $ & 204,163 \\ \hline \multicolumn{7}{|l|}{\begin{tabular}{l} Adjustments to reconcile net income to net cash provided by operating \\ activities \end{tabular}} \\ \hline Depreciation and amortization & & 181,379 & & 170,504 & & 169,473 \\ \hline Share-based compensation & & 23,038 & & 27,506 & & 16,890 \\ \hline Deferred income taxes & & 6.541 & & (4,391) & & 44,312 \\ \hline Loss on impaiment of assets & & 66,252 & & 546 & & - \\ \hline \multicolumn{7}{|l|}{ Changes in assets and liabilities: } \\ \hline Merchandise imventory & & (21,615) & & (28,496) & & (35,912) \\ \hline Operating lease assets & & 261,303 & & - & & \\ \hline Operating lease liabilities & & (271,519) & & & & \\ \hline Other assets & & (32.845) & & (22,206) & & 13,755 \\ \hline Acoounts payable & & 44,949 & & 4,329 & & (16,663) \\ \hline Accrued compensation and payroll taxes & & (38,603) & & 28,043 & & 1,289 \\ \hline Accrued and other liabilities & & 5,279 & & 18,908 & & (2,881) \\ \hline Net cash provided by operating activities & & 415,416 & & 456,645 & & 394,426 \\ \hline \multicolumn{7}{|l|}{ Investing activities: } \\ \hline Capital expenditures for property and equipment & & (210,360) & & (189,021) & & (169,469) \\ \hline Purchase of available-for-sale investments & & (85,000) & & (202,912) & & \\ \hline Sale of available-for-sale investments & & 122,135 & & 109,776 & & - \\ \hline Other inwesting activities & & (1,669) & & (672) & & (2,681) \\ \hline Net cash used for investing activities & & (174,894) & & (282,829) & & (172,150) \\ \hline \multicolumn{7}{|l|}{ Financing activities: } \\ \hline Repurchase of common stock as part of publicly announoed programs & & (112,381) & & (144,405) & & (87,682) \\ \hline Repurchase of common stock from employees & & (8,087) & & (19,688) & & (12,513) \\ \hline Not proceeds from stock options exercised & & 2,119 & & 15,495 & & 3,355 \\ \hline Cash dividends paid & & (92,783) & & (97,123) & & (88,548) \\ \hline Other financing activitios & & (94) & & (6,802) & & (3,384) \\ \hline Net cash used for financing activities & & (211,226) & & (252,503) & & (188,772) \\ \hline Effect of exchange rates on cash & & & & (1,596) & & 1,496 \\ \hline Net change in cash and cash equivalents & & 28,600 & & (80,283) & & 35,000 \\ \hline Cash and cash equivalents - beginning of period & $ & 333,330 & $ & 413,613 & $ & 378,613 \\ \hline Cash and cash equivalents - end of period & & 381,930 & & 333,330 & & 413,613 \\ \hline \end{tabular} Refer to Notes to Consolidated Financial Statements

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts